The issue is back in the news. This time in Brazil (it was briefly an issue here when Trump did not reappoint Yellen, and then complained about Powell's interest rate where too high). At any rate, I always thought that there were good reasons for skepticism about central bank independence (CBI). As noted by Massimo Pivetti in this old piece on the Maastricht Accord and the, at that time, plan for the euro, the main reason to be doubtful is related to the interaction of monetary policy and...

Read More »My new podcast episode is out

My new podcast episode is out.

My new podcast is out.

Interest rates are up, and what is the real problem with that

Not by much. To 0.75%, and yes it wasn't necessary because we're not at full employment yet (Krugman thinks we're; his point is that wages are increasing again, but not that much and participation rates remain low). Two things worth mentioning. One is that Yellen agrees with Krugman, and that signals that the Fed doesn't get what's the current state of the economy. She said: "I believe my predecessor and I called for fiscal stimulus when the unemployment rate was substantially higher than...

Read More »More on the slow recovery

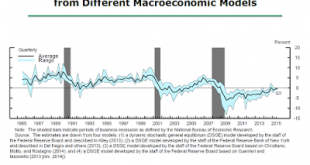

The private sector added 156,000 jobs in April, according to the Automatic Data Processing (ADP) report, ahead of the Bureau of Labor Statistics (BLS) more comprehensive release this Friday. As the graph shows there is a slowdown form last month. This adds to weak manufacturing growth,and a smaller trade deficit, resulting from lower imports, that is, a slower economy. I still think a recession might not be in the immediate horizon. However, the data seem to indicate, as I said before, that...

Read More »Domestic reasons for Yellen to remain dovish

The last estimate of real GDP growth in the fourth quarter of 2015 indicates that the economy expanded at 1.4%. Not very fast. Also, this week the Bureau of Economic Analysis (BEA) announced that personal consumption expenditures (PCE) increased 0.1%, and revised down the January number to 0.1%. In other words, consumption is slowing down, or so it seems. More importantly, the report says: "The February PCE price index increased 1.0 percent from February a year ago. The February PCE price...

Read More »Fed holds on the interest rate hike, for now

From the Federal Reserve Board press release: "The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. However, global economic and financial developments continue to pose risks. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the...

Read More »Interest rates will go up (almost certain now)

Not a conventional rate Janet L. Yellen said in her speech at the Economic Club of Washington that rates are going to increase. Perhaps there will be no unanimous decision by the FOMC, but gradual increases should start in December. It must be noted that she did say that: "we cannot yet... declare that the labor market has reached full employment." She is also concerned with the weakness of the global economy, and, hence, of US exports. The forecast in a nutshell: "I anticipate continued...

Read More »Even The Economist is against raising the interest rate

In the last issue, The Economist suggests that the Fed should not be concerned too much with inflation, and that they should not raise the interest rate for now. They say: "Weak wage growth suggests that there is still lots of slack in the labour market. Underemployment, which includes workers who are part-time but want a full-time job, and discouraged workers who might be tempted back into the labour force, stands at just over 10%, higher than before the crisis. This measure probably has...

Read More » Heterodox

Heterodox