This post was sparked by conversations with people who have opposing views of how money creation works. Some people think that classical models such as IS-LM don't work with endogenous money theory, therefore the models need to be discarded: others think that there's nothing wrong with the model and the problem is endogenous money theory. Personally I think that simple models like IS-LM can be powerful tools to explain aspects of the working of a market economy, and it behooves us therefore...

Read More »Dirk Ehnts — A short comment on Temin and Vines on Keynes

… For those that want to understand how Keynes is relevant for the 21st century I would recommend reading the original books – now in public domain – or modern books from Post-Keynesian/Modern Monetary Theory authors. econoblog 101A short comment on Temin and Vines on KeynesDirk Ehnts | Lecturer at Bard College Berlin

Read More »The “Natural” Interest Rate and Secular Stagnation: Loanable Funds Macro Models Don’t Fit Today’s Institutions or Data

By Lance TaylorCan America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.)The main points of this paper are that loanable-funds macroeconomic models with their “natural”...

Read More »Lance Taylor on Loanable Funds and the Natural Rate

New paper on INET. Here is from Lance's conclusion: ... writing in the General Theory after leaving his Wicksellian phase, Keynes said that “... I had not then understood that, in certain conditions, the system could be in equilibrium with less than full employment….I am now no longer of the opinion that the concept of a ‘natural’ rate of interest, which previously seemed to me a most promising idea, has anything very useful or significant to contribute to our analysis (pp. 242-43).”...

Read More »Steve Keen on Loanable Funds and Endogenous Money

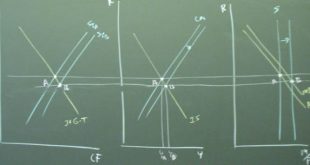

Steve Keen gives a lecture below on the macroeconomics of loanable funds and endogenous money using his program Minsky.[embedded content]

Read More » Heterodox

Heterodox