This is a topic I discussed several times here (for example, here, here, here, here or here). Now there is a paper by Marc Lavoie (with co-author) in Intervention, on the same topic. The paper notes that: "There is a paper by Vernengo/Ford (2014) that covers some of the same ground. Their conclusion is that the 2008 crisis prompted only some cautious change in the views being entertained at the IMF" (my paper with Kirsten is here). Just to clarify, that's not exactly our point. The point...

Read More »Bill Mitchell — IMF policies undermine the health of mothers and children in the poorest nations

In our new book Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017) – Thomas Fazi and I argue that a new progressive agenda would see the abolition of the IMF and the World Bank and the creation of a new multilateral institution that is entrusted with ensuring poor nations can access necessary funds to prevent their societies collapsing. This organisation would not be a bulwark for inflicting neoliberal policies on the poorer nations,...

Read More »IMF Worried that High Inequality Could Threaten Global Capitalism — Sharmini Peries interviews Michael Roberts

MICHAEL ROBERTS: I think the IMF, and that clip shows it, is worried that the huge increase in inequality of income and wealth in many countries, like the US and the UK, over the last 20 or 30 years is reaching such extreme levels that there is serious danger of social and political unrest. The great status quo of globalization and neoliberal policies and international activity in the direction of big business is being threatened by this high inequality. Their economists have now started to...

Read More »David F. Ruccio — Tackle this!

The latest IMF Fiscal Monitor, “Tackling Inequality,” is out and it represents a direct challenge to the United States. Occasional Links & CommentaryTackle this!David F. Ruccio | Professor of Economics, University of Notre Dame

Read More »Mark Weisbrot — The International Monetary Fund’s world economic outlook in theory and practice

The International Monetary Fund (IMF) released its biannual “World Economic Outlook” (WEO) today, presenting a 300-page overview of the world economy and where it might be going. The Fund is one of the most powerful and influential financial institutions in the world. Despite the fact that this flagship publication, and the Fund’s hundreds of PhD economists, missed the two biggest asset bubbles in US and world history (the stock market bubble in the late 1990s and the housing bubble that...

Read More »Ramanan — An Important Note By The United Nations On The IMF And The World Order

The IMF is one institutional which has been responsible for maintaining this world order. Since governments need exceptional financing, they are arm-twisted by the IMF. A recent United Nations General Assemby note, Promotion Of A Democratic And Equitable International Order, has recognized this and criticizes the IMF strongly.… The report is 18 pages long and critical of the IMF from the start to the end. Please read. You won’t find any discussion of the report in the mainstream media....

Read More »Andrew Batson — SDR inclusion as commitment device

Perhaps another way of putting this is that SDR inclusion is a commitment device. In addition to the practical concerns raised by Zhou, there would also be reputational costs to reversing exchange-rate and capital-account reforms. Since SDR inclusion is contingent on the IMF’s determination that the renminbi is “freely usable,” it could conceivably be reversed if the currency were to stop being freely usable. What future Chinese central bank governor will want to see headlines screaming...

Read More »Bill Mitchell — Running trains faster but leaving more people on the platform is nonsense

Earlier in the week I was in Britain. Walking around the streets of Brighton, for example, was a stark reminder of how a wealthy nation can leave large numbers of people behind in terms of material well-being, opportunity and, if you study the faces of the people, hope. I am used to seeing poverty and mental illness on the streets of the US cities but in Brighton, England it very visible now as Britain has struggled under the yoke of austerity. Swathes of people living from day to day...

Read More »IMF Provides Cover for Europe’s Dysfunctional Currency Union

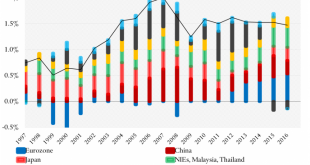

The Council on Foreign Relations’ Brad W. Setser has produced a couple of interesting blogposts on Germany’s fiscal policies of late. The first one, titled “Germany Cannot Quit Fiscal Consolidation,” was published at the end of August. On September 18th, the second one appeared, titled “The Global Cost of the Eurozone’s 2012 Fiscal Coordination Failure.” The latter is more limited in scope and draws heavily on a recent report by the Banque de France. Setser elaborates on the rather...

Read More »Nick Johnson — The ‘organised hypocrisy’ of US industrial policy

Maintaining the core-periphery dichotomy of imperialism and colonialism under neoliberalism, Neo-imperialism, and neocolonialism. The Political Economy of DevelopmentThe ‘organised hypocrisy’ of US industrial policyNick Johnson

Read More » Heterodox

Heterodox