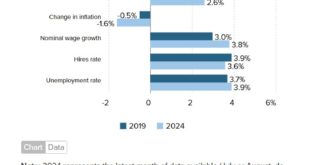

Labor market remains strong. Even so, the Fed should cut rates in September (EPI) Two things are true right now for the U.S. economy: The labor market is extraordinarily strong when judged by any historical benchmark. The Federal Reserve is behind the curve in cutting interest rates and should start cutting rates at the Federal Open Market Committee (FOMC) meeting next week. To aim for something like a federal funds rate that is at least two...

Read More »Catching Up on Climate Risk Research

Two excellent short and very readable mini articles (to be redundant). Both pieces are pointing to a direction the Fed should take in the next year or sooner with regard to Climate Change. It is doubtful they will do so until catastrophe hits. What is a few $billion more in spending, right??? This aspect of our economy and how it can impact the economy should be taken into consideration in decision making and costs. This is partially why, these...

Read More »If the consumer has nowhere else to go, they’ll pay whatever price is available.

A long and interesting read. And yes on paying the price. Article by David and Lindsay on what is happening today with increasing pricing across the economy. You can experience it in just about every part of the economy. Further on down this article the authors say, this is more about pricing than supply chain. I would say this is true. However, you can discern whether excess pricing can be justified by reviewing the supply chain costs. Not...

Read More »April existing home sales remain deeply depressed, continuing the chronic shortfall in housing supply

– by New Deal democrat Let me tie this morning’s report on April existing home sales into my two last posts (Part 1 and Part 2), which concerned the huge role that shelter prices, and the underlying shortfall in housing capacity, have in the continued elevation in overall consumer prices. So let’s start by looking at the last 10 year history of existing home inventories [note: all graphs in this article are from the site Trading Economics,...

Read More »The Fed’s Target Is Workers or Labor . . .

The Fed’s Target Is Workers, Project Syndicate, James K. Galbraith, January 2022 A year and a half later and the Fed is still trying to slay the dragon. They stab it with their steely knives, But they just can’t kill the beast. So it seems, the Feds losing battle is with Labor, direct Labor is the smallest portion of manufacturing. Without labor there is no product, just bets on the outcome of the economy. ~~~~~~~~ By announcing forthcoming...

Read More »The (Recessionary) Projections of December 2022 Live On

Editorial by EMPLOY AMERICA on The Fed Chair’s 25bp hike which are aligning with the Fed’s consensus and market beliefs and Powell’s expectations of continuing inflation risks. Gotta make sure the chance of inflation is really dead. Poking at it with 25bp hike now, making sure it is dead, and two more rounds of the same in the near future. Good take by Skanda Amarnath of EMPLOY AMERICA on Fed Chair Powell’s beliefs. Skanda’s belief is the...

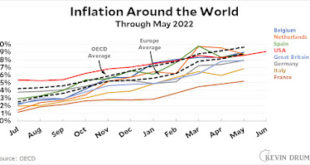

Read More »Inflation, Should the Fed continue to raise rates – and whether it is “behind the curve”

A note on inflation and whether the Fed should continue to raise rates – and whether it is “behind the curve” No important economic releases today (july 18), and almost no reporting by States as to COVID counts over the weekend, so let’s back up and take a look at something that’s been simmering on my intellectual back stove, so to speak: should the Fed be raising rates to combat this inflation? Has inflation already peaked? Or is the Fed way...

Read More » Heterodox

Heterodox