So well over a year ago the dollar started going up based on falling oil prices, which I suggested was a mistake. That was because it seemed to me that this time around the falling price of oil was not likely to lower the US current account deficit the way lower oil prices have lowered it in the past. I suggested two reasons. First, US production was likely to go down and therefore oil imports would rise, offsetting much of the price drop. Second, US exports to oil producers were likely to go down, while non oil imports were likely to rise This is pretty much what happened. Lower oil prices initially helped trade some but then the gain leveled off as oil imports increased. And the non oil trade deficit rose as those exports fell and imports increased. And so overall the trade deficit went higher rather than lower as had happened historically with falling oil prices:And so portfolio managers chased the dollar higher in response to falling oil prices. But fundamentally it turns out they were going the wrong way. The US trade deficit has gone higher, and, for example, the euro has experienced a large and growing trade surplus, which fundamentally supports the euro.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

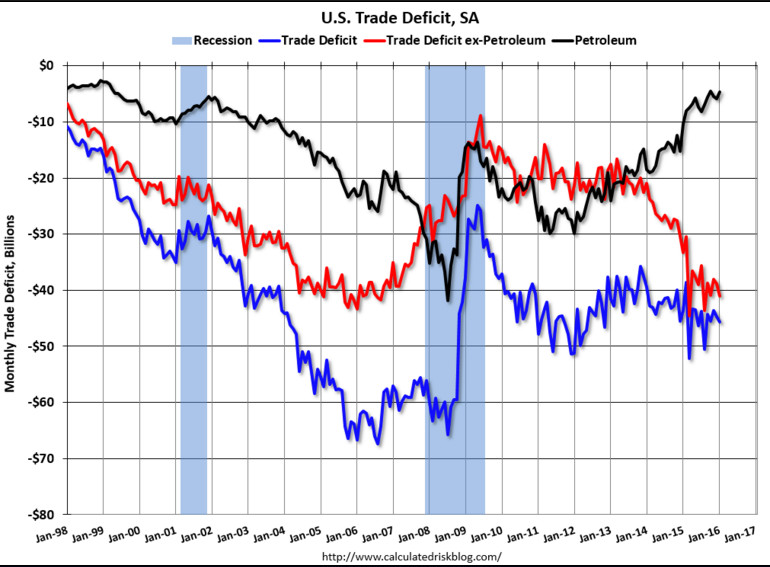

So well over a year ago the dollar started going up based on falling oil prices, which I suggested was a mistake. That was because it seemed to me that this time around the falling price of oil was not likely to lower the US current account deficit the way lower oil prices have lowered it in the past.

I suggested two reasons. First, US production was likely to go down and therefore oil imports would rise, offsetting much of the price drop. Second, US exports to oil producers were likely to go down, while non oil imports were likely to rise

This is pretty much what happened. Lower oil prices initially helped trade some but then the gain leveled off as oil imports increased. And the non oil trade deficit rose as those exports fell and imports increased.

And so overall the trade deficit went higher rather than lower as had happened historically with falling oil prices:

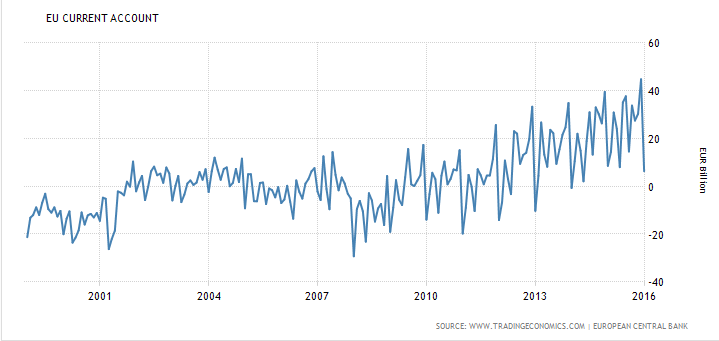

And so portfolio managers chased the dollar higher in response to falling oil prices. But fundamentally it turns out they were going the wrong way. The US trade deficit has gone higher, and, for example, the euro has experienced a large and growing trade surplus, which fundamentally supports the euro.

So it wouldn’t surprise me if the trade flows drive the dollar back to where it was before it was mistakenly presumed that lower oil prices would fundamentally support the dollar:

And by the way, this is not meant to be taken as trading advice.

I first made this point about the fundamentals working against the dollar and in favor of the euro well over a year ago. At that time I suggested that, fundamentally, the dollar was rising due to portfolio shifting rather than fundamentals, made more so by most portfolio managers believing the relevant fundamentals were interest rate differentials and monetary policy biases. Point is, technicals can carry markets counter to the fundamentals for long periods of time.

That is:

There is nothing so disastrous as a rational investment policy in an irrational world.

-JM Keynes