Summary:

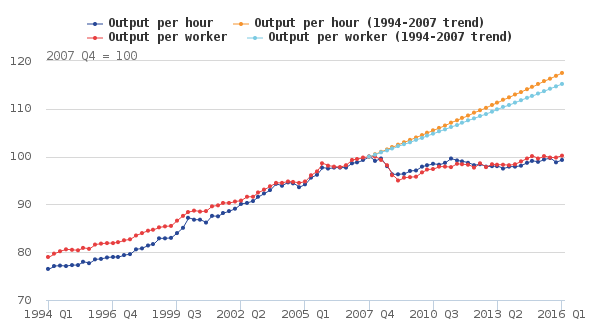

The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped: Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems likely that the financial crisis and the productivity slump are both symptoms of an underlying shock. But what was that shock?To shed some light on this, here is another great ONS chart from the same publication: In the middle of this we had the biggest financial crash since the 1930s, so the productivity drop for financial services is not surprising. What is surprising is that it is by no means the biggest productivity drop. There has been a catastrophic productivity collapse in extractive industries and utilities.This chart comes from Tomas Hirst: That big red bubble is North Sea Oil. The UK's massive productivity growth from 1990-2006 was due to oil, not financial services. Even energy utilities downstream from North Sea Oil had a greater productivity rise than financial services. And both oil and utilities suffered a massive collapse.

Topics:

Frances Coppola considers the following as important: Oil, productivity, UK

This could be interesting, too:

The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped:The ONS has produced a fascinating discussion of the UK's productivity puzzle, with some great charts. This one shows just how much the UK's productivity has slumped: Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems likely that the financial crisis and the productivity slump are both symptoms of an underlying shock. But what was that shock?To shed some light on this, here is another great ONS chart from the same publication: In the middle of this we had the biggest financial crash since the 1930s, so the productivity drop for financial services is not surprising. What is surprising is that it is by no means the biggest productivity drop. There has been a catastrophic productivity collapse in extractive industries and utilities.This chart comes from Tomas Hirst: That big red bubble is North Sea Oil. The UK's massive productivity growth from 1990-2006 was due to oil, not financial services. Even energy utilities downstream from North Sea Oil had a greater productivity rise than financial services. And both oil and utilities suffered a massive collapse.

Topics:

Frances Coppola considers the following as important: Oil, productivity, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Merijn T. Knibbe writes The political economy of estimating productivity.

Merijn T. Knibbe writes In Greece, gross fixed investment still is at a pre-industrial level.

Merijn T. Knibbe writes ´Fryslan boppe´. An in-depth inspirational analysis of work rewarded with the 2024 Riksbank prize in economic sciences.

Notice when productivity started to slump. It was much earlier than 2008. In fact the data (which ONS have helpfully provided in Excel) show that output per hour started to fall in Q4 2006. The productivity slump, therefore, cannot be caused by the financial crisis. I suspect we have a "third variable" problem here. It seems likely that the financial crisis and the productivity slump are both symptoms of an underlying shock. But what was that shock?

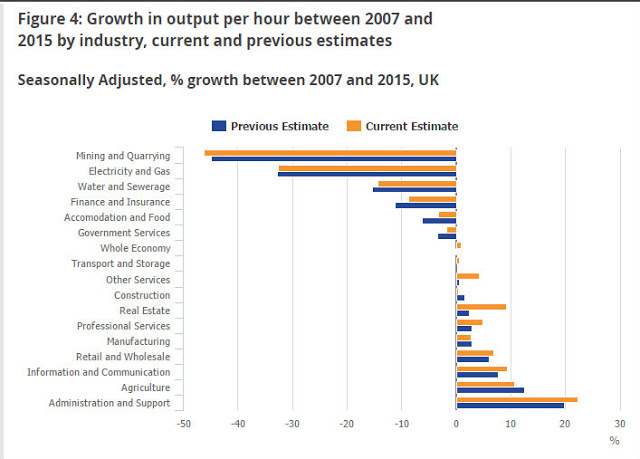

To shed some light on this, here is another great ONS chart from the same publication:

In the middle of this we had the biggest financial crash since the 1930s, so the productivity drop for financial services is not surprising. What is surprising is that it is by no means the biggest productivity drop. There has been a catastrophic productivity collapse in extractive industries and utilities.

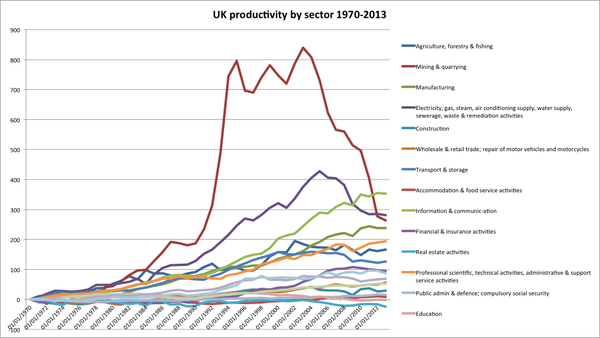

This chart comes from Tomas Hirst:

That big red bubble is North Sea Oil. The UK's massive productivity growth from 1990-2006 was due to oil, not financial services. Even energy utilities downstream from North Sea Oil had a greater productivity rise than financial services. And both oil and utilities suffered a massive collapse.

The collapse of North Sea Oil productivity started in 2004. And as this chart shows, that is when the price of Brent crude started to rise - astronomically:

Since this is a global price, to what extent the price rise is linked with the productivity fall is unclear. But it does speak of a supply/demand imbalance, to which falling productivity in the North Sea must have contributed.

The collapse of NSO productivity was followed by a productivity collapse in downstream utilities, probably due to input price rises. Tom's chart shows that this was partly offset by a rise in financial services output per hour - though the gigantic falls in NSO and utilities output per hour dwarf the increasing productivity of financial services.

We now know that the financial services rise was due to a credit bubble which disastrously burst in 2008. But just have a look at that oil price chart. Why is no-one talking about the mammoth oil price spike from 2004 to the first half of 2008 and its relationship to the financial crisis?

Anyway, the UK's productivity puzzle is perhaps not such a puzzle after all. It seems to be mainly a story of the rise and fall of North Sea Oil. The financial bubble maintained productivity growth for a while as NSO declined. But as the bubble was itself driven by oil price dynamics*, it was doomed. It burst disastrously in September 2008, though the warning signs were there from 2007 onwards.

This suggests that, far from representing some kind of slump, the present productivity trend could actually be normal. We thought the productivity growth of the NSO period was normal, but it is in fact abnormal - and will never return. That does not bode well for future wage growth. Though of course technology might still save us.....

But somehow I doubt it.

UPDATE: Richard Jones of SPERI has reached similar conclusions, though he says the oil productivity slump is not the whole story. He says the UK economy is suffering from Dutch disease, and desperately needs to diversify and invest in R&D and innovation. I can only concur.

Here's Richard's fascinating paper on UK productivity (pdf). Do read it.

Related reading