The two most leading sectors of the real economy – manufacturing and construction – remain “on fire” Data for January 2021 started out this morning with the ISM manufacturing index, while the December laggard of construction spending was also reported. While the ISM manufacturing reading declined from 60.7 to 58.7, since 50 is the break-even point, this is still a very strong positive. The even more leading new orders subindex also declined from 67.9 to 61.1, also still a very positive reading: The manufacturing sector remains very healthy. Turning to construction, one of my consistent themes in the past few months has been how the housing market is priming the economy for strong growth in 2021 as soon as the pandemic is brought under

Topics:

NewDealdemocrat considers the following as important: construction, manufacturing, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The two most leading sectors of the real economy – manufacturing and construction – remain “on fire”

Data for January 2021 started out this morning with the ISM manufacturing index, while the December laggard of construction spending was also reported.

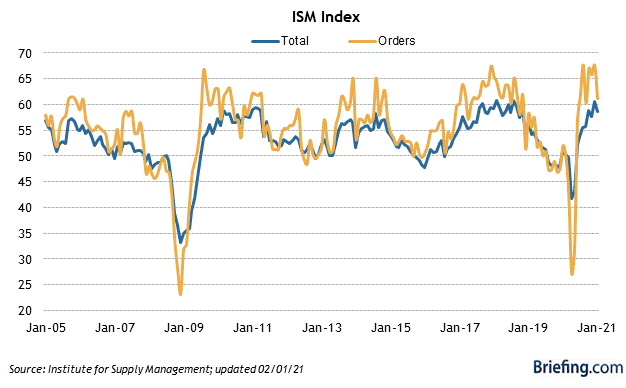

While the ISM manufacturing reading declined from 60.7 to 58.7, since 50 is the break-even point, this is still a very strong positive. The even more leading new orders subindex also declined from 67.9 to 61.1, also still a very positive reading:

The manufacturing sector remains very healthy.

Turning to construction, one of my consistent themes in the past few months has been how the housing market is priming the economy for strong growth in 2021 as soon as the pandemic is brought under control. That was further confirmed as December construction spending surged yet again, confirming what we have already been seeing in housing permits and starts.

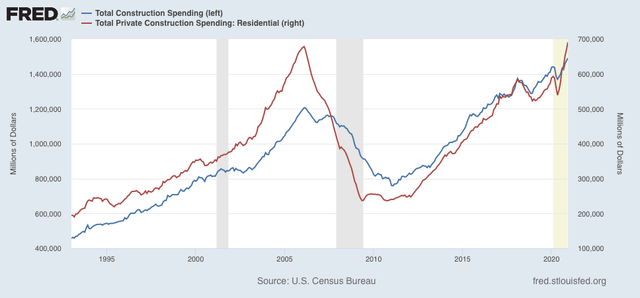

First of all, here are both total and residential construction spending for the past 25 years:

In raw, non-inflation-adjusted terms, both made new all-time highs last month.

Of the two, residential construction is the more important because it is a more leading, indicator. Commercial and government construction, which is included in the total, relatively speaking lag.

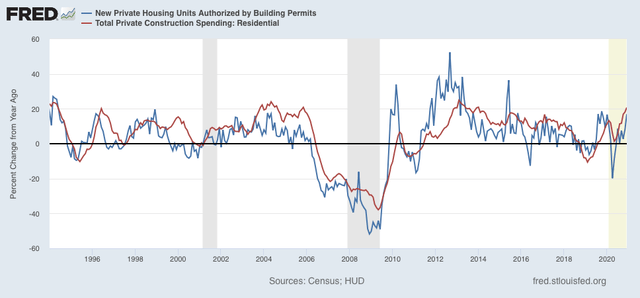

Because permits have to be taken out before construction can begin, typically these lead to construction spending (although in fairness that really hasn’t been true in the past 2 years). Below I show the YoY% change in both, which helps take care of the fact that residential construction spending isn’t adjusted for inflation:

Beginning last May, residential construction spending has been increasing at a pace equivalent to its best in the past 5 years, just as permits have done even better. In short, soaring permits should mean soaring construction continuing through this spring and summer.

Simply put, this morning’s two reports together show that manufacturing and housing, the two most important leading sectors of the real economy, continue to be “on fire.