Instrumentalvariabler och heterogenitet — en kommentar (wonkish) Användandet av instrumentalvariabler används numera flitigt bland ekonomer och andra samhällsforskare. Inte minst när man vill försöka gå bakom statistikens ‘korrelationer’ och också säga något om ‘kausalitet.’ Tyvärr brister det ofta rejält i tolkningen av de resultat man får med hjälp av den vanligaste metoden som används för detta syfte — statistisk regressionsanalys. Ett exempel från...

Read More »When should we believe the unconfoundedness assumption?

[embedded content] Economics may be an informative tool for research. But if its practitioners do not investigate and make an effort of providing a justification for the credibility of the assumptions on which they erect their building, it will not fulfil its task. There is a gap between its aspirations and its accomplishments, and without more supportive evidence to substantiate its claims, critics — like yours truly — will continue to consider its ultimate arguments as a...

Read More »Regression analysis — a constructive critique

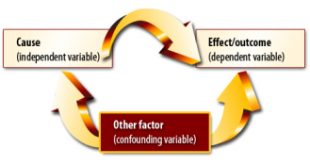

Regression analysis — a constructive critique As a descriptive exercise, all is well. One can compare the average salary of men and women, holding constant potential confounders. The result is a summary of how salaries differ on the average by gender, conditional on the values of one or more covariates. Why the salaries may on the average differ is not represented explicitly in the regression model … Moving to causal inference is an enormous step that needs...

Read More »How to control confounding (wonkish)

How to control confounding (wonkish) [embedded content] Advertisements

Read More »The debate about RCTs is over. The randomistas lost. We won.

The debate about RCTs is over. The randomistas lost. We won. [embedded content] Advertisements

Read More »Structural econometrics

In the ongoing discussion on the ’empirical revolution’ in economics, some econometricians criticise — rightfully — the view that quasi-experiments and RCTs are the (only) true solutions to finding causal parameters. But — the alternative they put forward, structural models, have their own monumental problems. Structural econometrics — essentially going back to the Cowles programme — more or less takes for granted the possibility of a priori postulating relations that describe...

Read More »Estadística y econometría no son muy útiles para entender la economía

Estadística y econometría no son muy útiles para entender la economía La mayor parte del trabajo en econometría y estadística se realiza suponiendo que el investigador tiene un modelo teórico que es “verdadero”. Sin embargo, “pensar que podemos construir un modelo donde todas las variables relevantes están incluidas, y que las relaciones funcionales que hay entre ellas están correctamente especificadas, no es solamente una creencia sin sustento, sino que es...

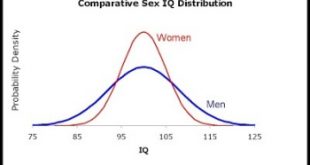

Read More »The range of men and women

The range of men and women I happen to be reading The Puppet Masters, a Heinlein novel from the 1950s … and came across this line: “Listen, son—most women are damn fools and children. But they’ve got more range than we’ve got. The brave ones are braver, the good ones are better—and the vile ones are viler. . . .” What struck me about the above quote is how it goes in the opposite of current received wisdom about men and women, the view, associated with...

Read More »Causal interaction and external validity

Causal interaction and external validity As yours truly has repeatedly argued on this blog, randomized control trials (RCTs) usually do not provide evidence that their results are exportable to other target systems. The almost religious belief with which its propagators portray it, cannot hide the fact that RCTs cannot be taken for granted to give generalizable results. Randomized evaluations have become widespread in development economics in recent...

Read More »The Gambler’s Ruin (wonkish)

The Gambler’s Ruin (wonkish) [embedded content] [In case you’re curious what happens if you start out with $25 but we change the probabilities — from 0.50, 0.50 into e. g. 0.49, 0.51 — you can check this out easily with e.g. Gretl:matrix B = {1,0,0,0; 0.51,0,0.49,0;0,0.51,0,0.49;0,0,0,1} matrix v25 = {0,1,0,0} matrix X = v25*B^50 X which gives X = 0.68 0.00 0.00 0.32] Advertisements

Read More » Heterodox

Heterodox