Labor market remains strong. Even so, the Fed should cut rates in September (EPI) Two things are true right now for the U.S. economy: The labor market is extraordinarily strong when judged by any historical benchmark. The Federal Reserve is behind the curve in cutting interest rates and should start cutting rates at the Federal Open Market Committee (FOMC) meeting next week. To aim for something like a federal funds rate that is at least two percentage points lower by mid-2025. These might strike some as being in tension, normally we want the Fed to cut interest rates to stimulate a weak economy. Why then, if the labor market is quite strong, do we need them to cut? Simply put, the interest rates the Fed controls are now at levels that

Topics:

Angry Bear considers the following as important: politics, the fed, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Labor market remains strong. Even so, the Fed should cut rates in September (EPI)

Two things are true right now for the U.S. economy:

- The labor market is extraordinarily strong when judged by any historical benchmark.

- The Federal Reserve is behind the curve in cutting interest rates and should start cutting rates at the Federal Open Market Committee (FOMC) meeting next week. To aim for something like a federal funds rate that is at least two percentage points lower by mid-2025.

These might strike some as being in tension, normally we want the Fed to cut interest rates to stimulate a weak economy. Why then, if the labor market is quite strong, do we need them to cut?

Simply put, the interest rates the Fed controls are now at levels that are highly contractionary. They are rates you would want if your goal was to substantially slow the pace of aggregate demand growth (say because you were trying to quickly reduce inflation). There is a whole debate to be had about whether or not the Fed should have raised rates this high and this fast in an effort to combat the post-pandemic inflation. Regardless of where you landed in that debate, it seems far clearer, today’s economy does not need a rapid reduction in aggregate demand.

The labor market is strong, but it is not inflationary. To summarize its strength, we would note that the prime-age employment-to-population ratio (the share of adults ages 25–54 who are employed) remained in August at its highest level since 2001. But this strength comes even as inflation has been rapidly decelerating since mid-2022. The price index for personal consumption expenditures excluding food and energy prices (the measure of “core” prices that should be the Fed’s target) saw its growth rate fall by more than 1.5 percentage points just in the past year. It is now just about a half-point above the Fed’s long-run target, and it is falling fast.

Crucially, this rapid disinflation has happened even as the labor market remains strong. Hence, there is no reason why the Fed should be looking to generate a weaker labor market, but recent months have seen signs of a slight softening at the labor markets on the margin. Continued contractionary monetary policy will exacerbate this labor market weakening. This happening even as the last two years show such weakening is clearly not needed to get the last bit of excess inflation wrung out of the system.

Nominal wage growth is below 4%—a pace fully consistent with the Fed’s long-run 2% inflation target.

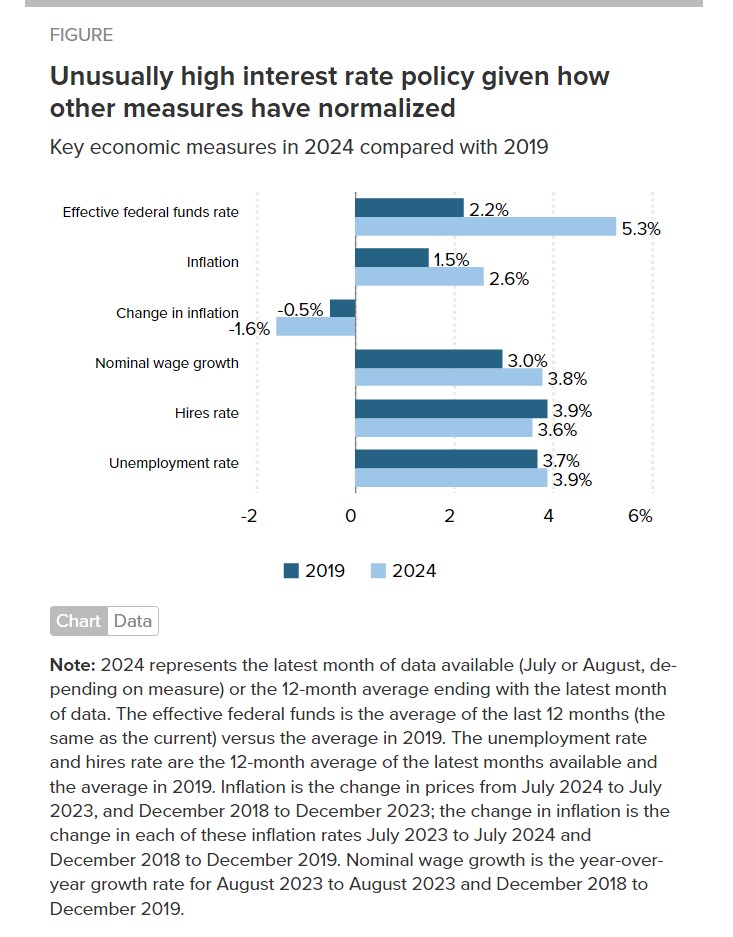

Further, many labor market indicators look about the same as they did pre-pandemic, and interest rates in this period were substantially lower than today, and the Fed even cut rates in 2019.

The figure displays a series of economic indicators—including the federal funds rate—in the most recent period compared with 2019. Most metrics we are experiencing today are in line with the strong 2019 labor market. Over the year, the unemployment rate has averaged just below 4%, while the hires rate has come down considerably and is just below 2019 levels. Nominal wage growth hasn’t fallen to pre-pandemic growth rates, but that’s an affirmatively good thing—it means workers are receiving real (inflation-adjusted) wage gains while still having nominal wage growth that can allow a full normalization to pre-pandemic inflation rates. Further, while inflation was higher in the past year than it was in 2019, it has decelerated far faster than in 2019, when this inflation deceleration contributed to a Fed decision to cut interest rates.

In short, we have a strong labor market that is also not inflationary. Meaning, we do not need expansionary or contractionary policy. This means interest rates should be much closer to neutral levels than they are today.

Where exactly is the “neutral” rate for the Fed (in the jargon people call this R*, or R-star)? Nobody really knows. But everybody knows it’s nowhere near the 5.3% effective federal funds rate the Fed is maintaining today. 3-3.5% would be a lot closer to neutral, so getting closer to this range—and pretty soon—should be the Fed’s goal until something significant changes in the economy.

Lower rates will not just keep today’s excellent labor market from undesirably softening. It will also help long-run investments in housing and clean energy become more viable and lift off faster in coming years, which are both hugely important goals.