In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of the cat being dead, 1-p is the probability of it being alive. The problem is that until the box is opened, we do not know if the cat is alive or dead. In Schroedinger’s universe of probabilities, the cat is both “alive” and “dead” until the box is opened, when one of the possible outcomes is crystallised.Now for “cat”, read assets. In Woodford’s model, when there is no crisis, the probability of asset collapse is zero. But if there is a crisis, the probability of an asset collapse is greater than zero but less than 100% (my emphasis): The sequence of events, and the set of alternative states that may be reached, within each period is indicated in Figure 1. In subperiod 1, a financial market is open in which bankers issue short-term safe liabilities and acquire risky durables, and households decide on the cash balances to hold for use by the shopper.

Topics:

Frances Coppola considers the following as important: government debt, property, QE, safe assets, safety

This could be interesting, too:

Angry Bear writes Commercial Interests Lobbying Against Railroad Safety kill Legislation

Frances Coppola writes Silvergate Bank – a post mortem

Frances Coppola writes Lessons from the disaster engulfing Silvergate Capital

Frances Coppola writes Proof of reserves is proof of nothing

In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.

Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of the cat being dead, 1-p is the probability of it being alive. The problem is that until the box is opened, we do not know if the cat is alive or dead. In Schroedinger’s universe of probabilities, the cat is both “alive” and “dead” until the box is opened, when one of the possible outcomes is crystallised.

Now for “cat”, read assets. In Woodford’s model, when there is no crisis, the probability of asset collapse is zero. But if there is a crisis, the probability of an asset collapse is greater than zero but less than 100% (my emphasis):

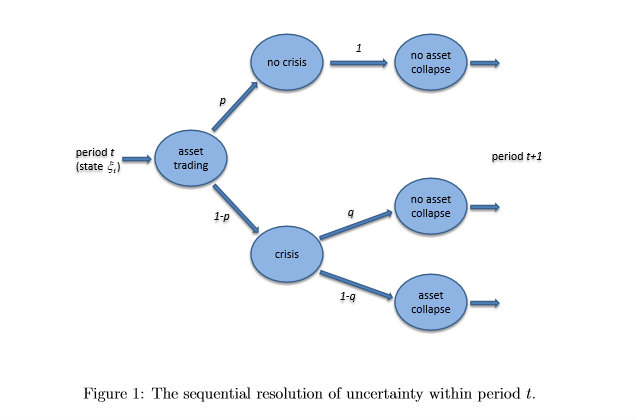

Here is Woodford’s Figure 1 showing his sequence of events: The binary forks are clear. Either there is a crisis, or there is not. If there is a crisis, either assets collapse or they do not, and until either the asset collapse happens or the crisis is over we do not know which it will be.The sequence of events, and the set of alternative states that may be reached, within each period is indicated in Figure 1. In subperiod 1, a financial market is open in which bankers issue short-term safe liabilities and acquire risky durables, and households decide on the cash balances to hold for use by the shopper.8 In subperiod 2, information is revealed about the possibility that the durable goods purchased by the banks will prove to be valueless. With probability p, the “no crisis” state is reached, in which it is known with certainty that the no collapse in the value of the assets will occur, but with probability 1−p, a “crisis” state is reached, in which it is understood to be possible (though not yet certain) that the assets will prove to be worthless. Finally, in subperiod 3, the value of the risky durables is learned.

To keep things simple, Woodford also assumes that asset collapse after a crisis renders assets worthless. The reality in most cases is not so extreme, of course, but hey, why destroy a perfectly good binary argument with unhelpful facts. So, following Schroedinger, we can say that until one of the two possible outcomes is crystallised, our assets are both worthless and valuable.

But Woodford thinks investors can’t cope with such uncertainty. Faced with a probability 0.5<q<1 that the value of their assets will collapse, rational investors will sell. So whereas the patient Schroedinger waits to open his box, and presumably only cremates the cat if it is dead, impatient investors cremate the box with the cat – whether dead or alive - inside. This changes a probability of perhaps 60% that there will be an asset collapse into a dead cert, since if all investors sell, the value of the assets falls to zero. Investors’ rational decision not to accept the risk of total loss resolves uncertainty in a way that ensures the majority of them lose. It’s the madness of crowds.

The economic consequences of panicky investors all selling assets at once can be extremely serious. Sharply falling asset prices quickly bankrupt financial institutions, corporations and households, while impaired collateral values disrupt funding, causing a sudden stop in financial flows. So what is Woodford’s solution?

Step forward, central banks. Woodford’s big idea is that central banks should resolve the uncertainty by buying the risky cat box and replacing it with their own breed of risk-free cat. We replace the certainty of asset price collapse with the certainty of no collapse. Schroedinger’s cat is alive and well.

But what on earth is new about this? We have known for years that central banks can support asset prices. It is the main benefit of quantitative easing. When a central bank credibly stands as buyer of last resort for a given asset class (JGBs, anyone?), it effectively sets the price – to the annoyance of those who would really like to make money from shorting those assets. Central banks cannot prevent their own currencies from collapsing, but they can prevent the value of any asset denominated in their own currency from falling. This is pretty basic and doesn’t need a very long paper and lots of complicated mathematics to explain it.

But Woodford’s intention is not simply to remove the possibility of asset price collapse after a crisis. It is to remove the possibilityat all times. He wants to wipe out both the second AND the first binary fork in his diagram. Specifically, central banks should provide sufficient public sector safe assets to eliminate the possibility of the private sector creating things that it calls “safe assets” which can turn out to be anything but safe. So not only should the cat not be cremated while still in its box, it should not be put in the box in the first place.

There is nothing new about this idea, either. Gary Gorton (whom Woodford cites) has been saying for years that the private sector cannot create genuinely safe assets. And back in 2012, BIS produced a paper arguing that governments in good standing (by which it meant reserve currency issuers, particularly the US) should issue sufficient safe assets to meet demand. BIS did not specify what it meant by safe assets: but Poszar defined them as cash and various varieties of short-term government debt (such as Treasury bills). Woodford follows Poszar in regarding these as as equivalent to cash.

Widening the definition of “cash” to include short-term government debt securities as well as currency and reserves eliminates an obvious criticism of any proposal to replace “safe assets” with cash. Reserves are only available to regulated banks, while physical currency is inconvenient in large quantities. But non-banks need safe assets too. Pozsar explains that a shortage of public sector safe assets for non-banks contributed to excessive production of private sector “safe assets” prior to the 2007-8 financial crisis.

And this is the heart of Woodford’s paper. He thinks he can dismantle the US banks’ securitisation engine by removing the incentive for them to fund themselves by issuing short-term asset-backed securities. If the central bank floods the place with short-term liquid government securities, demand for bank-issued “safe assets” will collapse, banks will stop funding themselves by issuing the things and there will never be another 2008.

Of course, there would have to be a large increase in the supply of short-term liquid government securities. This has significant implications for fiscal finances. Short-term they may be, but T-bills are still debt. So to accommodate the demand for T-bills, either the US government would have to increase the total amount of US government debt in circulation, or it would have to fund itself primarily with very short-term debt. But governments funding themselves largely with very short-term debt suffer interest rate risk. Normally, the only governments funding themselves in this way are in distress.

And there remain question marks over the effect of very high debt/gdp levels on growth and welfare. BIS's idea that government should issue far more debt but ensure its future safety by permanently running primary surpluses shows an incredible naivety about the political process. How could a democratically-elected government possibly maintain continual austerity while storing up the proceeds from unprecedented levels of public debt issuance? Such blatant favouring of the demands of the financial system over the needs of its population would seriously raise political risk.

So there is a conundrum. To meet demand for safe liquid assets, the US government must shorten the average duration of its own debt. But doing so raises its risk, hence making its debt less "safe". How to resolve this problem?

This brings us to Woodford’s REALLY big idea. The Operation Twist variant of QE shortens the duration of government securities held by the private sector. So the US government can still fund itself with long-term debt, but much of this would be exchanged by the Fed for T-bills (Operation Twist) or monetary base (QE). The T-bills would of course also be issued by the US government, so the nominal amount of US debt would increase significantly. But because the majority of long-term debt would be held by the Fed, the amount of US debt held by the private sector would not significantly increase. Only its composition would change. And of course the Fed controls short-term interest rates, so interest rate risk on such short-term funding of government spending would be neutralised. What's not to like?

Woodford’s scheme is consistent with BIS’s argument that the central bank should routinely monetise its own government’s debt in order to control the price. Safe assets have to remain safe, after all.

Now, as a cat lover, I am all in favour of not cremating cats until we know for certain they are dead. But why deprive cats of the boxes that they love, simply because not all cats are immune to poison? And why create a special breed of cat that is immune to poison? Why not remove the poison?

This, to my mind, is a serious weakness in Woodford's paper. He makes no attempt to identify what the poison is. What is it that kills the cat?

Recall that, prior to 2008, the supposedly safe private sector assets were mispriced. They were believed to be safer than they turned out to be, and when the nakedness of the emperor was disclosed for all the world to see, their value crashed. But why were they believed to be safe?

The clue is in this paragraph (my emphasis):

I'm afraid this is a serious error. Housing is not thought of as a risky investment. It was - and still is - believed to be safe.Lowering the equilibrium return on risky investments (such as the “durable goods” modeled here, which one may think of as housing) by lowering the return on safe assets works only insofar as the increased spread between the two returns that would result if the return on risky investments did not also fall increases the incentive to finance additional risky investment by issuing safe liabilities, thus increasing the leverage of the banks and the degree to which they engage in liquidity transformation; this results in a reduced equilibrium return on risky investment, but not by enough to fully eliminate the increased spread that induces banks to issue additional safe asset-backed liabilities.

This is the poison that kills the cat. And it was put in the box by Franklin D. Roosevelt back in 1934.

The National Housing Act established the principle of persistent government support of the housing market - a principle that was extended and developed by subsequent governments, often to prevent property market collapses. For example, the Savings & Loan crisis of the 1980s resulted in further federal and state guarantees for mortgage lending and bailout of institutions that had bought mortgage-backed securities. By the end of the 20th century, the US mortgage market was the most government-controlled in the world and property prices had been protected from significant falls for seventy years. No wonder people believed that property was a safe investment.

So the securities issued by banks were "safe" because they were backed by safe physical assets. They collapsed because those safe physical assets turned out not to be safe. Nor is this the only time this has happened. Indeed, the National Housing Act itself came about because of the terrible property market crash in the Great Depression, in which real estate prices fell by 30%.

Woodford correctly notes that real estate is a risky investment, but he fails completely to note that governments have fostered the illusion of safety, not because they wish to deceive but because they really believe that risky investments can be made safe. The securitisation engine that Woodford hopes to dismantle grew from seeds sown in the New Deal, seeds that - as the Market Realist explained in 2013 - were sown with the best of motives:

In short, securitisation was believed to make the financial system more stable. Nor has Woodford thought about the economic consequences of dismantling the mortgage securitisation engine. Removing the incentive for securitisation is presumably intended to force banks to keep mortgages on their balance sheets. In combination with macroprudential regulation (which Woodford suggests should be used in conjunction with QE), this would be likely to cause a considerable reduction in mortgage origination. How long would it be before a desperate government looked for ways of circumventing this restriction in order to stimulate the property market in the interests of improving economic growth? How long before the Fed trod the path that the Bank of England laid with its "funding for lending" scheme, accepting mortgage loans in return for short-term government debt to enable banks to reduce their cost of funds and thus increase mortgage lending?The use of securitization came out of the Great Depression. Prior to the Great Depression, local banks largely served their communities, and if the local community suffered an economic shock—like an employer going out of business or a weather-related problem—the entire bank’s customer base would have problems all at once. This put undue risk on the bank but also left the community with no source of credit if the bank started having problems. Securitization allowed lenders from outside the area to provide capital to borrowers within the community. It also allowed the local bank to lay off some of its geographic risk.

For over seventy years, the combination of government intervention and a liquidity transformation engine (for that is what securitisation is, in the US) created the illusion that property prices could never fall. But no government can entirely insulate markets from shocks: and the securitisation engine, far from dispersing risk safely, in fact concentrated it. The crash, when it came, was made far worse by the deliberately fostered belief that real estate was a safe investment.

Now Woodford calls for for permanent government intervention in financial markets, and for routine use of liquidity transformation to reduce risk. Like this worked so well last time.

But why should financial markets be protected from shocks? Why should governments preserve the illusion of safety by creating "safe assets" purely for the use of the financial industry, regardless of the needs of their population? In short, why should we continue to put poison in the boxes that cats love to sit in?

There is no such thing as a safe asset. The idea that any asset is, or can be made, completely safe, is dangerous folly. Financial markets must learn to price risk correctly and manage it appropriately. Until they do, they will continue to put the whole of society at risk.

Related reading:

Have we done enough to prevent another crisis?

When governments become banks

Safe assets and Triffin's dilemma

Central banks, safe assets and that independence problem

On risk and safety

Shadow banking's enduring perils - Perry Mehrling

Brad Delong's take on Woodford's paper is here.

* I'm very sorry about the paywall. Academic publishing, meh. I have quoted the bits of Woodford's paper that I think are relevant to my argument. Brad Delong has done likewise.

Image from heinakroon.com.