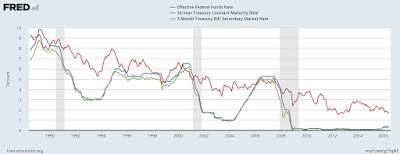

So the yield curve is really flat, not inverted, but really flat, and that has many (or here) afraid of an impending recession. The fear is basically associated to the inverted yield curve (see below: when the blue line is above the red and green lines, there is an inverted yield curve, with a high short rate and lower longer rates, signaling a recession) which is really flat, and the danger that the Fed will rise the rate in the next meeting in a few weeks. Yield Curve (click to enlarge) Blanchard, cited in one of the WSJ pieces above, thinks that the Fed might be forced to hike interest rates, since the economy, presumably is close to the natural rate, that is, to full employment and inflation is a danger. Note that Blanchard is suggesting that the 2% target should be upheld, even though he was against this when he was at the IMF.I think this is misguided on many levels. On the theoretical front the reliance on the natural rate is problematic, of course. The notion that we are close to full employment is doubtful to say the least, given that participation rate has not recovered much at all since the last recession. Real wages have not grown that much either, and with lower commodity prices the risk of higher inflation (if one is concerned not just with core inflation) is not particularly high. The FOMC should leave the short run rate unchanged. But that is not enough.

Topics:

Matias Vernengo considers the following as important: Blanchard, IMF, Natural Rate, recession, yield curve

This could be interesting, too:

Matias Vernengo writes Milei’s Psycho Shock Therapy

Matias Vernengo writes Elon Musk (& Vivek Ramaswamy) on hardship, because he knows so much about it

NewDealdemocrat writes What to look for if housing construction does forecast a recession

Matias Vernengo writes More on the possibility and risks of a recession

I think this is misguided on many levels. On the theoretical front the reliance on the natural rate is problematic, of course. The notion that we are close to full employment is doubtful to say the least, given that participation rate has not recovered much at all since the last recession. Real wages have not grown that much either, and with lower commodity prices the risk of higher inflation (if one is concerned not just with core inflation) is not particularly high. The FOMC should leave the short run rate unchanged. But that is not enough. The Eccles mantra should be repeated more often. Monetary policy is like pushing on a string, in a situation like this one. We need fiscal stimulus.