I was teaching about deficits and debt this last week. If you know me and follow this blog, you'd know that I always emphasize the importance of the distinction between debt in domestic currency and debt in foreign currency. Functional finance authors (and MMT too) are correct in noting that a country cannot default on debt in its own currency (for a model of a currency crisis and default, in foreign currency go here; as afar as I know the only formalization of a PK alternative to the...

Read More »Climate crisis, global debt, and the Fermi paradox – a proposal to the IMF

This article first appeared in the Indian journal Economic and Political Weekly on 13 November, 2021.Fermi ParadoxIn a recent article, Yıldızoğlu (2021) reminded us of the Fermi Paradox, which can be summarised as: Although the probability of the existence of other forms of life in the universe is sufficiently high, why have we not met any?Enrico Fermi, the Italian–American physicist and the creator of the world’s first nuclear reactor, was probably not the first person who asked: “but where...

Read More »Climate crisis, global debt, and the Fermi paradox – a proposal to the IMF

This article first appeared in the Indian journal Economic and Political Weekly on 13 November, 2021.Fermi ParadoxIn a recent article, Yıldızoğlu (2021) reminded us of the Fermi Paradox, which can be summarised as: Although the probability of the existence of other forms of life in the universe is sufficiently high, why have we not met any?Enrico Fermi, the Italian–American physicist and the creator of the world’s first nuclear reactor, was probably not the first person who asked: “but where...

Read More »Climate crisis, global debt, and the Fermi paradox – a proposal to the IMF

This article first appeared in the Indian journal Economic and Political Weekly on 13 November, 2021. Fermi Paradox In a recent article, Yıldızoğlu (2021) reminded us of the Fermi Paradox, which can be summarised as: Although the probability of the existence of other forms of life in the universe is sufficiently high, why have we not met any? Enrico Fermi, the Italian–American physicist and the creator of the world’s first nuclear reactor, was probably not the first person who asked: “but...

Read More »To save the climate – don’t listen to mainstream economists

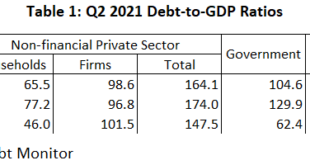

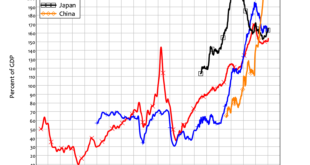

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so...

Read More »To save the climate – don’t listen to mainstream economists

Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one. Figure 1: Private debt levels over the history of capitalism Looking forward to the next ten years, and given...

Read More »Commercial property: * Prêt a Payer *, or Prêt-à-Fermer?

The government wants us to return to our office workplaces in the cities. The FT tells us:“The government will [this] week launch a media campaign to encourage more employees back to their workplaces amid growing concern in Downing Street over the rising number of job losses at service businesses in city centres that are reeling...

Read More »Commercial property: * Prêt a Payer *, or Prêt-à-Fermer?

The government wants us to return to our office workplaces in the cities. The FT tells us: “The government will [this] week launch a media campaign to encourage more employees back to their workplaces amid growing concern in Downing Street over the rising number of job losses at service businesses in city centres that are reeling from a lack of customers. And from Sky News (Aug 20): “Just one in six workers have gone back to work in cities this summer after companies and staff ignored...

Read More »Debt, wealth and climate: globally coordinated Climate Authorities for green financing

By T.Sabri Öncü & Ahmet Öncü This article first appeared in the Indian journal, Economic and Political Weekly on 18 April 2020. The authors’ contact details are at he foot of this article.Abstract Based on the German Currency Reform of 1948 and the “Modern Debt Jubilee” of Steve Keen, a globally coordinated orderly debt deleveraging mechanism is proposed to address the global debt overhang problem. Since the global debt overhang and lack of sufficient climate finance...

Read More » Heterodox

Heterodox

-310x165.png)