Haavelmo and modern probabilistic econometrics — a critical-realist perspective (wonkish) Mainstream economists often hold the view that criticisms of econometrics are the conclusions of sadly misinformed and misguided people who dislike and do not understand much of it. This is a gross misapprehension. To be careful and cautious is not equivalent to dislike. The ordinary deductivist ‘textbook approach’ to econometrics views the modelling process as...

Read More »Causal inference (student stuff)

Causal inference (student stuff) [embedded content]

Read More »Read my lips — using an RCT guarantees nothing!

Read my lips — using an RCT guarantees nothing! The claimed hierarchy of methods, with randomized assignment being deemed inherently superior to observational studies, does not survive close scrutiny. Despite frequent claims to the contrary, an RCT does not equate counterfactual outcomes between treated and control units. The fact that systematic bias in estimating the mean impact vanishes in expectation (under ideal conditions) does not imply that the...

Read More »‘Doctor, it hurts when I p’

‘Doctor, it hurts when I p’ A low-powered study is only going to be able to see a pretty big effect. But sometimes you know that the effect, if it exists, is small. In other words, a study that accurately measures the effect … is likely to be rejected as statistically insignificant, while any result that passes the p < .05 test is either a false positive or a true positive that massively overstates the … effect. … A conventional boundary, obeyed long...

Read More »An introduction to probability density functions (student stuff)

An introduction to probability density functions (student stuff) [embedded content]

Read More »Some basic COVID-19 mathematics

Some basic COVID-19 mathematics [embedded content]

Read More »Simpson’s paradox and the limits of econometrics

Simpson’s paradox and the limits of econometrics [embedded content] From a more theoretical perspective, Simpson’s paradox importantly shows that causality can never be reduced to a question of statistics or probabilities. To understand causality we always have to relate it to a specific causal structure. Statistical correlations are never enough. No structure, no causality. Simpson’s paradox is an interesting paradox in itself, but it can also highlight a...

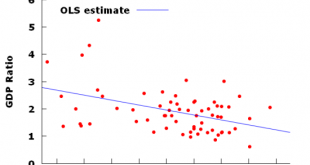

Read More »Economic growth and the size of the ‘private sector’

Economic growth and the size of the ‘private sector’ Economic growth has since long interested economists. Not least, the question of which factors are behind high growth rates has been in focus. The factors usually pointed at are mainly economic, social and political variables. In an interesting study from the University of Helsinki, Tatu Westling expanded the potential causal variables to also include biological and sexual variables. In the report Male...

Read More »Econometric modelling as junk science

Econometric modelling as junk science Do you believe that 10 to 20% of the decline in crime in the 1990s was caused by an increase in abortions in the 1970s? Or that the murder rate would have increased by 250% since 1974 if the United States had not built so many new prisons? Did you believe predictions that the welfare reform of the 1990s would force 1,100,000 children into poverty? If you were misled by any of these studies, you may have fallen for a...

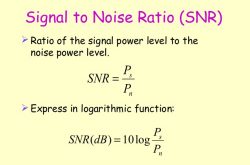

Read More »Econometrics — the signal-to-noise problem

Econometrics — the signal-to-noise problem When we first encounter the term, “noisy data,” in econometrics, we are usually told that it refers to the problem of measurement error, or errors-in-variables—especially in the explanatory variables (x). Most textbooks contain a discussion of measurement error bias. In the case of a bivariate regression, y = a + bx + u, measurement error in x means the ordinary least squares (OLS) estimator is biased. The...

Read More » Heterodox

Heterodox