IMF to Greece: Sorry We'll Destroy You | Michael Hudson Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum global requests per minute for crawlers or humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum global...

Read More »On the possibility of a recession, again

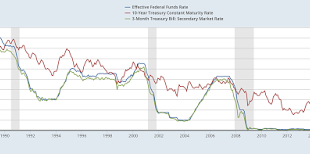

So the yield curve is really flat, not inverted, but really flat, and that has many (or here) afraid of an impending recession. The fear is basically associated to the inverted yield curve (see below: when the blue line is above the red and green lines, there is an inverted yield curve, with a high short rate and lower longer rates, signaling a recession) which is really flat, and the danger that the Fed will rise the rate in the next meeting in a few weeks. Yield Curve (click to...

Read More »The Eurogroup statement on Greece, annotated

The Eurogroup (part of which is pictured above) has produced a statement on the outcome of the latest debt talks with Greece. As ever with Eurogroup statements, it confuses more than it enlightens. So here is my attempt at translating Eurogroup-speak into plain English. __________________________________________________________________________________ The Eurogroup welcomes that a full staff-level agreement has been reached between Greece and the institutions. Phew. We got that through...

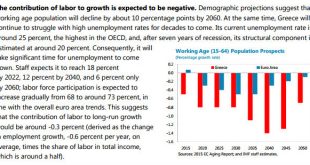

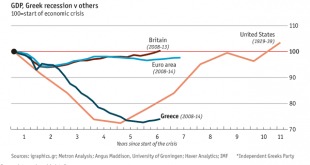

Read More »Where on earth is growth in Greece going to come from?

It's not going to come from people working more. Excerpt from the IMF's latest Debt Sustainability Analysis for Greece, just released: Oh dear. Quite apart from the negative contribution to growth, the prospect of unemployment taking 44 years to return to something approaching normality is simply appalling for Greece's population. I've looked in more detail at this here (Forbes).Well, if labour isn't going to drive growth, there's always investment, yes?Er, not really. The outlook for...

Read More »Latin American corner: When will they ever learn?

By Naked Keynes (Guest Blogger)The latest IMF World Economic Outlook (April 2016) projects stagnation in World Growth (3.1% and 3.2% in 2015 and 2016) both in advanced economies (4.0% and 4.1% in 2015 and 2016) and emerging market and developing economies (1.9% and 1.9% for 2015 and 2016). The prospects for 2017 are hardly any better with an estimate of 3.5% for global output and continuing stagnation of advanced economies. But things could get worse.The current outlook scenario depends on...

Read More »Maurice Obstfeld and the IMF push structural reforms

Spot the difference The new World Economic Outlook (WEO) is out, now under the direction of Maurice Obstfeld, after the retirement of Olivier Blanchard. They suggests many reason for why the global economy has been Too Slow for Too Long, as the title of the report indicates. In the forward Obstfeld tells us that part of the solution would be to promote: "structural reforms in product and labor markets [since this] can be effective in boosting output, even in the short term, and...

Read More »Causality and the new World Economic Outlook (WEO)

I often say that causality is the main, but not the only, difference between mainstream and heterodox approaches in macroeconomics. It's true for differences between Say's Law versus the Principle of Effective Demand, for discussions of exogenous/endogenous money, and also for interpretations of the relation between growth and productivity.The new WEO is out (here). This one the first under Maurice Obstfeld, who substituted Oliver Blanchard. The explanation for lower growth in Obstfeld's...

Read More »Never mind Greece, look at Venezuela

Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely...

Read More »A New Deal for Greece

It appears that the Greeks have given a bloody nose to the EU, turning in a resounding NO vote in Sunday's referendum. Though exactly what they have rejected is unclear. The ballot paper is, to say the least, complicated. The UK's Telegraph published this translation from Greek Analyst:The ballot paper of the #greferendum question upon which the Greek people are called to vote on. (Translated) pic.twitter.com/hPGJcp49Gs— The Greek Analyst (@GreekAnalyst) June 29, 2015 And the paper asked,...

Read More »Stiglitz and Krugman on Troika’s Attack On Greek Democracy

By Joseph StiglitzThe rising crescendo of bickering and acrimony within Europe might seem to outsiders to be the inevitable result of the bitter endgame playing out between Greece and its creditors. In fact, European leaders are finally beginning to reveal the true nature of the ongoing debt dispute, and the answer is not pleasant: it is about power and democracy much more than money and economics. Of course, the economics behind the program that the “troika” (the European Commission, the...

Read More » Heterodox

Heterodox