The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that offers the safety that fearful investors desperately crave. That, fundamentally, is what is driving down the returns on assets. It is also the primary cause of the wide US trade deficit. The President likes to think that the reason for the US’s persistent trade deficits is unfair trade practices and

Topics:

Frances Coppola considers the following as important: Capital, currency, negative rates, safety, saving, savings, tax, trade

This could be interesting, too:

Frances Coppola writes Trade lunacy is back

Frances Coppola writes We need to talk about the state pension

Angry Bear writes Commercial Interests Lobbying Against Railroad Safety kill Legislation

NewDealdemocrat writes Spending soars, income stagnates, savings sink like the Titanic

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that offers the safety that fearful investors desperately crave. That, fundamentally, is what is driving down the returns on assets.

It is also the primary cause of the wide US trade deficit. The President likes to think that the reason for the US’s persistent trade deficits is unfair trade practices and currency manipulation. And for some countries, these are undoubtedly contributing factors. But the biggest reason by far is the global dominance of the dollar, and above all, the pre-eminence of dollar-denominated financial assets as the world’s preferred savings vehicles.

The world loves to save in dollar-denominated “safe assets” – not only the dollar itself, but also US Treasuries, mortgage-backed securities. dollar-denominated debt issued by other governments in good standing, and dollar-denominated blue-chip corporate debt. When global demand for these assets rises and/or their supply falls, dollars become relatively scarcer internationally, both because foreigners increase their holdings of dollars and because they buy or borrow more dollars to buy other dollar-denominated safe assets. This drives up the dollar exchange rate against all other currencies. It also depresses yields, both on dollar-denominated safe assets and on all other financial assets. Thus the strong dollar and negative yields are both primarily caused by the world's dollar saving habit, not by its trade practices. And the dollar safety quest intensifies as political tensions rise.

You might think that the high price of dollar-denominated safe assets would discourage investors. But a new paper presented at Jackson Hole last week finds the opposite. When the price of dollar-denominated safe assets rises, so does demand for them:

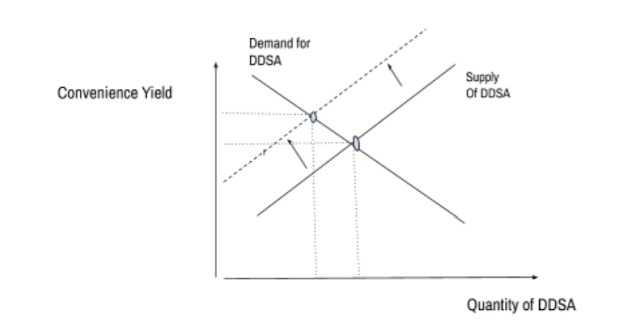

The equilibrium convenience yield on dollar-denominated safe assets (DDSA) depends on the marginal willingness to pay for the services of DDSA, and on the supply of these services, i.e. the stock of DDSA. As the price of these services increases, the quantity foreign investors demand increases. The supply of DDSA is upward sloping because other issuers (governments, banks and corporations) supply more DDSA as the price for these services increases.

When the Fed tightens, the bond markets infer that a reduction in the supply of safe dollar assets is imminent. As a result of this supply shift, the marginal willingness of global investors to pay for the safety and liquidity of dollar-denominated assets - as measured by the convenience yield on these assets - increases, leading to an appreciation of the dollar in response to this increase in the convenience yield (even when controlling for interest rates).This is similar to how “Veblen goods" behave. Normally, when the price of a good rises, demand for it falls away until the price stabilises. But with Veblen goods, the opposite happens: rising prices feed demand. Veblen goods are typically luxury items to which (rich) investors are attracted because of their scarcity: making them even more scarce raises demand. So it seems DDSAs are luxury financial assets for which investors fiercely compete. And US Treasuries are the most luxurious of all. The authors show that synthetic equivalents of US Treasuries don’t command equivalent prices: there is a premium attached to a real US Treasury.

The "luxury" nature of US Treasuries lowers the US’s long-term borrowing costs. This has been known for a long time: back in the 1960s, France’s Finance Minister (later President) Valéry Giscard d’Estaing dubbed it the US’s “exorbitant privilege.” But the persistent inflows of capital that arise from global demand for DDSAs are not without cost. As Michael Pettis explains, they force the US either to borrow much more or tolerate much higher unemployment. Thus far, US governments – and the Fed, through its dual mandate – have always preferred debt over unemployment.

But the US is becoming less tolerant of the world’s dollar saving habit. The Great Financial Crisis of 2008 showed that although the US can borrow cheaply from the rest of the world in good times, when it all goes horribly wrong the rest of the world looks to the US to make good its losses. This responsibility, which the economist Hélène Rey calls the US’s “exorbitant duty,” is resented by many Americans. They didn’t agree to be the world’s “insurer of last resort,” and they object to paying up. And a growing number of Americans also resent the US’s role of “consumer of last resort” to the rest of the world. They see the US’s persistently wide trade deficit, high private and public indebtedness, and haemorrhage of good jobs to foreign shores, as an “exorbitant burden” of which they would like to be relieved.

But how to relieve it? Two senators think they have a solution. They have proposed a Bill that would mandate the Fed to impose a variable charge on inflows of capital over $10,000. The idea is that the charge would discourage investors from buying dollar-denominated assets, particularly on a short-term basis. Dollar demand would fall, the dollar exchange rate would weaken, and the trade deficit would narrow. The Bill proposes that the charge should be set at such a level that the trade deficit would shrink to within 0.5% of GDP from its current level of around 3% of GDP. That is quite a drop.

Michael Pettis thinks that taxing capital inflows would close the trade deficit as effectively as import tariffs without their distorting effects. "Whereas tariffs subsidize some U.S. producers at the expense of others, taxing capital inflows would benefit most domestic producers with the costs borne primarily by banks and speculators," he says. And he continues:

Unlike issuing tariffs, levying a tax on capital inflows doesn’t disrupt value chains to anywhere near the same extent or distort relative prices on tradable goods. Tariffs favor some sectors of the productive economy over others, so they can be highly politicized as well as highly distorting to global value chains and the role of U.S. producers. Taxing capital flows works by forcing financial adjustments—by adjusting the value of the dollar, for example, or by reducing debt—so such a tax is likely to be both less politicized and less distortionary to the real economy. In fact, to the extent that trade imbalances are driven by distortions in global savings, taxes on capital inflows will even drive prices closer to their optimal level.Pettis adds that since the charge would particularly discourage short-term flows, it would not need to be very large to be effective.

If this were any country other than the US, I would wholly agree with Pettis. But the US is the provider of safe assets to the whole world. There is no substitute for dollar-denominated safe assets, either as a safe savings vehicle or – importantly – as collateral for borrowing and lending dollars. The proposed tax on capital inflows therefore amounts to an attempt to force the rest of the world to give up its desperate quest for safety.

Personally, I think that the world's obsession with safety is the principal cause of what is now a decade of economic stagnation. I would like to see much less saving, especially by some developed countries whose almost religious belief in the virtue of accumulation is in my view creating dangerous imbalances and causing rising political tension. But the wounds from the financial crisis and the Euro crisis are as yet unhealed, and the world economy has other painful scars, notably from the Asian crisis of 1997-8. And the world is still suffering from a bad case of post-traumatic stress disorder: everyone is constantly on the lookout for the next crisis. In these circumstances, it is wholly understandable that people want to build up buffers to protect themselves from the terrible consequences of another crisis, and wholly reasonable of them to think the best buffer is a very large claim on the world's richest economy.

For this reason, I think it unlikely that a tax on capital inflows would significantly discourage investors from buying dollar-denominated safe assets. In fact as David Beckworth observes, the turmoil that such an attack on the “status quo” might cause could encourage investors to purchase even more dollar-denominated assets, driving down yields everywhere as money left the rest of the world and flowed into the US. I can't think of a faster way of bringing about the negative-rate universe that investors seem to fear so much.

The fact is that the US doesn't have the power to force the rest of the world to stop amassing claims on it. And attempting to force investors to reduce their appetite for dollar safety could perversely increase it. Until there is a viable alternative to dollar-denominated safe assets, the US is stuck with its role of "insurer to the world."

If the tax failed to discourage dollar-denominated safe asset investment, the dollar exchange rate would not fall. In fact since it would be more expensive to buy the assets, demand for dollars would rise, and it would rise even more if fearful investors fled into safe assets in response to the tax. This would be likely to drive up the dollar exchange rate. Perversely, therefore, this Bill could have the opposite effect on the dollar exchange rate from that intended.

I say “perversely”, but I actually don’t find this at all surprising. Looking at the whole problem through the opposite end of the telescope gives a different perspective. I like to regard America's debt not as its biggest liability but as its greatest export. So, let's return to the concept of DDSAs - of all kinds - as a luxury export. They are hugely in demand, very expensive and there is never enough of them.

The Bill would impose an export tariff not only on genuine US Treasuries, but also on the private sectors’ cheaper substitutes, thus raising the general price of dollar safety. Raising the price of a luxury good is unlikely to discourage demand for it: indeed taxing DDSAs could even increase demand in much the same way as the Fed tightening monetary policy does, since it would send a clear signal that the US government wished to reduce the supply. So gross dollar inflows would increase and the dollar exchange rate would rise.

Alternatively, we can regard dollar safety as an essential good for which demand is completely inelastic because there are no substitutes for it. In this scenario, too, dollar inflows would increase and the dollar exchange rate would rise. Thus the Bill's aim could only be achieved if investors stopped looking for dollar safety. Frankly, given the present political turmoil, they are more likely to emigrate to Mars.

When dollar inflows increase, the trade deficit must, as a matter of accounting, widen. This might show itself as a fall in exports as foreign countries, faced with higher bills for safety and poorer returns on dollar safe assets, cut back on other imports from the US. Or it could show itself as a rise in imports enabled by a stronger dollar. Or both. Whatever. Unless demand for US dollar-denominated safe assets is very much more elastic than recent research suggests, taxing capital inflows cannot bring down the dollar exchange rate or narrow the US's trade deficit. It might even strengthen the dollar and widen the trade deficit.

This would be unfortunate, not only for the US but for the rest of the world. The dollar is pre-eminent in international trade and on international financial markets. More than half of all trade invoices are in dollars. Two-thirds of all securities issuance is in dollars. Nearly 90% of all FX transactions involve the dollar. Large amounts of corporate and government debt, notably in emerging-market economies, is in dollars. The world has become more reliant on dollars since the financial crisis, not less. So when dollars become more expensive, the whole world suffers.

Satisfying investors' craving for dollar safety comes at a very high price. The world desperately needs a lower dollar, but escalating tariffs on imports and taxes on capital flows are not going to bring it down. They are more likely to raise it, to everyone's detriment. And as the dollar rises, so does the global political temperature.

What is really needed is a new Plaza Accord. But international accords require international cooperation, and I fear that the belligerent attitude of the Trump administration means too much goodwill has been burned for this to be possible. All that seems to be left is that most futile of games - a tit-for-tat struggle which no-one can win, for which the price will be an ever-stronger dollar, ever-weaker global growth, and ever-lower interest rates. In a speech at Jackson Hole last week, Mark Carney warned about the risks associated with very low interest rates:

Past instances of very low rates have tended to coincide with high risk events such as wars, financial crises, and breaks in the monetary regime.Let us hope that this does not come to pass.

Related reading:

Weird is normal

The deadly quest for safety

Safe assets and Triffin's dilemma

The illusion of safety

On risk and safety

The golden calf