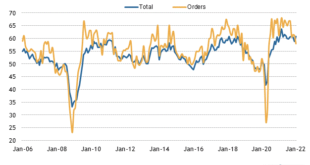

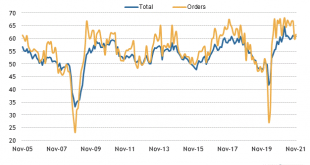

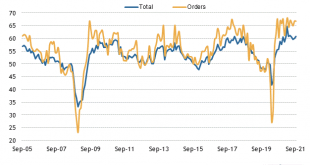

Let’s take a look at the new month’s first data, on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. In May both increased, by 0.7 to 56.1, and by 1.6 to 55.1, respectively. The breakeven point between expansion and contraction is 50, so these both remain solidly positive, if not white hot like they were during last year’s...

Read More »Manufacturing positive, inflation-adjusted construction spending is flat

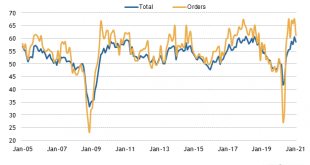

Manufacturing positive, but no longer red hot; inflation-adjusted construction spending is flat In addition to the jobs report, Friday gave us updates on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. While the index remained positive, its leading new orders component stumbled. In March the index declined from 58.6 to...

Read More »Manufacturing continues strong in January; construction continued to sag in December

Manufacturing continues strong in January; construction continued to sag in December As usual, the first data for last month starts out with the ISM manufacturing report. This index, especially its new orders subindex, is an important short leading indicator for the production sector. In January the index declined from 58.8 to 57.6, as did the more leading new orders subindex, which declined from 61.0 to 57.9 (note the breakeven point...

Read More »Fourth Quarter GDP (2021) – Strongest Year in Decades

WSJ reports Stocks rose broadly Thursday morning after the GDP report, but they retreated later in the day, with the Nasdaq falling 1.4%, the S&P 500 dropping 0.54%, and the Dow Jones Industrial Average off 0.02%.Thursday’s report contained warning signs. Most of the growth owed to companies’ restocking rather than people and firms buying stuff. In part, the rise in inventory investment reflected a rebound from super-low inventory levels in...

Read More »Manufacturing still red hot; construction still very cool

Manufacturing still red hot; construction still very cool Our first November data is out this morning with the forward-looking ISM manufacturing report for October, as well as construction spending for October. Let’s take the ISM report first, since it is an important short leading indicator for the production sector, and in particular its new orders subindex. In November the index rose slightly from 60.8 to 61.1, as did the more leading...

Read More »Manufactuing remains white hot, while construction spending is mixed

Manufactuing remains white hot, while construction spending is mixed As usual, we started out the month with the forward-looking ISM manufacturing report for September, as well as construction spending for August. Let’s take the ISM report first since it is an important short-leading indicator for the production sector. And here, the news was good, as the overall index improved to 61.1, among its highest numbers in several decades (but not...

Read More »Industrial Production Rose 0.9% in July

Industrial Production Rose 0.9% in July After Prior Four Months Were Revised Higher, RJS at MarketWatch 666 The Fed’s G17 release on Industrial production and Capacity Utilization for July indicated industrial production rose by 0.9% in July after rising by a revised 0.2% in June and a revised 0.8% in May, and is now up 6.6% from a year ago . . . the industrial production index, with the benchmark now set for average 2017 production to equal to...

Read More »Manufacturing and housing – turn even hotter

Two leading sectors of the economy – manufacturing, and housing – turn even hotter Last month I wrote that both the manufacturing and housing sectors were “on fire.” If anything, this month they turned white hot, with both construction spending and ISM manufacturing data at levels not seen in years. The overall ISM manufacturing reading rose from 58.7 to 60.8, tying the highest reading since the Great Recession, and indeed since 2004. The even...

Read More »Manufacturing and construction – remain “on fire”

The two most leading sectors of the real economy – manufacturing and construction – remain “on fire” Data for January 2021 started out this morning with the ISM manufacturing index, while the December laggard of construction spending was also reported. While the ISM manufacturing reading declined from 60.7 to 58.7, since 50 is the break-even point, this is still a very strong positive. The even more leading new orders subindex also declined...

Read More »Manufacturing and construction – remain “on fire”

The two most leading sectors of the real economy – manufacturing and construction – remain “on fire” Data for January 2021 started out this morning with the ISM manufacturing index, while the December laggard of construction spending was also reported. While the ISM manufacturing reading declined from 60.7 to 58.7, since 50 is the break-even point, this is still a very strong positive. The even more leading new orders subindex also declined...

Read More » Heterodox

Heterodox