Remember Friday Night Is Downgrade Night, from the Eurozone crisis? It's back. Last night, Fitch Ratings downgraded the UK to AA-, negative outlook. Here's their rationale: The downgrade reflects a significant weakening of the UK's public finances caused by the impact of the COVID-19 outbreak and a fiscal loosening stance that was instigated before the scale of the crisis became apparent. The downgrade also reflects the deep near-term damage to the UK economy caused by the coronavirus...

Read More »The myth of monetary sovereignty

How many countries can really claim to have full monetary sovereignty? The simplistic answer is "any country which issues its own currency, has free movement of capital and a floating exchange rate." I have seen this trotted out MANY times, particularly by non-economists of the MMT persuasion. It is, unfortunately, wrong. This is a more complex definition from a prominent MMT economist: 1. Issues its own currency exclusively 2. Requires all taxes and related obligations to be...

Read More »A private debt story: Republic of Turkey (un-)hires McKinsey

From earlier private debt crisis 10 years ago - President Bush welcomes then Prime Minister Erdogan of Turkey to the G20 Summit on Financial Markets and the World Economy, Nov. 15 2008, Washington D.C. White House photo by Chris Greenberg. This article first appeared in the Indian Journal the Economic...

Read More »TASS — Moody’s upgrades outlook on Russia’s sovereign rating to positive from stable

For what it's worth. Russia FeedMoody’s upgrades outlook on Russia’s sovereign rating to positive from stable TASS

Read More »Zero Hedge — “Credit Negative For U.S. Government”: Moody’s Threatens Downgrade If Trump Tax Plan Is Passed

Moody's goes all proactive. As various institutions continue to publish very detailed estimates of how Trump's tax plan will impact the federal budget, which is somewhat amazing since income brackets haven't even been assigned yet, Moody's published a note today threatening to finally strip the U.S. of its AAA credit rating if the tax plan is ultimately passed as currently contemplated.... The deficit would be too big. Gotta cut some welfare.Zero Hedge"Credit Negative For U.S. Government":...

Read More »Slovenia and the banks

I bet you've never heard of Slovenia. It's the northernmost Balkan state, squeezed between Austria, Italy and Croatia on the Adriatic coast. It's small, peaceful (by Balkan standards) and prosperous compared to the rest of the Balkans, though that isn't saying much. It is also stunningly beautiful, in a mountains-and-lakes sort of way. It is in many ways rather like Austria.But at the moment, Slovenia is famous not for its lovely scenery, or its important history, or its rich culture. No,...

Read More »The Eurogroup statement on Greece, annotated

The Eurogroup (part of which is pictured above) has produced a statement on the outcome of the latest debt talks with Greece. As ever with Eurogroup statements, it confuses more than it enlightens. So here is my attempt at translating Eurogroup-speak into plain English. __________________________________________________________________________________ The Eurogroup welcomes that a full staff-level agreement has been reached between Greece and the institutions. Phew. We got that through...

Read More »Have we done enough to prevent another financial crisis?

Notes from a talk given at Trinity Business School, Dublin, on 26th May 20164 Well, it depends what sort of crisis you mean. Have we done enough to prevent a crisis like the last one? Yes. We have scared ourselves so much about the dangers of disorderly bank failure that no way are we going to allow that to happen again – at least, not until we who lived through the crisis, and our children and grandchildren whom we tell about the crisis, are long gone and our legacy forgotten. No-one...

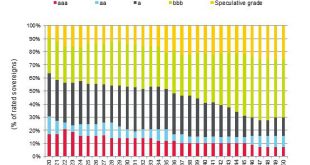

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

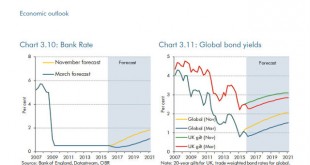

Read More »Bond yields and helicopters

The ever-optimistic OBR has some encouraging forecasts for interest rates and global government bond yields: Well, ok, they were rather more encouraging in November than they are now. The uplift was supposed to start ANY DAY NOW, but there has been an interruption to normal service. Leaves on the line, perhaps. Or the wrong sort of snow.The trouble is, the OBR has a long record of hockey-stick forecasting. Not that it is unique in having a noticeable bias to the upside: If ever there were...

Read More » Heterodox

Heterodox