The limits of probabilistic reasoning Probabilistic reasoning in science — especially Bayesianism — reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but, even granted this questionable reductionism, it’s not self-evident that rational agents really have to be probabilistically consistent. There is no strong warrant for believing so. Rather, there is strong evidence for us encountering huge problems if we let...

Read More »Hierarchical models and clustered residuals (student stuff)

Hierarchical models and clustered residuals (student stuff) [embedded content] Advertisements

Read More »Exaggerated and unjustified statistical claims

Exaggerated and unjustified statistical claims [embedded content] Advertisements

Read More »Analysis of covariance (student stuff)

Analysis of covariance (student stuff) [embedded content] Advertisements

Read More »On probabilism and statistics

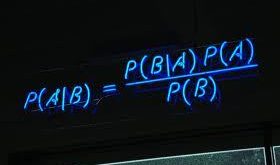

On probabilism and statistics ‘Mr Brown has exactly two children. At least one of them is a boy. What is the probability that the other is a girl?’ What could be simpler than that? After all, the other child either is or is not a girl. I regularly use this example on the statistics courses I give to life scientists working in the pharmaceutical industry. They all agree that the probability is one-half. So they are all wrong. I haven’t said that the older...

Read More »Pornography and infidelity — moderation and mediation in SPSS

Pornography and infidelity — moderation and mediation in SPSS [embedded content] One of the things yours truly appreciates with Andy and his book Discovering statistics using SPSS is the thought-provoking examples used … Advertisements

Read More »What should we do with econometrics?

What should we do with econometrics? Econometrics … is an undoubtedly flawed paradigm. Even putting aside the myriad of technical issues with misspecification and how these can yield results that are completely wrong, after seeing econometric research in practice I have become skeptical of the results it produces. Reading an applied econometrics paper could leave you with the impression that the economist (or any social science researcher) first formulated...

Read More »Deaton-Cartwright-Senn-Gelman on the limited value of randomization

Deaton-Cartwright-Senn-Gelman on the limited value of randomization In Social Science and Medicine (December 2017), Angus Deaton & Nancy Cartwright argue that RCTs do not have any warranted special status. They are, simply, far from being the ‘gold standard’ they are usually portrayed as: Randomized Controlled Trials (RCTs) are increasingly popular in the social sciences, not only in medicine. We argue that the lay public, and sometimes researchers, put...

Read More »The thing that people just don’t get about statistics

The thing that people just don’t get about statistics The thing that people just don’t get is that is just how easy it is to get “p less than .01” using uncontrolled comparisons … Statistics educators, including myself, have to take much of the blame for this sad state of affairs. We go around sending the message that it’s possible to get solid causal inference from experimental or observational data, as long as you have a large enough sample size and a...

Read More »Big Data Bullshit

[embedded content] Advertisements

Read More » Heterodox

Heterodox