“Silly” Arizona House Representative Republican Justin Wilmeth is making an argument for lower gasoline, etc. prices to Arizona. Justin traveled to California to ask for no cap on fuel prices at a California refinery (Arizona has no refinery). As if he does not have enough to do in AZ? Not sure what makes him think, they will not raise prices anyway and without a cap. Justin’s main beef . . . “If they were to lower production or supply, the...

Read More »A Boy’s Love Affair with Tonka Trucks

No that is not the real story here today. It does give a perspective on why so many too big, too fast, and too often vehicles are eating up limited supplies of gasoline and oil. However, what is being missed is we are not buying more oil for the Strategic Oil Reserve. Although, I am recalling our younger days when for Christmas the boys (meaning my brothers and I) would get “metal” Tonka pickup trucks and other versions of the same brand. Not a...

Read More »Consumer inflation remains dominated by gas prices (good) and shelter (bad)

Consumer inflation remains dominated by gas prices (good) and shelter (bad) – by New Deal democrat Declining gas prices continue to do wondrous things for the economy. In December they declined from roughly $3.50 to $3.10/gallon. Meanwhile the phantom menace of Owners’ Equivalent Rent continues to drag “core” inflation higher. Details below. Total inflation: -0.1%m/m , +6.4% YoY (12 month+ low), +0.9% since June, 1.8% annual rate Core...

Read More »Continued good news for consumers on gas prices

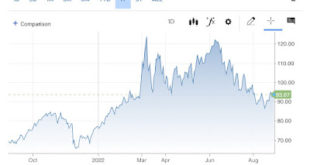

Continued good news for consumers on gas prices There’ll be lots of economic news starting tomorrow, but for today let’s pause and take a look at the energy situation. Here’s a look at oil prices in the past year up through yesterday from CNBC: And here’s a look over the same time period from Gas Buddy: Here’s a close-up of gas prices for the past month: Gas prices follow oil prices with typically a delay of several weeks. Oil prices...

Read More »Today’s lesson: never simply project the current trend forward

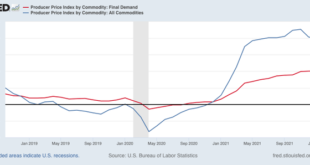

Today’s lesson: never simply project the current trend forward An important reason why I am so insistent on dividing data into long leading, short leading, and coincident indicators is in order to avoid the most common pitfall in any forecasting, which is that of projecting the current trend forward. This morning PPI for February was reported. Frequently – but not always! – commodity prices lead producer prices, which in turn lead consumer...

Read More » Heterodox

Heterodox