The main reason why almost all econometric models are wrong How come that econometrics and statistical regression analyses still have not taken us very far in discovering, understanding, or explaining causation in socio-economic contexts? That is the question yours truly has tried to answer in an article published in the latest issue of World Economic Association Commentaries: The processes that generate socio-economic data in the real world cannot just be...

Read More »What instrumental variables analysis is all about

What instrumental variables analysis is all about [embedded content] Advertisements

Read More »The randomistas revolution

In his new history of experimental social science — Randomistas: How radical researchers are changing our world — Andrew Leigh gives an introduction to the RCT (randomized controlled trial) method for conducting experiments in medicine, psychology, development economics, and policy evaluation. Although it mentions there are critiques that can be waged against it, the author does not let that shadow his overwhelmingly enthusiastic view on RCT. Among mainstream economists, this...

Read More »Econometrics cannot establish the truth value of a fact. Never has. Never will.

Econometrics cannot establish the truth value of a fact. Never has. Never will. There seems to be a pervasive human aversion to uncertainty, and one way to reduce feelings of uncertainty is to invest faith in deduction as a sufficient guide to truth. Unfortunately, such faith is as logically unjustified as any religious creed, since a deduction produces certainty about the real world only when its...

Read More »The illusion of certainty

The illusion of certainty [embedded content] Advertisements

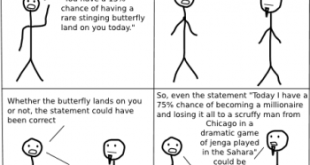

Read More »Probability and rationality — trickier than you might think

Probability and rationality — trickier than you might think The Coin-tossing Problem My friend Bengt says that on the first day he got the following sequence of Heads and Tails when tossing a coin: H H H H H H H H H H And on the second day he says that he got the following sequence: H T T H H T T H T H Which day-report makes you suspicious? Most people I ask this question says the first day-report looks suspicious. But actually, both days are equally...

Read More »The main reason why almost all econometric models are wrong

The main reason why almost all econometric models are wrong Since econometrics doesn’t content itself with only making optimal predictions, but also aspires to explain things in terms of causes and effects, econometricians need loads of assumptions — most important of these are additivity and linearity. Important, simply because if they are not true, your model is invalid and descriptively incorrect. And when the model is wrong — well, then it’s wrong. The...

Read More »So much for ‘statistical objectivity’

Last year, we recruited 29 teams of researchers and asked them to answer the same research question with the same data set. Teams approached the data with a wide array of analytical techniques, and obtained highly varied results … All teams were given the same large data set collected by a sports-statistics firm across four major football leagues. It included referee calls, counts of how often referees encountered each player, and player demographics including team position,...

Read More »Lying with statistics

[embedded content] Advertisements

Read More »On the limits of ‘mediation analysis’ and ‘statistical causality’

“Mediation analysis” is this thing where you have a treatment and an outcome and you’re trying to model how the treatment works: how much does it directly affect the outcome, and how much is the effect “mediated” through intermediate variables … In the real world, it’s my impression that almost all the mediation analyses that people actually fit in the social and medical sciences are misguided: lots of examples where the assumptions aren’t clear and where, in any case,...

Read More » Heterodox

Heterodox