Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection. The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes m. This is the maximum that Voyager could draw down from Alameda's credit line in a 30-day period. So it appears that Alameda did not pull its credit line as I thought. Rather, Voyager maxed it out - but still ran out of money. Voyager's desperate shortage of cash is the proximate reason for its bankruptcy. But for its customers, the hole in its balance sheet is the bigger problem. Voyager admits that it cannot repay all, or even most, deposits

Topics:

Frances Coppola considers the following as important: banks, cryptocurrency, deposit insurance, insolvency

This could be interesting, too:

Joel Eissenberg writes Crypto capital of the world

merijn knibbe writes The incredible cost of Bitcoin.

Bill Haskell writes FDIC: Number of Problem Banks Increased in Q1 2024

Angry Bear writes The “Wayback Machine” and Rescuing Problem Banks

Two days after I published my last post, the ship went down. Voyager Digital filed for Chapter 11 bankruptcy protection.

The bankruptcy filing revealed the extent of its indebtedness. Tragically, most of its creditors are customers, some of whom hold claims worth millions of dollars. But its largest creditor is Alameda Research, to whom it owes $75m. This is the maximum that Voyager could draw down from Alameda's credit line in a 30-day period. So it appears that Alameda did not pull its credit line as I thought. Rather, Voyager maxed it out - but still ran out of money. Voyager's desperate shortage of cash is the proximate reason for its bankruptcy.

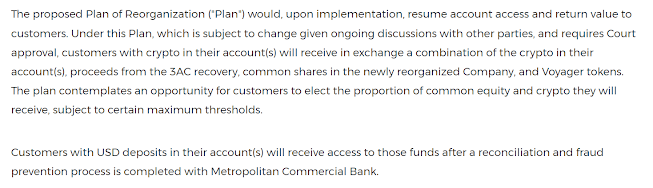

But for its customers, the hole in its balance sheet is the bigger problem. Voyager admits that it cannot repay all, or even most, deposits in full. Its press release outlines a resolution plan that distinguishes between two classes of depositor (click image for a larger view):

US dollar deposits on Voyager don't earn interest. To earn interest, depositors must exchange their US dollars for one of the cryptocurrencies and stablecoins listed as available for trading. Typically, depositors do this as soon as the dollars have been transferred to the platform. So the vast majority of deposits on Voyager are crypto deposits. These will now be subject to a haircut, the size of which will depend on the outcome of the bankruptcy proceedings of Three Arrows Capital (3AC). And that is a complete can of worms.

On 29th June, a court in the British Virgin Islands (BVI) ordered 3AC into compulsory liquidation. This would have resulted in the winding up of 3AC and distribution of its assets to its creditors, including Voyager. But 3AC responded by filing for U.S. Chapter 15 bankruptcy protection, thus preventing its assets in the United States from being seized by the BVI liquidators.

Normally, filing for bankruptcy protection means immediate freezing of assets. But in the decentralized crypto world, freezing assets is voluntary. And it seems 3AC's co-founders, Su Zhu and Kyle Davies, don't think they should have to do it. Shortly after filing for bankruptcy, 3AC moved a sizeable part of its remaining stablecoin holdings to a wallet on the KuCoin exchange that, according to the exchange, did not belong to 3AC. And according to a major NFT investor, 3AC had also started to move its NFT collection. There was a real risk that the remaining assets would simply disappear and creditors would end up with nothing.

Two days ago, annoyed investors obtained a court order to freeze 3AC's assets, saying that the 3AC pair were not cooperating. Liquidators were not being granted access to company documentation, the company's offices in Singapore appeared to be deserted, and Su Zhu and Kyle Davies had disappeared.

The court order had a remarkable effect. Su Zhu popped up on Twitter complaining that the liquidators were "baiting", and accusing them of negligence:

It does not appear that Su Zhu has any intention of handing over 3ACs assets without a fight - not least because he claims to be a creditor himself.

For Voyager's customers, the 3AC shenanigans are very bad news. If the 3AC loan is not recovered, then they could be facing a haircut of at least 30% and possibly quite a bit more.

But not all of them will. USD depositors won't be subject to this haircut. Their money (and Voyager is at pains to insist that it is their money) is supposedly safely held in an omnibus account at Metropolitan Commercial Bank.

Voyager says it intends to restore access to USD deposits "after a reconciliation and fraud prevention process". I find this rather concerning. If Voyager was keeping proper records of customer deposits and regularly reconciling them with the balance in the bank account, such a process would not be necessary. And what fraud do they think they need to prevent? Could they be planning to blame the bank if there is a discrepancy between their customer records and the balance in the account, and advise customers to sue the bank?

This brings us back to the question of FDIC insurance. Metropolitan Commercial Bank has FDIC insurance. Voyager does not, but it claims that US deposits are covered by FDIC insurance on an individual customer basis by virtue of being held in an FDIC-insured bank. Voyager insists that US depositors are customers of the bank. This implies that FDIC passthrough insurance applies. And if it does, then the bank is indeed liable.

Back in 2018, FDIC introduced a rule change that forced banks to be able to identify all of their insured depositors, including any that qualify for passthrough insurance, so that FDIC insurance claims could be settled quickly. So if Voyager is correct, then Metropolitan Commercial Bank must know each of Voyager's USD depositors. It cannot argue - as its statement appears to - that customer records are held by Voyager and it has no responsibility for them.

However, Voyager's claims regarding FDIC coverage for its depositors are decidedly suspect. Voyager's marketing material strongly implied that cash deposits were FDIC-protected in the event of the company's failure: a 2019 blogpost stating this remained up on the company's website and was frequently pointed to in marketing communications. FDIC is now investigating whether the company misled customers.

Whether the bank is liable for any missing funds will depend on whether passthrough insurance applies to Voyager's USD deposits. But Voyager is not a trust company or a licensed broker, and nowhere in its documentation does it say it acts as a fiduciary or agent for its customers. It thus does not appear to meet the requirements for FDIC passthrough insurance. And if it does not, then it is unclear what if any liability the bank has for losses suffered by Voyager's customers.

It is notable that Voyager's statement only says it will "restore access" to USD deposits. It does not say it will refund them in full. If the bank account has a shortfall, therefore, USD depositors could suffer a haircut. Pursuing recovery of any missing money through the courts could take a long time and ultimately be unsuccessful - especially if the bank is not liable.

But it is the crypto customers who face the biggest losses. To use banking parlance, they are going to be bailed in. A substantial part of their crypto will be coercively exchanged for new shares in Voyager (which will initially be worthless) and Voyager tokens (currently trading at 7 cents).

It is easy to say "they should have done their due diligence", but it is nonetheless heartbreaking to read the stories of people who have lost their life savings. Whether they ever recover their losses will depend on the performance of the company once its restructuring is complete and it starts trading again. They will be the new owners of the company and the holders of its native token. Like the Bitfinex depositors who suffered haircuts of 36% in 2016, it will be in their interest to ensure it succeeds.

Related reading:

The Demon Barber of Bitcoin - Forbes

The Great Greek Bank Drama, Act II; The Heist