Falling aggregate profit rate? As James Montier, the post-Keynesian economist at GMO, the large asset fund manager, points out, real earnings growth in the corporate sector has been below the rate of real GDP growth even after the significant boost from the financial engineering from share buybacks. According to Montier, when you dig down into the market you find that a staggering 25-30 per cent of firms are actually making a loss. In Montier’s view, “the US is witnessing the rise of the...

Read More »I’m looking for recession and not finding it.

These are stats from my latest MMT Trader report. Are these recessionary signs? Warren Mosler is bearish as hell. Auto loans rising at the fastest pace in 8 months. Residential real estate loans rising at fastest pace in 3 weeks. Bank "residual" (capital) at record highs and up 3 weeks straight and up 6 of the last 7 weeks. (Implies growing bank earnings.) Bank assets at record levels. Gasoline demand at 6-month high. Distillate demand at 3-month high. Federal tax deposits have been...

Read More »The budget, the fragile recovery and the next recession

I'm not a forecaster. I do macro, and worked for Wynne Godley at the Levy, but I feel that there are too many dangers in forecasting. Wynne was also, btw, more concerned with what he called medium term scenarios, than pinpointing when a recession would take place. The obvious joke applies here. Economists have predicted 10 of the last 9 recessions. Having said that let me do the exact opposite and throw caution to the wind.So I'm going out on a limb here. Everybody thinks the recession...

Read More »An Analysis of Financial Flows in the Canadian Economy

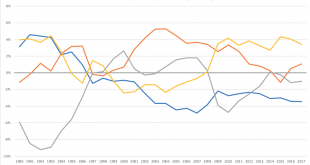

An essential but perhaps overlooked way of looking at the economy is a sector financial balance approach. Pioneered by the late UK economist Wynne Godley, this approach starts with National Accounts data (called Financial Flow Accounts) for four broad sectors of the economy: households, corporations, government and non-residents. Here’s how it works: in any given quarter or year each sector can be a net borrower or lender, but the sum of the four sectors’ borrowing/lending must equal to...

Read More »On the possibility of a recession, again

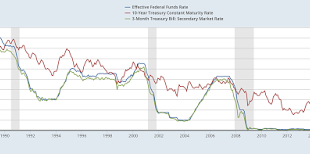

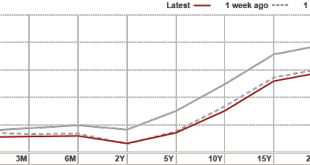

So the yield curve is really flat, not inverted, but really flat, and that has many (or here) afraid of an impending recession. The fear is basically associated to the inverted yield curve (see below: when the blue line is above the red and green lines, there is an inverted yield curve, with a high short rate and lower longer rates, signaling a recession) which is really flat, and the danger that the Fed will rise the rate in the next meeting in a few weeks. Yield Curve (click to...

Read More »Gazing into the distance

The result of the EU referendum was a considerable shock - not just to the UK, but to the EU and indeed to the whole world. Just how big a shock it was is evident from the fact that the OECD has suspended its forecasts until September. It usually only does this for "significant unforeseen or unexpected events", such as a major earthquake or a tsunami. Brexit is a shock to the global economy of a similar order. And it has permanently changed the world. Whatever the future holds, we can be...

Read More »Short-run effects of the Brexit shock

The Governor of the Bank of England's opening remarks at the release of today's Financial Stability Report were stark: At its March meeting, the FPC judged that “the risks around the referendum [were] the most significant near-term domestic risks to financial stability.” Some of those risks have begun to crystallise. The Governor was admirably calm and balanced in his press conference. But nevertheless there was a degree of schadenfreude about his remarks. Prior to the referendum, the Bank...

Read More »More on the slow recovery

The private sector added 156,000 jobs in April, according to the Automatic Data Processing (ADP) report, ahead of the Bureau of Labor Statistics (BLS) more comprehensive release this Friday. As the graph shows there is a slowdown form last month. This adds to weak manufacturing growth,and a smaller trade deficit, resulting from lower imports, that is, a slower economy. I still think a recession might not be in the immediate horizon. However, the data seem to indicate, as I said before, that...

Read More »Euro area depression, charted

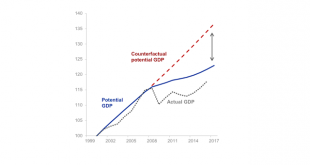

"The euro area economy is gradually emerging from a deep and protracted downturn. However, despite improvements over the last year, real GDP is still below the level of the first quarter of 2008. The picture is more striking still if one looks at where nominal growth would be now if pre-crisis trends had been maintained." So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.He's not wrong. From his presentation,...

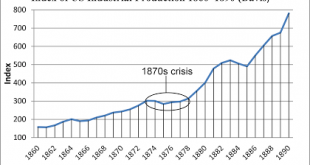

Read More »The 1870s Economic Crisis in America: Reality versus Rothbard

It doesn’t matter how many times Rothbard’s view of the 1870s is refuted, Austrians and libertarians simply continue to shun reality and repeat Rothbard’s errors (such as here and here).It can’t hurt to review the data.First, industrial production. The best and most recent index of US industrial production in this era is Davis (2004) (see Hanes 2013: 121), which draws on many more industrial products and services than other, older indices.The data from Davis shows that US industrial...

Read More » Heterodox

Heterodox