– by New Deal democrat As usual we start the month with two important reports on the leading sectors of manufacturing and construction. First, the ISM manufacturing index showed contraction yet again, with the headline number “less negative” by way of increasing from 46.8 to 47.2, and the more leading new orders subindex declining sharply by -2.8 from 47.4 to 44.6: Including August, here are the last sis months of both the headline (left column) and new orders (right) numbers: MAR 50.3. 51.4 APR 49.2 49.1 MAY 48.9. 45.4 JUN 48.5. 49.3 JUL. 46.8. 47.4 AUG 47.2. 44.6 Because manufacturing is of diminishing importance to the economy, and was in deep contraction both in 2015-16 and again in 2022 without any recession

Topics:

NewDealdemocrat considers the following as important: 2024, manufacturing and construction, Uncategorized, US EConomics

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

– by New Deal democrat

As usual we start the month with two important reports on the leading sectors of manufacturing and construction.

First, the ISM manufacturing index showed contraction yet again, with the headline number “less negative” by way of increasing from 46.8 to 47.2, and the more leading new orders subindex declining sharply by -2.8 from 47.4 to 44.6:

Including August, here are the last sis months of both the headline (left column) and new orders (right) numbers:

MAR 50.3. 51.4

APR 49.2 49.1

MAY 48.9. 45.4

JUN 48.5. 49.3

JUL. 46.8. 47.4

AUG 47.2. 44.6

Because manufacturing is of diminishing importance to the economy, and was in deep contraction both in 2015-16 and again in 2022 without any recession occurring, I now use an economically weighted three month average of the manufacturing and non-manufacturing indexes, with a 25% and 75% weighting, respectively, for forecasting purposes.

The three month average of the headline manufacturing number is 47.5. The average for the new orders component is 47.1 For the past two months, the average for the non-manufacturing headline has been 51.1 and the new orders component has been 49.8. That means on Thursday the threshold for the August non-manufacturing numbers is 50.2 and 51.6 respectively for the economically weighted average not to forecast recession.

If the news for manufacturing seems a little grim, the status of construction spending is better.

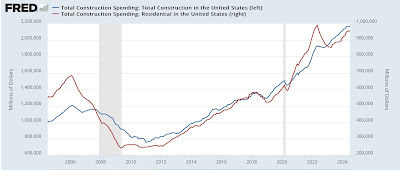

In nominal terms, total construction spending declined -0.3% in July, while the more leading residential construction spending declined -0.4%. Here’s the long term picture:

A post-pandemic close-up shows that spending appears to have been topping for the last 4 months:

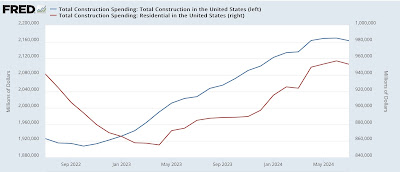

But the picture looks better once we adjust for the cost of construction materials:

So deflated, total construction spending rose 0.7% for the month and is at its highest level since 2007. Residential construction spending rose 0.2% for the month and is also at its highest level since 2007, except for three months at year-end 2021.

I do not see the US economy falling into recession unless either both construction and manufacturing are in synchronous decline, or else at least one of them contracts very sharply. While manufacturing is on the brink, that is not the case with construction at this point. Basically the picture is of weak, but overall still slightly positive leading sectors of the economy.

The Bonddad Blog

Manufacturing and construction make up the vast bulk of the goods producing sector, and they are still trending positive, Angry Bear by New Deal democrat