Debating econometrics and its short-comings yours truly often gets the response from econometricians that “ok, maybe econometrics isn’t perfect, but you have to admit that it is a great technique for empirical testing of economic hypotheses.” But is econometrics — really — such a great testing instrument? Econometrics is supposed to be able to test economic theories but to serve as a testing device you have to make many assumptions, many of which themselves cannot be tested or...

Read More »Ergodicity: a primer

Why are election polls often inaccurate? Why is racism wrong? Why are your assumptions often mistaken? The answers to all these questions and to many others have a lot to do with the non-ergodicity of human ensembles. Many scientists agree that ergodicity is one of the most important concepts in statistics. So, what is it? Suppose you are concerned with determining what the most visited parks in a city are. One idea is to take a momentary snapshot: to see how many people are...

Read More »Machine learning — puzzling ‘big data’ nonsense

Machine learning — puzzling ‘big data’ nonsense If we wanted highly probable claims, scientists would stick to low-level observables and not seek generalizations, much less theories with high explanatory content. In this day of fascination with Big data’s ability to predict what book I’ll buy next, a healthy Popperian reminder is due: humans also want to understand and to explain. We want bold ‘improbable’ theories. I’m a little puzzled when I hear...

Read More »Statistical models for causation — a critical review

Statistical models for causation — a critical review Causal inferences can be drawn from nonexperimental data. However, no mechanical rules can be laid down for the activity. Since Hume, that is almost a truism. Instead, causal inference seems to require an enormous investment of skill, intelligence, and hard work. Many convergent lines of evidence must be developed. Natural variation needs to be identified and exploited. Data must be collected. Confounders...

Read More »Randomness and probability — a theoretical reexamination

Randomness and probability — a theoretical reexamination Modern probabilistic econometrics relies on the notion of probability. To at all be amenable to econometric analysis, economic observations allegedly have to be conceived as random events. But is it really necessary to model the economic system as a system where randomness can only be analyzed and understood when based on an a priori notion of probability? In probabilistic econometrics, events and...

Read More »Econometrics — a critical realist critique

Econometrics — a critical realist critique Mainstream economists often hold the view that criticisms of econometrics are the conclusions of sadly misinformed and misguided people who dislike and do not understand much of it. This is really a gross misapprehension. To be careful and cautious is not the same as to dislike. And as any perusal of the mathematical-statistical and philosophical works of people like for example Nancy Cartwright, Chris Chatfield,...

Read More »The history of econometrics

The history of econometrics There have been over four decades of econometric research on business cycles … But the significance of the formalization becomes more difficult to identify when it is assessed from the applied perspective … The wide conviction of the superiority of the methods of the science has converted the econometric community largely to a group of fundamentalist guards of mathematical rigour … So much so that the relevance of the research to...

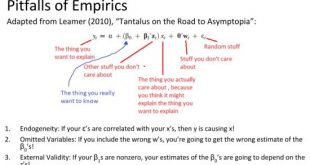

Read More »Econometrics — the scientific illusion of an empirical failure

Econometrics — the scientific illusion of an empirical failure Ed Leamer’s Tantalus on the Road to Asymptopia is one of yours truly’s favourite critiques of econometrics, and for the benefit of those who are not versed in the econometric jargon, this handy summary gives the gist of it in plain English: Most work in econometrics and regression analysis is made on the assumption that the researcher has a theoretical model that is ‘true.’ Based on this belief...

Read More »Why I am not a Bayesian

Why I am not a Bayesian Assume you’re a Bayesian turkey and hold a nonzero probability belief in the hypothesis H that “people are nice vegetarians that do not eat turkeys and that every day I see the sun rise confirms my belief.” For every day you survive, you update your belief according to Bayes’ Rule P(H|e) = [P(e|H)P(H)]/P(e), where evidence e stands for “not being eaten” and P(e|H) = 1. Given that there do exist other hypotheses than H, P(e) is less...

Read More »Econometrics — a crooked path from cause to effect

Econometrics — a crooked path from cause to effect [embedded content] In their book Mastering ‘Metrics: The Path from Cause to Effect Joshua Angrist and Jörn-Steffen Pischke write: Our first line of attack on the causality problem is a randomized experiment, often called a randomized trial. In a randomized trial, researchers change the causal variables of interest … for a group selected using something like a coin toss. By changing circumstances randomly,...

Read More » Heterodox

Heterodox