Alan Blinder published recently two columns on the WSJ (here and here) on the need to exercise fiscal restraint. In both cases he complains that the fiscal deficit is too large. Note that he is not saying that this is always the case, he emphasizes that in the second and most recent piece. The reason, as always, is that we are close to full employment. In his words:"... today we are back at full employment, or perhaps beyond it, ad economic growth kooks solid. The economy doesn't need...

Read More »On mainstream Keynesianism

Looking up to Galbraith The ASSA Meeting was this last weekend in Philadelphia. It was the bomb... cyclone (Nate Cline's joke; I'm sure many others too came up with that one). I don't have much to report actually. I did participate in one section, and will post a link to a preliminary version of my paper soon. I was at the Economists for Peace and Security (EPS) dinner, that honored Jamie Galbraith. This blog was named Naked Keynesianism, as you may know, because years ago Fox News...

Read More »Brian Romanchuk — Initial Comments On Zero Rate Policy And Inflation Stability

This article represents my initial comments on the question of the stability implications of locking interest rates at zero. Martin Watts, an Australian academic, had an interesting presentation at the first Modern Monetary Theory (MMT) conference (link to videos of presentations). Although MMT fits within a broad-tent definition of "post-Keynesian" economics, there are still sharp debates with other post-Keynesians. One topic of debate is the effect of permanently locking the policy...

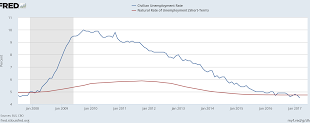

Read More »Edmund S. Phelps — Nothing Natural About the Natural Rate of Unemployment

All this does not mean there is no natural unemployment rate, only that there is nothing natural about it. There never was. Project SyndicateNothing Natural About the Natural Rate of Unemployment Edmund S. Phelps | 2006 Nobel laureate in economics, and Director of the Center on Capitalism and Society at Columbia University

Read More »The Economist and the natural rate of unemployment

The Economist new series on 'big ideas' tackled in a recent issue the concept of the natural rate unemployment (subscription required; other ideas included Say's Law and Human Capital, just to give you the broad picture of what they think it's big). I will only comment very briefly on two issues, one related to the history of ideas and the other to the concept itself.The Economist suggests that the natural rate of unemployment can somehow be connected to the ideas of Keynes. In their...

Read More »The danger of a recession

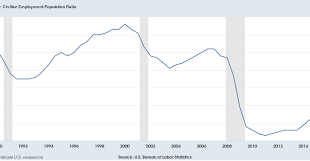

So the BLS has the new job numbers for March. Recovery continues at slow pace, as expected. 98k jobs created, considerably below the 200k average of the last couple of years, and unemployment rate reduced to 4.5% with the participation rate up a little bit, but still below its previous peak, at 63% of the labor force. The danger is that many more will suggested that we are now below the natural rate of unemployment (yes, that is a very problematic concept, something discussed here many...

Read More »The “Natural” Interest Rate and Secular Stagnation: Loanable Funds Macro Models Don’t Fit Today’s Institutions or Data

By Lance TaylorCan America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.)The main points of this paper are that loanable-funds macroeconomic models with their “natural”...

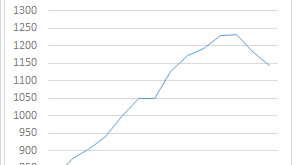

Read More »Lara-Resende, Cochrane and the Brazilian Recession

GDP has collapsed by a bit more than 7% in real terms over the last two years in Brazil (graph below show more recent data). This constitutes the worst crisis in recorded macroeconomic history, worse than the debt crisis of the early 1980s, and even the Great Depression. The reasons for this crisis are entirely self-inflicted. I discussed those issues before here (and here). The problem is not fiscal, which resulted from the crisis, nor external, since there was no real issue in financing...

Read More »The “Natural” Interest Rate and Secular Stagnation

New paper by Lance Taylor in Challenge Magazine. From the blurb: Can America recover ideal rates of growth through interest-rate policies? This important analysis suggests that most economists misunderstand the issue. Updating Keynes, the analysis suggests that fiscal stimulus, labor union bargaining power, and more progressive income taxes are needed to support growth. (The article includes some algebra, which some readers may choose to skip.) Read full paper here.

Read More »Lance Taylor on Loanable Funds and the Natural Rate

New paper on INET. Here is from Lance's conclusion: ... writing in the General Theory after leaving his Wicksellian phase, Keynes said that “... I had not then understood that, in certain conditions, the system could be in equilibrium with less than full employment….I am now no longer of the opinion that the concept of a ‘natural’ rate of interest, which previously seemed to me a most promising idea, has anything very useful or significant to contribute to our analysis (pp. 242-43).”...

Read More » Heterodox

Heterodox