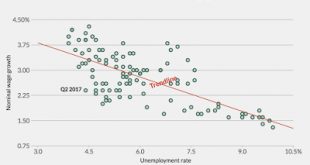

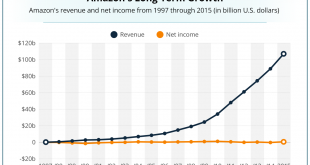

by Hale Stewart (originally published at Bonddad blog) Is This Why Wages Are Low? These are two graphs from a post over at the Center for Equitable Growth. The top chart shows that the relationship between unemployment and wage growth isn’t as strong as you’d think. Recent research highlighted by Fed President Bullard made the same observation. But the bottom chart — now that’s what a tight correlation looks like! I ran a quick, down-and-dirty...

Read More »The Incidence of the Obamacare Subsidies

The Incidence of the Obamacare Subsidies Justin Fishel and Mary Bruce covers Trump’s dismantling of Obamacare: The White House announced Thursday night that the administration will slash Obamacare subsidy payments to insurers. The “cost-sharing reduction payments,” worth an estimated $7 billion this year, are intended to reduce out-of-pocket costs for low-income Americans on Obamacare … House Democratic leader Nancy Pelosi and Senate Democratic leader...

Read More »Enslaved to an Individualist View of Social Change

Enslaved to an Individualist View of Social Change I note with some interest the debate over whether it is ethically necessary to refer to slaveholders as “enslavers” in order to convey our disapproval over their actions. The obsessive use of the enslaving terminology in The Half Has Never Been Told (Baptist) bothered me at the time, and now I see he was part of a trend. I understand the motivation—up to a point. Anyone who participated in the slave...

Read More »They are monsters

They are monsters The President and his GOP majorities in Congress are monsters. As one commentator on NPR put it yesterday afternoon, the President’s default mode is to toss an armed hand grenade into a room in order to create chaos. He can then pick out the most vulnerable, and use that leverage to enter into a win-lose deal. Meanwhile, having been emboldened by the 2011 Debt Ceiling Debacle, the Congressional GOP majorities, who haven’t been able to...

Read More »How Amazon’s Accounting Makes Rich People’s Income Invisible

By Steve Roth (originally published at Evonomics) How Amazon’s Accounting Makes Rich People’s Income Invisible Image you’re Jeff Bezos, circa 1998. You’re building a company (Amazon) that stands to make you and your compatriots vastly rich. But looking forward, you see a problem: if your company makes profits, it will have to pay taxes on them. (At least nominally, in theory, 35%!) Then you and your investors will have to pay taxes on them again when...

Read More »IMF Fiscal Monitor: Progressive Taxation Need Not Deter Growth

IMF Fiscal Monitor: Progressive Taxation Need Not Deter Growth The latest from the IMF is a must read for progressives even if it runs contrary to the nonsense coming out of the White House: At the global level, inequality has declined substantially over the past three decades, but within national boundaries, the picture is mixed: some countries have experienced a reduction in inequality while others, particularly advanced economies, have seen a...

Read More »Does Kevin Hassett Understand Transfer Pricing?

Does Kevin Hassett Understand Transfer Pricing? Howard Gleckman does: It is true that bringing US corporate rates in line with our trading partners may reduce incentives for improper transfer pricing. But there is a flaw in Hassett’s argument: While these practices are aimed at reducing tax lability, they do not represent real economic activity. And limiting income shifting won’t significantly increase domestic employment. He was noting this...

Read More »The Times Handles the Trump Tax Cut Framework with Kid Gloves

The Times Handles the Trump Tax Cut Framework with Kid Gloves There’s been a good bit written about the Trump tax cut framework released just over a week ago. Most of it points out, as I have here and here, the absurdity of the claims by Trump and GOP spokespeople that this isn’t a tax cut aimed at benefiting the ultra wealthy. After all, even with few details and no attempt to deal with the really tough issues that would face real tax reform...

Read More »The Tax-Cut Framework Won’t Create Jobs and Digs the Inequality Ditch even Deeper

The Tax-Cut Framework Won’t Create Jobs and Digs the Inequality Ditch even Deeper Marcus Ryu, a self-described Silicon Valley entrepreneur who created, with others, a company now worth $5 billion on the New York Stock Exchange, argues in today’s Op-Ed section of the New York Times that “Tax Cuts Won’t Create Jobs“, NY Times (Oct. 9, 2017), at A23 (the title in the digital edition is different from the print title: Why Corporate Tax Cuts Won’t Create...

Read More »Part of Patriotism is Paying Taxes

Part of Patriotism is Paying Taxes As Americans, we pay taxes to allow our government to support important activities that we as individuals or individual businesses either can’t do at all or can’t do as successfully. Both individuals and businesses benefit from government, so that paying taxes is a wonderful exercise in patriotism. For individuals, the idea of paying taxes as patriotism may be obvious to many of us, because we think that taxes are an...

Read More » Heterodox

Heterodox