from Peter Radford I want to note, with sadness, the death of Alan Krueger who was one of those economists undaunted by the existence of the real world and all its complexity, and had the courage to present conclusions based on empirical work rather than on pure theory. Others will write more cogently than I can about his impact on the profession, so I will simply note that his work, with David Card, on debunking the notion that a rise in the minimum wage will always cause higher...

Read More »No More Fed Rate Hikes in 2019…

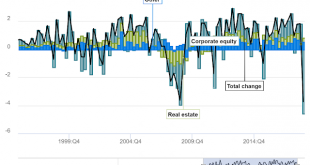

The fundamentals are “sound”?: PICTURE = 1000 WORDS

Read More »RWER special issue: Economics and the Ecosystem

Real-World Economics Review – issue no. 87 Economics and the Ecosystem download whole issue Introduction 2Jamie Morgan and Edward Fullbrook download Growthism: Its ecological, economic, and ethical limits 9Herman Daly download Producing ecological economy 23Katharine N. Farrell download Economics 101: dog barking, overgrazing and ecological collapse 33Edward Fullbrook download Addressing meta-externalities:...

Read More »Beyond behavioral economics: the self-governance of nudging

from Maria Alejandra Madi Looking back, after the Second World War, new theoretical and applied work in economics fostered empirical techniques that included structural estimation, the development of input-output methods and linear programming. Among the theoretical advances, the Keynesian revolution, the mathematical modeling of the business cycle, game theory, dynamic modeling, new models of consumer behavior and general equilibrium analysis can be highlighted. What is significant about...

Read More »Help please!

Can anyone out there help me? Just saw a headline on CNN saying that, in spite of Brexit chaos, unemployment was at an historic low. Likewise in US where in spite of Trump — could it really be because of? — unemployment is also at an historic low. Reminds me that back in the late 1970s there was a G-7 summit in London England. There were pictures in the press of the leaders, beginning with Thatcher. For Italy the joke was that politics was so volatile that no one could remember who was its...

Read More »Help please!

Can anyone out there help me? Just saw a headline on CNN saying that, in spite of Brexit chaos, unemployment was at an historic low. Likewise in US where in spite of Trump — could it really be because of? — unemployment is also at an historic low. Reminds me that back in the late 1970s there was a G-7 summit in London England. There were pictures in the press of the leaders, beginning with Thatcher. For Italy the joke was that politics was so volatile that no one could...

Read More »Open thread March 19,2019

Labor’s share — the ‘stylized fact’ that isn’t a fact at all

from Lars Syll According to one of the most widely used textbooks on mainstream theories of economic growth, one can for the United States “calculate labor’s share of GDP by looking at wage and salary payments and compensation for the self-employed as a share of GDP. These calculations reveal that the labor share has been relatively constant over time, at a value of around 0.7.” But is this “classic stylized fact” — that the labour share is relatively constant over time at around...

Read More »Ultra low wage growth isn’t accidental. It is the intended outcome of government policies (updated)

That’s the headline for my latest piece in The Conversation, my contribution to a three-part series mini-symposium on Wages, Unemployment and Underemployment presented by The Conversation and the Academy of the Social Sciences in Australia. Key quote For more than forty years, both the architecture of labour market regulation and the discretionary choices of governments have been designed with the precise objective of holding wages down. These policies have been highly...

Read More »Sandpit

A new sandpit for long side discussions, conspiracy theories, idees fixes and so on. Like this:Like Loading...

Read More » Heterodox

Heterodox