The centrality of public debt to private capital marketsIn thinking about the next ten years, we must acknowledge that new times are coming, and they will lead to big changes in the capitalist system. The absolute novelty of the situation in which the COVID-19 crisis has placed the world, and even more markedly, Europe has made the financial and monetary options that have preoccupied economic debate so far, if not obsolete, at least questionable. It is a crisis that obliges us to rethink,...

Read More »From a troubled horizon to a better world?

The Covid-19 crisis is deepening existing fissures and adding new threats to an already scarred and anxious world. As a localized health crisis became a global pandemic, many countries put broad swathes of their economies into a policy induced coma to halt the spread of the virus and ease the burden on overstretched health systems. As a result, the global economy will experience a recession this year on a scale not experienced since the 1930s. The damage will be both lasting and severe,...

Read More »From a troubled horizon to a better world?

The Covid-19 crisis is deepening existing fissures and adding new threats to an already scarred and anxious world. As a localized health crisis became a global pandemic, many countries put broad swathes of their economies into a policy induced coma to halt the spread of the virus and ease the burden on overstretched health systems. As a result, the global economy will experience a recession this year on a scale not experienced since the 1930s. The damage will be both lasting and severe,...

Read More »From a troubled horizon to a better world?

The Covid-19 crisis is deepening existing fissures and adding new threats to an already scarred and anxious world. As a localized health crisis became a global pandemic, many countries put broad swathes of their economies into a policy induced coma to halt the spread of the virus and ease the burden on overstretched health systems. As a result, the global economy will experience a recession this year on a scale not experienced since the 1930s. The damage will be both lasting and severe,...

Read More »COVID 19-related debt relief: a consortium proposal to the SDR basket countries

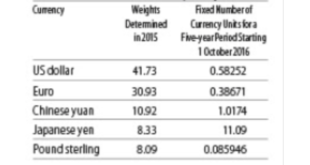

By T. Sabri Öncü & Ahmet ÖncüIn Memory of David Graeber (1961–2020)This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a $2.5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD...

Read More »In Memory of David Graeber – COVID 19-related debt relief

By T. Sabri Öncü & Ahmet Öncü In Memory of David Graeber (1961–2020) This article first appeared in the Indian journal, Economic and Political Weekly, on 21 November, 2020 under the title “A Consortium Proposal to the SDR Basket Countries” On 30 March 2020, the United Nations Conference on Trade and Development (UNCTAD) called for a $2.5 trillion COVID-19 crisis package for developing countries.[1] The UNCTAD proposals were: (i) $1 trillion to be made available through the expanded use...

Read More »A European Debt Agency as a structural response to the crisis

Massimo Amato is Professor of Economics, Bocconi University, Milan. The full paper, whose key points this post seeks to summarise, can be downloaded here in pdf format. ForewordThis post sums up the results of a collective research [1] and aims at providing the fundamental elements of a feasible European Debt Agency (DA). The DA is meant to be charged with financing sovereign debts with advantages both for the Eurozone Member States (MS) and for the system as a whole. The...

Read More »Doing “Whatever It Takes”

The economy slumbers in its induced coma. Businesses are closed, workers furloughed or laid off. But the astonishing headline falls in economic indicaters such as GDP and PMI conceal a grim reality. Businesses are closing not just because they have been ordered to do so, but because they are running out of money. And people who have lost their jobs or become ill are also running out of money. If businesses fail instead of being mothballed, the eventual economic recovery will be slow. And...

Read More »Doing “Whatever It Takes”

The economy slumbers in its induced coma. Businesses are closed, workers furloughed or laid off. But the astonishing headline falls in economic indicaters such as GDP and PMI conceal a grim reality. Businesses are closing not just because they have been ordered to do so, but because they are running out of money. And people who have lost their jobs or become ill are also running out of money. If businesses fail instead of being mothballed, the eventual economic recovery will be slow. And...

Read More »Shut down the ratings agencies

Remember Friday Night Is Downgrade Night, from the Eurozone crisis? It's back. Last night, Fitch Ratings downgraded the UK to AA-, negative outlook. Here's their rationale: The downgrade reflects a significant weakening of the UK's public finances caused by the impact of the COVID-19 outbreak and a fiscal loosening stance that was instigated before the scale of the crisis became apparent. The downgrade also reflects the deep near-term damage to the UK economy caused by the coronavirus...

Read More » Heterodox

Heterodox