Celsius Network was never a real business. It did not have a viable business model. Really, it was a momentum trading scheme that relied on the premise that crypto prices would always rise. And when they didn't, it resorted to fake valuations and market manipulation to escape insolvency. It was fraudulent from the start. This is the conclusion I've reached after studying the U.S. Examiner's final report (yes, I've read all 476 pages of it) and Celsius's audited reports and accounts up to...

Read More »The FTX-Alameda nexus

How did it all go so wrong, so quickly? Less than a month ago, Sam Bankman-Fried was the golden boy of crypto, with a net worth in the $billions, and his exchange FTX was valued at $32bn. Now, FTX has a gaping hole in its balance sheet, thousands of people have lost their money, and Sam is facing personal bankruptcy and, potentially, fraud charges. The short answer is - it didn't. The hole in FTX's balance sheet has existed for a long time. We don't know exactly how long, but the size of the...

Read More »Celsius is heading for absolute zero

Yesterday, the failed crypto lender Celsius filed a monthy cash flow forecast and a statement of its assets and liabilities held in the form of cryptocurrency and stablecoins. They showed that the lender is deeply underwater and will run out of money within two months. Today, Celsius presented an update regarding its chapter 11 bankruptcy plans. Reading this, you'd think it was a different company. Liquidation isn't on the agenda. No, they are talking about "reorganization" and and seeking...

Read More »Where has all the money gone?

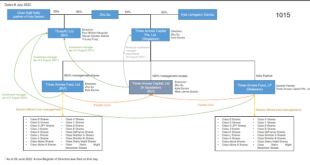

The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC's collapse, it was Do Kwon. How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court,...

Read More »Why Celsius Network’s depositors won’t get their money back

The crypto lender Celsius has filed for Chapter 11 bankruptcy. This should come as a surprise to absolutely no-one, though the grief and pain on Twitter and Reddit suggests that quite a few "Celsians" didn't want to believe what was staring them in the face. Celsius suspended withdrawals nearly a month ago. So far, every crypto lender that has suspended withdrawals has turned out to be insolvent. There was no reason to suppose that Celsius would be different. Celsius's bankruptcy filing...

Read More »Shipwrecked

Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection. The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes $75m. This is the maximum that Voyager could draw down from Alameda's credit line in a 30-day period. So it appears that Alameda did not pull its...

Read More »What went wrong at intu?

In June this year, a company called intu (no capitalisation) collapsed. Most people had never heard of it. But they knew what it did. It was the owner of many of the UK's biggest shopping centres. Lakeside in Thurrock, Metro Centre in Newcastle, and the Trafford Centre in Manchester - all of these were owned by intu. Indeed, they still are. At the time of writing, no disposals have been made. So intu is the landlord of a significant part of the UK's retail sector. And it is dead, killed by...

Read More »What went wrong at intu?

In June this year, a company called intu (no capitalisation) collapsed. Most people had never heard of it. But they knew what it did. It was the owner of many of the UK's biggest shopping centres. Lakeside in Thurrock, Metro Centre in Newcastle, and the Trafford Centre in Manchester - all of these were owned by intu. Indeed, they still are. At the time of writing, no disposals have been made. So intu is the landlord of a significant part of the UK's retail sector. And it is dead, killed by...

Read More »The sad story of Maplin Electronics

Last week saw two high-profile corporate failures in the UK. Toys R Us finally went into administration after a stay of execution over Christmas. And private equity firm Rutland Partners pulled the plug on geeky electronics retailer Maplin. Total job losses from both failures amount to something in the region of 5,000 across the whole of the UK. No-one was particularly surprised by the failure of Toys R Us. The company had proved slow to respond to the rise of online shopping and the...

Read More »The Carillion whitewash

The Carillion whitewash has begun. Carillion's interim CEO, Keith Cochrane, is spinning the line that had banks not pulled funding, its collapse could have been averted. And the Financial Times has released details of a letter Carillion sent to the Government at the beginning of January, in which it asked for short-term advances to tide it over while it underwent restructuring. Labour MP Pat McFadden has written to the Treasury Secretary asking whether it would have been more...

Read More » Heterodox

Heterodox

-310x165.jpg)