Celsius Network was never a real business. It did not have a viable business model. Really, it was a momentum trading scheme that relied on the premise that crypto prices would always rise. And when they didn't, it resorted to fake valuations and market manipulation to escape insolvency. It was fraudulent from the start. This is the conclusion I've reached after studying the U.S. Examiner's final report (yes, I've read all 476 pages of it) and Celsius's audited reports and accounts up to 31st December 2020. There are no more recent audited accounts. It was due to file its 2021 accounts by 31st December 2022, but it did not do so. The accounts are now significantly overdue. I doubt if they will ever be filed. The U.S. Examiner's report reveals deep and long-lasting insolvency, concealed

Topics:

Frances Coppola considers the following as important: accounting, Banking, Celsius, crypto, cryptocurrency, fraud, insolvency, liquidity

This could be interesting, too:

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Joel Eissenberg writes Crypto capital of the world

Ken Houghton writes Time for A Few Small Repairs?

merijn knibbe writes The incredible cost of Bitcoin.

Mashinsky's company A.M. Ventures (AMV) agreed to purchase any unsold tokens from the ICO at $0.20, up to a maximum of $18m, plus a 30% bonus. So, after the ICO failed, AMV bought 117m tokens for $18m. But it did not complete the purchase. The 117m tokens were left in limbo. They were "owned" by AMV, but "custodied" by Celsius. Obviously, Celsius couldn't burn them. So it segregated them in a separate blockchain wallet.

"In January 2020, Celsius and AM Venture attempted to paper over AM Venture’s failure to close on its purchase agreement by entering into a loan agreement. Under the loan agreement, AM Venture would borrow $18 million from Celsius at 6% annual interest. AM Venture would then allow Celsius to offset AM Venture’s obligation to purchase $18 million worth of CEL To secure the loan, AM Venture would pledge the 117 million in CEL that AM Venture had agreed to, but did not purchase, and Mr. Mashinsky would pledge his stock in Celsius Network Inc."

But AMV hadn't completed its purchase of the CEL tokens. It didn't own them. So it couldn't "pledge" them to Celsius. Furthermore, since Mashinsky owned both companies, Celsius's equity pledge was meaningless. So what was really going on?

Taking the tokens out of the picture reveals a fraudulent self-financing scheme. In Celsius-speak, "pledge" means full transfer of ownership rights for a period of time. So Celsius actually lent $18m to AMV to purchase its own share capital. Lending to purchase own shares is illegal in most jurisdictions. Moreover, since Mashinsky owned both companies, he was pledging shares he already owned to himself, presumably to give the impression that this was a legitimate market transaction. It was a clever deception devised by someone well-versed in corporate finance and accounting.

Celsius's management knew this scheme was fraudulent. One senior manager, Ashley Harrell, commented that AMV couldn't pledge tokens it didn't own. But it didn't last long. A few months later, Celsius and AMV wrote off the loans. And in December 2020, Celsius took the 117m tokens onto its own balance sheet, inflating its value by $628m. I'm pretty sure this was the end goal of the scheme.

The amazing balance sheet inflation scheme

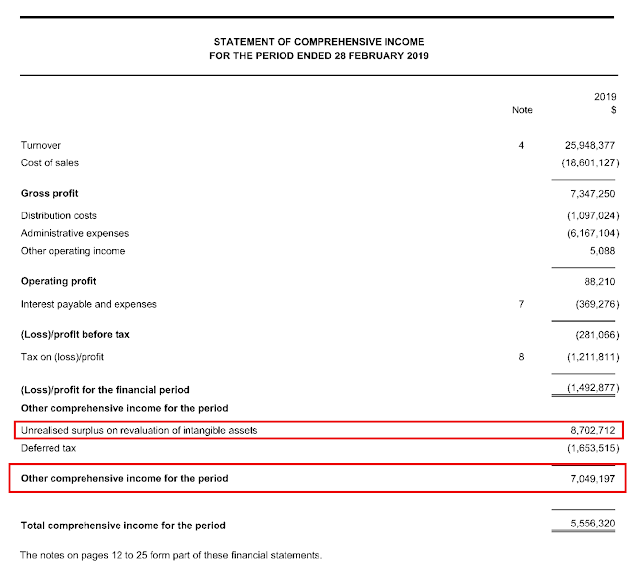

The accounting policies in Celsius's first set of audited accounts, made up to 28th February 2019, reveal that it held the 325m CEL tokens in its Treasury at fair value, with changes in value taken to P&L through "other comprehensive income". Furthermore, although the tokens were minted within the accounting period, it did not record any production costs for them (my emphasis):

"The company considers that treasury cryptocurrencies are an intangible asset with an indefinite useful life as the Company considers that they do not have an expiry date nor have a foreseeable limit to the period of which they will be exchanged with a willing counterparty for cash or goods and services. Treasury cryptocurrencies relate to CEL tokens held by the company and can be issued at the company's discretion. No costs were capitalised in respect of treasury tokens in line with the company's policy on research and development.

So although the individual CEL tokens were individually worth very little, 325m of them recorded at fair value and zero cost was a substantial boost to Celsius's balance sheet. We don't know how they determined the fair value of the tokens, but a back-of-the-envelope calculation using Coingecko's CEL price on 28th February 2019 gives a value of approximately $12.8m, all of which was taken to P&L. It is included in the "Other Comprehensive Income" line in the income statement:

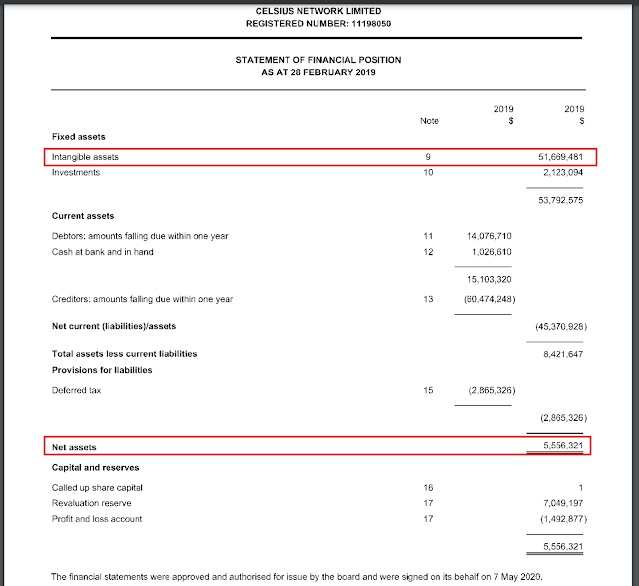

On the balance sheet, Celsius recorded intangible assets of $51.67m:

So Celsius was insolvent in its first year of trading. It should have gone into bankruptcy in the UK. But by recording its own issued tokens at fair value on its balance sheet and taking this into P&L as unrealised gains, it convinced its auditors, Companies House and the general public that it was a going concern. What a racket.

The Notes to the Accounts recorded a warning that the company might not be able to continue as a going concern, ostensibly due to the threat of Covid. As these accounts are supposedly made up to 28th February 2019, which was best part of a year before the threat of Covid even emerged, this is not a credible reason for the going concern warning. However, the auditors noted it:

"We draw attention to note 2.2 in the financial statements, which indicates that while the directors consider that the company has adequate resources to continue in operational existence for the foreseeable future, there is uncertainty due to the impact of the COVID-19 virus which cannot yet be fully quantified. As stated in note 2.2, these events or conditions, along with the other matters as set forth in note 2.2, indicate that a material uncertainty exists that may cast significant doube on the Company's ability to continue as a going concern."

And to cover their own backs, they included a disclaimer placing all responsibility for any fraudulent misrepresentation on Celsius's directors:

"Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an Auditor's Report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatementss can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements".

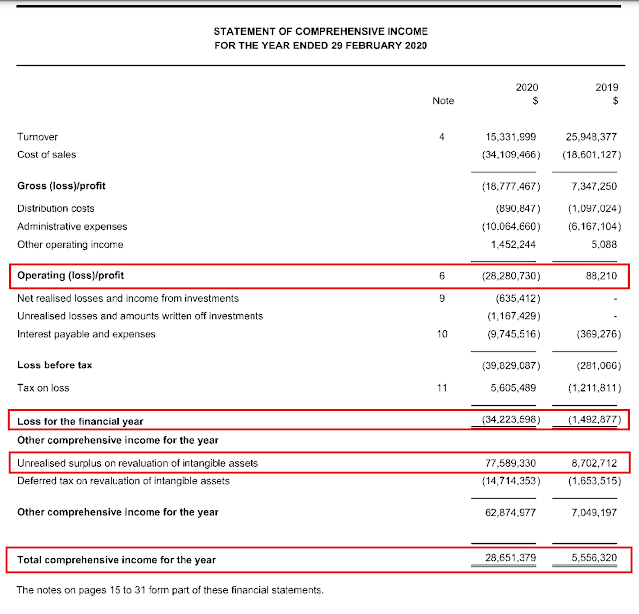

A year later, Celsius was in even deeper trouble. Its accounts dated 28th February 2020 reveal a company teetering on the edge of bankruptcy. It posted a whopping before-tax loss of nearly $40m, and an operating loss of some $28m, largely because of a toxic combination of falling turnover and rapidly rising cost of sales:

Once agin, revaluation of intangible assets came to the rescue. A whopping loss magically became total comprehensive income of $28.65m. Partly, this was because of a general rise in crypto prices over the course of the year, which resulted in significant fair value gains on Celsius's crypto asset holdings. But it was also helped by the increase in value of the CEL token during that time. Using the same method as I used above, I calculate that the total value of the Treasury CEL tokens had risen from $12.8m to approximately $47.6m. Deducting the fair value gain of $29.8m on these tokens from Other Comprehensive Income reveals a total comprehensive loss of approximately $1.5m.Now, I know you're thinking "that's not too bad". True, it's not. But Celsius's actual business was losing money hand over fist. And the cash flow statement shows that it was also bleeding cash. Between March 2019 to February 2020 it suffered a net operating cash outflow of $25.4m and spent nearly $50m buying "short term unlisted instruments". It financed this cash drain with new borrowing totalling nearly $87.6m. The additional borrowing meant it ended the year with a positive cash balance, but at the price of a massive increase in debt. By the year end its short-term borrowing (less than 1 year) totalled over half a billion dollars, and its current ratio - a crucial measure of liquidity - was flashing red at only 0.6. Celsius was dreadfully short of cash and in serious danger of not being able to meet its obligations.

As in the 2018-19 accounts, the notes to the 2019-20 accounts contain a warning that Celsius might not be able to continue as a going concern. Again, Covid is blamed, and with some justification this time, since the pandemic struck the UK with full force in March 2020, forcing the government to impose a lockdown that remained in place with varying degrees of strictness for the next two years. But my analysis shows that the company would have gone down anyway - unless it found a means of generating cash.

The flywheel

The crypto world doesn't have any endogenous sources of cash. Crypto lenders like Celsius can't create dollars when they lend in the way that banks do, and they can't tap the Fed for liquidity. They can borrow from banks and financial markets if they have acceptable collateral, but crypto assets generally aren't acceptable. So for a cash-strapped lender like Celsius, there are really only two sources of dollar liquidity: investors, and depositors. Celsius went for both.

In 2020, Celsius changed its year-end to December. So the final set of accounts it produced while headquartered in the UK covers the period from 1st March 2020 to 31st December 2020. And it documents a remarkable transformation in Celsius's fortunes. In ten months, it moved from a fragile small company bleeding cash at an unsustainable rate to a cash-generating behemoth. The "going concern" warning disappeared from its accounts, though the auditors still warned (presciently, as it turned out) about the possibility of fraudulent misstatement.

But a closer look reveals that the underlying fragilities were still there. In fact they were much, much worse. During the period, Celsius sold some shares, raising $23.26m of unencumbered dollars. But the rest of the money it managed to attract came from short-term creditors, principally new depositors. In ten months, current liabilities rose from $0.5 billion to $4.8 billion, of which $3.9 billion were new deposits.

As a result of this influx of new money, Celsius's end of year cash postion improved to $17.8 million, and its total current assets increased to $2.203 billion. But its liquidity had actually deteriorated. Its net current liabilities were $2.6 billion and its current ratio had slipped to 0.39. It had no means of repaying its short-term creditors.

What was it spending the money on? Mainly, buying and selling cryptocurrencies. During the period, it bought $3.1bn and sold $2.15 bn, and at the end of the period it recorded a revaluation gain of $1.51 bn.

Without this gain, Celsius would have once again been in balance sheet insolvency at the end of the period.

We now know that the cryptocurrency Celsius was so actively trading was is own token, CEL. By the end of 2020, the "fair value" of Celsius's Treasury CEL tokens had risen from a few millions to $1.5bn. Once again, Celsius had escaped insolvency by puffing up its balance sheet with its own tokens.

But this time, the fair value gain did not arise from Celsius's accounting policies and the absence of generally-accepted accounting standards for crypto assets. The U.S. Examiner explains how from May 2020, Celsius's business strategy changed from simple deposit-taking and lending to actively manipulating the price of CEL:

"In May 2020, Celsius’s strategy became more nuanced. In connection with discussions of overall strategy for buying CEL, Mr. Mashinsky stated his basic premise: “Our job is to protect CEL . . . .” In line with this thinking, the new approach to CEL management had one “main thesis”—that Celsius will “rise and fall with CEL" "

The Examiner says there were three main components to Celsius's CEL manipulation:

- Celsius began to regularly buy back more than 50% (and usually 100%) of the weekly CEL rewards from the market... Based on the setting of reward rates, Celsius would calculate how much CEL was needed to pay customers rewards. Celsius would time its purchases of the needed CEL throughout the week to either raise the price of CEL or avoid a price drop. This strategy proved to be successful.

- Celsius began placing “resting orders” of CEL purchases on exchanges at prices below the then-current market price of CEL; these resting orders would automatically trigger if CEL dipped to the specified price. For example, if CEL was trading at $0.10, Celsius would put in an order to automatically purchase a specified amount of CEL at $0.08. Celsius did this for the express purpose of token price control... To ensure that Celsius stayed ahead of market conditions, Mr. Treutler and Mr. Nolan, and later Dean Tappen (Coin Deployment Specialist) would monitor CEL trading activity seven days a week and readjust the “resting orders” as needed to protect the price of CEL.

- Celsius started using its over-the-counter (OTC) trading desk to sell CEL. These sales, which were made at market prices, went “hand in hand with the weekly CEL purchases for Interest payments. . . .” This strategy was internally referred to as the “OTC Flywheel” and operated on the theory that: “[t]he more CEL we sell . . . [t]he more CEL we can repurchase . . . [t]he more attractive CEL markets look like . . . [t]he more CEL buy orders we received . . . [t]he more our Treasury is worth.

Clearly, CEL's price was driven to a large extent by Celsius's buybacks.

Selling and buying back stocks or securities to give the impression that they are more heavily traded than is actually the case, thereby enticing other market participants to buy them and thus pushing up the price, is known as "painting the tape". It is market abuse and is illegal in most jurisdictions, including both the U.K. and the U.S. Celsius had crossed a line.

The U.S. Examiner's disclosure that the U.S. company was "insolvent from inception" appears shocking, but is really of interest only as evidence of the lengths to which Celsius would go to escape the attention of regulators.

Of much more importance is the long-standing insolvency of the entire Celsius Network and the fraudulent devices Celsius used to conceal it. And so I move on to the fundamental issue underlying all of this.

"Celsius Network Limited ("the Company") was created to create a community centric organization that will always act in the vest interest of its customers and depositors, providing two services:1. The ability to deposit digital assets and earn yield on such assets2. The ability to borrow or take a loan against such assets"

The end for Celsius came quickly. On 12th June, it suspended withdrawals. And a month later, on 13th July, it filed for Chapter 11 bankruptcy.

.

.jpg)