Academic Agent has got into another row on MMT, but this time with someone called “Adam Friended.”In brief, “Adam Friended” responded to Academic Agent in the following video on the issue of MMT and price inflation:[embedded content]Academic Agent then produced this response on MMT here:[embedded content]Academic Agent is correct that Covid welfare payments and furlough schemes were not the fundamental drivers of inflation in some goods. It is also true that the Western world is far from...

Read More »Response to Academic Agent on Modern Monetary Theory (MMT) Part 2

Academic Agent had a livestream here criticising my blog post that was a critique of his original video against MMT:[embedded content]This stream is a train wreck. Academic Agent and his Austrian-school libertarians struggle to even accurately grasp Modern Monetary Theory (MMT).I will not correct all the errors and misrepresentations here, or bother to correct every strawman argument.But, first of all, let us just provide a knockout blow to Academic Agent and his minions. Throughout the...

Read More »Dirk Ehnts — Keynes on the quantity theory and techniques of recovery (letter to FDR)

Changes in expenditure rather than changes in the money stock are causal in economic performance. Changes in money stock do not necessarily result in changes in expenditure. Velocity of money depends on liquidity preference. If the money stock increases while the population increasingly desires to save rather than spend, no change in economic performance will follow. A chief point of the General Theory is that spending as "effective demand" drives an economy. As a consequence fiscal...

Read More »Jason Smith — Money is the aether of macroeconomics

So I've never really understood Modern Monetary Theory (MMT). In some sense, I can understand it as a counter to the damaging "household budget" and "hard money" views of government finances. To me, it still cedes the equally damaging "money is all-important" message of monetarism and so-called Austrian school that manifests even today when a "very serious person" tells you it's really the Fed, not Congress or the President that controls the path of the economy and inflation when neither...

Read More »Lara-Resende, Cochrane and the Brazilian Recession

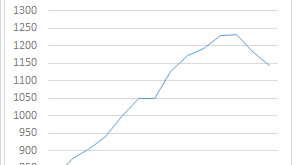

GDP has collapsed by a bit more than 7% in real terms over the last two years in Brazil (graph below show more recent data). This constitutes the worst crisis in recorded macroeconomic history, worse than the debt crisis of the early 1980s, and even the Great Depression. The reasons for this crisis are entirely self-inflicted. I discussed those issues before here (and here). The problem is not fiscal, which resulted from the crisis, nor external, since there was no real issue in financing...

Read More » Heterodox

Heterodox