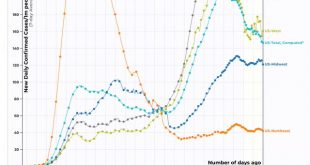

Coronavirus dashboard for August 19: a regional look at infections; the Deep South remains almost totally out of control Total US cases: 5,457,824 Average last 7 days: 48,764 Total US deaths: 163,595 Average last 7 days: 1,048 Source: COVID Tracking Project My overall thesis is that under the present leadership the US as a whole is politically and socially incapable of bringing the coronavirus under control, as almost every other industrialized country...

Read More »Initial and continuing claims: the most “less awful” so far

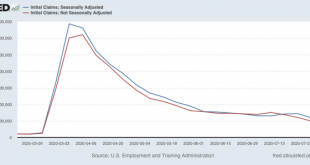

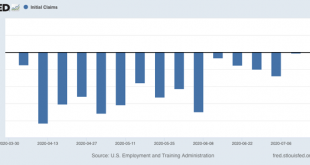

Initial and continuing claims: the most “less awful” so far This Thursday morning’s initial and continued jobless claims continue the trend of “less awful” numbers that resumed last week. New jobless claims, which fell to under 1,000,000 for the first time on an unadjusted basis last week, declined about 150,000 further to 831,856 (red in the graph below), and on an adjusted basis (blue) declined to 963,000, the first time since the pandemic that number...

Read More »The End Of Special Fiscal Stimulus

The End Of Special Fiscal Stimulus A week ago a two week long negotiation between Dem Congress people, Nancy Pelosi from the House and Chuck Schumer from the Senate and Treasury Secretary Steve Mnuchin, who cut deals with Pelosi and Schumer three times earlier this year, but now Trump’s Chief of Staff, former Freedom Caucus leader in the House, Mark Meadows, notorious for only destroying deals and never making any. And in this case, all the reporting is...

Read More »July inflation consistent with early recovery; no compelling evidence of wage deflation

July inflation consistent with early recovery; no compelling evidence of wage deflation Yesterday morning July consumer prices were reported to have increased 0.6% for the second month in a row (as did core inflation, ex-food and energy): As a result, YoY inflation has increased to 1.0%: The widespread price increases are signs of increased demand, which in these circumstances is a good thing. In the past, deflationary recessions, most notably...

Read More »How To Measure Quarterly Changes In GDP Can Make A Big Difference

How To Measure Quarterly Changes In GDP Can Make A Big Difference We have had dramatic headlines and commentary in recent days since the BEA issued its initial estimate of quarterly changes in GDP, which they do not officially measure on an shorter time period. This is a measure of the average GDP in one quarter compared to the average GDP in the next quarter. Looking at Q1 of this year and Q2 of this year, they reported the largest quarterly decline...

Read More »A Republican Idea for Onshoring Pharmaceutical Intangible Assets

A Republican Idea for Onshoring Pharmaceutical Intangible Assets Alex Parker reports on a proposal from Representative Darin LaHood: As part of the next round of pandemic relief, House Republicans are pushing new incentives for companies to bring home offshore intellectual property — something that they contend could boost job growth but that critics see as another corporate giveaway … While the 2017 Tax Cuts and Jobs Act overhauled the federal tax code...

Read More »Weekly indicators

by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. There was no significant change this week in any of the indicator time frames. I expect that to change in a hurry once the pain of the ending of the supplemental $600/week unemployment benefits is felt. That was all going to spending, and that spending is going to very abruptly stop. As usual, clicking over and reading brings you up to the virtual moment on the economy, and rewards me...

Read More »Initial claims: a jolt of bad news, as Mitch McConnell and the GOP dawdle on an emergency benefit extension

Initial claims: a jolt of bad news, as Mitch McConnell and the GOP dawdle on an emergency benefit extension This morning’s report on initial and continuing claims, which give the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment, was a jolt of bad news, as claims increased by over 100,000 to the worst level in 4 weeks. The trend of slight improvement to “less awful” since the end of March was broken, and there...

Read More »The 2017 Tax Cuts and Irish Jobs Act

The 2017 Tax Cuts and Irish Jobs Act Brad Setser has more to say about how the lack of enforcement with respect to transfer pricing in the Big Pharma sector has not only cost us Federal tax revenues but perhaps in American jobs in his “The Irish Shock to U.S. Manufacturing?” (May 25, 2020): America’s production of pharmaceuticals and medicines peaked in 2006, back before the global financial crisis. Output now is about 20 percent below its 2006 level....

Read More »Brad Setser on Offshoring Life Science Production and Transfer Pricing

Brad Setser on Offshoring Life Science Production and Transfer Pricing I just posted a discussion of an interesting proposal from Biden written by Alex Parker who mentioned some February 5, 2020 testimony from Brad Setser. The gist of this testimony was noted back in a March 26, 2019 blog post entitled When Tax Drives the Trade Data: I often hear that pharmaceuticals are one of America’s biggest exports. But that isn’t what is in the actual trade data...

Read More » Heterodox

Heterodox