Count to 10 The paper by Paul Romer, The Trouble with Macroeconomics, has been in the news, and many bloggers have posted about it (Lars Syll here, to name one) and some of the major newspapers (for example, here and here). This follows his previous critiques on what he referred to as mathiness. It's also important since now Romer is the World Bank's chief economist. In all fairness, the only refreshing thing in the paper is the sarcasm, and the internal sociological critique of the...

Read More »On the return of the natural rate of interest

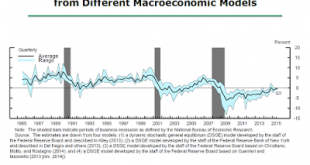

The natural rate is an old concept, well explained in Wicksell, that almost vanished (Keynes was explicitly against it, even though he partially failed to get rid of it), and has made a come back with the Neo-Wicksellian model that dominates macro today (misnamed New Keynesianism). Below the estimates published in the speech by John Williams. Note that what seems to drive the natural rate of interest is the basic rate determined by the central bank. Either the fall of the natural rate...

Read More »On the possibility of a recession, again

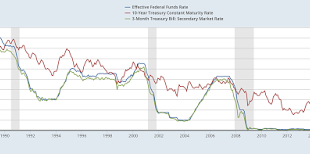

So the yield curve is really flat, not inverted, but really flat, and that has many (or here) afraid of an impending recession. The fear is basically associated to the inverted yield curve (see below: when the blue line is above the red and green lines, there is an inverted yield curve, with a high short rate and lower longer rates, signaling a recession) which is really flat, and the danger that the Fed will rise the rate in the next meeting in a few weeks. Yield Curve (click to...

Read More »Fed holds on the interest rate hike, for now

From the Federal Reserve Board press release: "The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the...

Read More »Unemployment is below 5%, and no inflation to be seen

Numbers are out,employment rose by 151,000 in last month, and December numbers were revised down too.Manufacturing added 29,000 jobs in January. The unemployment rate fell to 4.9 percent. Also, average hourly earnings increased by 12 cents last month, and at about 2.5 percent for the last year. So the unemployment rate has crossed the 5 percent barrier, but inflation does not seem to pick up. The natural rate keeps moving, and mainstream macro has very little to say about it.

Read More »On the natural rate and being always wrong

So I saw that someone linked to an old post of mine in a discussion on Jared Bernstein's blog. The discussion is on productivity slowdown.In that post I quote Alan Blinder on his views (slightly more than a year ago) on the natural rate. He said : "the 'central tendencies' in the Federal Open Market Committee’s latest published forecasts range from 5.2% to 5.5% for the 'full-employment' unemployment rate, and from 2% to 2.3% for the potential GDP trend." So unemployment should be below the...

Read More »Interest rates will go up (almost certain now)

Not a conventional rate Janet L. Yellen said in her speech at the Economic Club of Washington that rates are going to increase. Perhaps there will be no unanimous decision by the FOMC, but gradual increases should start in December. It must be noted that she did say that: "we cannot yet... declare that the labor market has reached full employment." She is also concerned with the weakness of the global economy, and, hence, of US exports. The forecast in a nutshell: "I anticipate continued...

Read More »Clarida on Fed policy: or how does the Fed affect inflation

Richard Clarida gave an interview (right at the beginning of the podcast) on why the Fed should increase the rate of interest. He also said that the Fed can affect inflation, which, he correctly points out, is denied by several economists. However, the degree of confusion on this subject is significant, and modern monetary theory, and its implications for central banking behavior, is, in part, responsible for that.The conventional wisdom on what central banks can do (and one can think of...

Read More » Heterodox

Heterodox