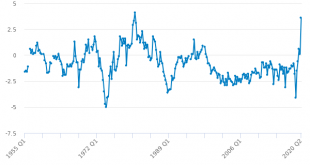

The UK is running a trade surplus. No, really, I am not joking. This is from the ONS's latest trade statistics release:The UK total trade surplus, excluding non-monetary gold and other precious metals, increased £3.8 billion to £7.7 billion in the three months to August 2020, as exports grew by £21.4 billion and imports grew by a lesser £17.5 billionIt's the first time the UK has run a trade surplus since the late 1990s: And if you were thinking this was because of the lockdown, you would...

Read More »Trade, saving and an economic disaster

The UK is running a trade surplus. No, really, I am not joking. This is from the ONS's latest trade statistics release:The UK total trade surplus, excluding non-monetary gold and other precious metals, increased £3.8 billion to £7.7 billion in the three months to August 2020, as exports grew by £21.4 billion and imports grew by a lesser £17.5 billionIt's the first time the UK has run a trade surplus since the late 1990s: And if you were thinking this was because of the lockdown, you would...

Read More »Zero Hedge — Hundreds Of Billions In Gold And Cash Are Quietly Disappearing

"Squirreling money under the mattress?" ?Zero HedgeHundreds Of Billions In Gold And Cash Are Quietly Disappearing Tyler Durden With the Hong Kong protests showing no sign of letting up, a new narrative has emerged; that anti-government activists are "sliding into terrorism with home-made bombs" designed to inflict mass casualties. On Sunday, Hong Kong police reported that they foiled a second bomb plot in under a week - arresting three men who were allegedly testing home-made devices and...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The desert of plenty

This post first appeared on Pieria in November 2013. Throughout history, humans have dreamed of plenty. They have longed for there to be abundant supplies not only of essentials, but of luxuries. The promise made to the Israelites wandering in the desert was that they would eventually come to a land “flowing with milk and honey”. And the vision of the New Jerusalem in Revelation is of riches beyond imagination. Recent forecasts of forthcoming abundance, too, have focused on...

Read More »Weird Is Normal

This post was originally published on Pieria in December 2013. Since then, the idea that the long-term real equilibrium interest rate must be equal to or lower than the long-term sustainable growth rate has become much more mainstream. I am just amazed that anyone ever thought it could be otherwise. A long-term real interest rate persistently above the sustainable growth rate cannot possibly be an "equilibrium" rate. As I show in this piece, it can only be maintained through rising...

Read More »Lars P. Syll’s Blog Krugman vs Kelton on the fiscal-monetary tradeoff

The battle of the titans. Or maybe better, David and Goliath. We have to free ourselves from the loanable funds theory — and scholastic gibbering about ZLB — and start using good old Keynesian fiscal policies. Keynes — as did Lerner, Kaldor, Kalecki, and Robinson — showed that it was possible to promote economic growth with an “appropriate size of the budget deficit.” The stimulus a well-functioning fiscal policy aimed at full employment may have on investment and productivity does not...

Read More »Dirk Ehnts — A short comment on Temin and Vines on Keynes

… For those that want to understand how Keynes is relevant for the 21st century I would recommend reading the original books – now in public domain – or modern books from Post-Keynesian/Modern Monetary Theory authors. econoblog 101A short comment on Temin and Vines on KeynesDirk Ehnts | Lecturer at Bard College Berlin

Read More »Nick Rowe — “Profits = Investment – Saving”

"Profits = Investment - Saving"Or, "Profits = Expenditure - Income". Those are just alternative ways of saying the same thing, for a closed economy, if investment and saving include government investment and saving. Most economists will say that's wrong. And it is wrong by standard definitions, where aggregate expenditure and income are the same thing, and investment and saving are also the same thing (for a closed economy, including government investment and saving). But let me tell you...

Read More » Heterodox

Heterodox