After the BRICs came the MINTs – Mexico, Indonesia, Nigeria and Turkey.In a series of January 2014 BBC programmes, Jim O’Neill – then the Goldman Sachs economist who had coined the term BRICs – celebrated the new acronym. On a blog under the title ‘The Mint countries: Next economic giants?’ he raved about the potential of his...

Read More »Bill Mitchell — US growth surprise will not last

Last Friday July 27, 2018), the US Bureau of Economic Analysis published their latest national accounts data – Gross Domestic Product: Second Quarter 2018 (Advance Estimate), which tells us that the annualised real GDP growth rate for the US was a very strong 4.1 per cent in the was 3 per cent in the June-quarter 2018. Note this is not the annual growth over the last four-quarters, which is a more modest 2.8 per cent (up from 2.6 per cent in the previous quarter). As this is only the...

Read More »Brian Romanchuk

In previous articles (example), I have been arguing that investment is the major driver of the private sector cycles. (I am using the national accounting definition of investment, and not the act of purchasing financial securities.) We can now turn to the data, and the important question: how are we doing right now?… There are a number of categories of expenditures that are all lumped under the notion of investment. The major categories of interest are: Investment by government (which is...

Read More »Protecting us from the worst? The Bank of England on private debt and financial ‘stability’

Mountains of private debt? Image with acknowledgment to Wikimedia “Countries that underwent sharp credit booms have often experienced a crisis” (Bank of England, 2018, Chart A.28 p. 22)For policymakers, the importance of private debt was the key take home from the financial crisis. Though why it...

Read More »Private debt hyperinflations and the prospect of renewed crisis

“Faced by failure of credit, they have proposed only the lending of more money”Franklin Delano Roosevelt, inaugural address, 4 March 19331. Introduction and overviewTen years ago the bursting of private debt ‘bubbles’ – most obviously in the US, UK and on the periphery of the EU – woke policymakers to the importance of...

Read More »Zero Hedge — Household Debt Rises By $572 Billion, Ends 2017 At All Time High

Zero Hedge Household Debt Rises By $572 Billion, Ends 2017 At All Time High Tyler Durden

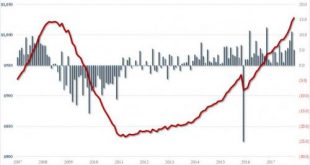

Read More »Constantin Gurdgiev — Money Velocity and Signals of Households Leverage Risks

Equally patent is the fact that the traditional indicators of forward inflationary pressure (e.g. money velocity) are not quite in agreement with the measured inflation (which has exceeded the Fed target four months in a row now and has been beating analysts' expectations over the last three months). The only way the two figures can be reconciled is via increased debt levels on household balances sustaining consumption growth.… true economicsMoney Velocity and Signals of Households Leverage...

Read More »Dan Crawford — Americans and debt…

Employment opportunities at debt collection agencies. Should drive up alcohol and drug sales, too.Angry BearAmericans and debt…Dan Crawford

Read More »Bill Mitchell — US growth performance hides very disturbing regional trends

Last Friday (October 27, 2017), the US Bureau of Economic Analysis published their latest national accounts data – Gross Domestic Product: Third Quarter 2017 (Advance Estimate), which tells us that annual real GDP growth rate was 3 per cent in the September-quarter 2017, slightly down on the 3.1 per cent recorded in the June-quarter. As this is only the “Advance estimate” (based on incomplete data) there is every likelihood that the figure will be revised when the “second estimate” is...

Read More »Reuters — China’s central bank Anticipates a “Minsky moment.”

Hyman Minsky goes to China. China will fend off risks from excessive optimism that could lead to a "Minsky Moment", central bank governor Zhou Xiaochuan said on Thursday, adding that corporate debt levels are relatively high and household debt is rising too quickly. A Minsky Moment is a sudden collapse of asset prices after a long period of growth, sparked by debt or currency pressures. The theory is named after economist Hyman Minsky...."If there are too many pro-cyclical factors in the...

Read More » Heterodox

Heterodox