In-depth analysis on Credit Writedowns Pro. Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading. The Absolute Return Letter, August/September 2015: Doodles from an eventful summer “There is something deeply troubling when the unthinkable threatens to become routine.” Bank for International Settlements Incidents of the summer 2015 This month’s Absolute Return Letter is a little different. I usually pick a particular subject and discuss it in great detail. However because of the host of issues which popped up over the summer while I took some time off from writing, I will comment on more than I normally do. I apologise in advance if you find my commentary somewhat superficial as a result. Not only is the style a little different this month. It is also published earlier than usual. There is only one reason for that and that is the recent turmoil in global equity markets which I will certainly comment on. Rarely have I experienced a summer so full of dramatic incidents. As I go through them one by one in the following, you will see what I mean. Most of the drama unfolded in June and July, but equity markets didn’t seem to notice until mid-August, and then behaved very erratically. One of my favourite reads is The Credit Strategist by Michael Lewitt.

Topics:

Niels Jensen considers the following as important: China, commodities, currencies, Debt, equities, Europe, Greece, inflation, Interest rates, investing, markets, United States, Weekly

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Dean Baker writes Businesses and DEI: Corporations don’t maximize shareholder value

Angry Bear writes Voters Blame Biden and Harris for Inflation

Editor’s note: This was originally published by Absolute Return Partners in late August. So we are a little late in releasing it. Apologies. It is still good reading.

The Absolute Return Letter, August/September 2015: Doodles from an eventful summer

“There is something deeply troubling when the unthinkable threatens to become routine.”

Bank for International Settlements

Incidents of the summer 2015

This month’s Absolute Return Letter is a little different. I usually pick a particular subject and discuss it in great detail. However because of the host of issues which popped up over the summer while I took some time off from writing, I will comment on more than I normally do. I apologise in advance if you find my commentary somewhat superficial as a result.

Not only is the style a little different this month. It is also published earlier than usual. There is only one reason for that and that is the recent turmoil in global equity markets which I will certainly comment on.

Rarely have I experienced a summer so full of dramatic incidents. As I go through them one by one in the following, you will see what I mean. Most of the drama unfolded in June and July, but equity markets didn’t seem to notice until mid-August, and then behaved very erratically.

One of my favourite reads is The Credit Strategist by Michael Lewitt. When he published his July letter in early July, he couldn’t quite understand the audacity of the major equity markets around the world which, at that stage at least, chose to ignore the drama unfolding around them. I cannot resist the temptation to quote Michael:

“Please tell me this is all a nightmare and I am going to wake up to the visions of Goldilocks that I keep reading about.”

In addition to his formidable writing skills, Michael is known for his bearish bias but, over the years, he has been more right than wrong, which is why you would only ignore him at your own peril.

Michael wrote the words I quoted above in response to a succession of incidents which unfolded over the early summer months:

- China experienced one of the most dramatic corrections ever when the Shanghai Shenzhen CSI 300 Index lost more than 30%.

- Greece endured a real rollercoaster of a summer, one minute being ‘rescued’ only to fall to new depths the next.

- Puerto Rico went bust. Although bankruptcy has not been officially declared, few would argue that the country is not effectively bankrupt.

- Ukraine balanced on the verge of full blown civil war.

- The Middle East spun further out of control.

- Oil and other commodity prices fell significantly.

In addition to this unpleasantly long list of hiccups, a few other things happened which I will also comment on. Firstly, the Bank for International Settlements (BIS) published its 85th Annual Report, which is a must read for everyone in our industry and, secondly, I came across new evidence to support my long standing bullishness on the U.S. dollar, but more about that later.

Finally two of the grandest in our industry – Jeremy Grantham (founder of GMO) and Bill Gross (now of Janus Capital but for many years of PIMCO) – decided in early August that the summer was over, at least as far as they were concerned.

First Jeremy Grantham went public with a statement saying that equity market are ripe for a major decline in 2016. Only a few days later, Bill Gross did his utmost to outflank his ‘rival’ by saying that the world is lurching dangerously close to outright deflation. Both of those statements deserve a comment as well.

China misunderstood

Let’s begin in China. Between the 8th June and the 8th July Chinese equity markets went through a rather dramatic correction with the CSI 300 Index falling over 30%, prompting some to argue that it was the sign of a hard landing to come.

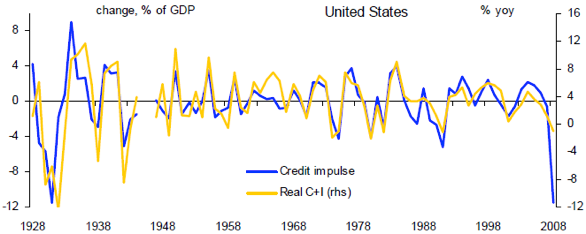

I don’t think so and will explain why but, before I do, I probably need to explain what the credit impulse is. The credit impulse is a term coined by Michael Biggs, then an economist at Deutsche Bank, when in 2008 he defined it as the change in new credit issued as a % of GDP. He showed that, in most countries, private sector demand (C+I) correlates very closely with the credit impulse and he argued that the important credit variable in terms of forecasting GDP growth is the change in the flow of credit, not the change in the stock of credit. When you look at chart 1, it is hard to disagree with him.

Chart 1 dates back to 2008, which is not ideal; however, it does offer an unprecedented illustration of the unusually strong link between the credit impulse and domestic, private sector demand (which is highly correlated with GDP growth). Later on in this month’s letter I will look at how the credit impulse has performed more recently.

Chart 1: Credit impulse’s impact on domestic demand in the United States

Source: Deutsche Bank

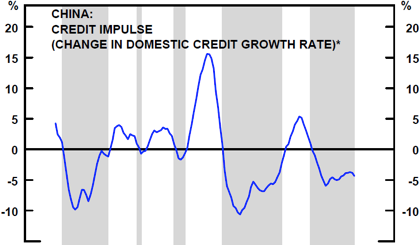

The reason all this is important as far as China is concerned is that the most recent reading of the credit impulse in China is not consistent with a hard landing. Although the reading did weaken months ago, it has actually strengthened marginally more recently (chart 2). I obviously cannot guarantee that the numbers haven’t been fudged but, assuming you can trust the stats, the Chinese economy is not likely to tank anytime soon. Something else must be driving the fall in Chinese equities.

Chart 2: Chinese credit impulse has weakened, but…

What could that be? Have China’s banks over-extended themselves more recently? Central planning or not, as we all learned in 2008, a surge in shadow banking can lead to terrible things. Official bank assets in China have grown 3.4-fold since 2008 (from 200% to 290% of GDP), whilst shadow banking activities (off balance sheet lending) have grown 12-fold from just a couple of percent to about 25% of GDP. And the rapid growth in lending activities since 2008 has happened almost exclusively as a result of increased leverage in banks and not because savings have risen.

In fact, according to the People’s Bank of China, so much lending is not classified as lending in China that (i) official loan-to-deposit ratios dramatically underestimate real lending activities, and (ii) one should look at assets instead to obtain a more correct picture.

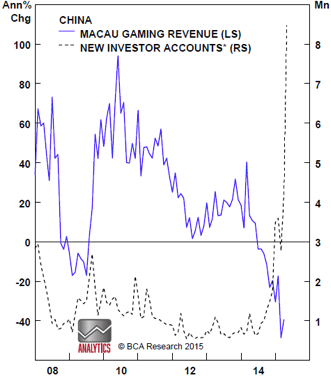

Or is it much simpler than that? The Chinese affinity for gambling is widely known and is tempting millions of Chinese to the casinos in Macau every year. This has been going on for many years and is not new. What is new is that gambling revenues in Macau have collapsed more recently, while the number of new brokerage accounts have exploded as Chinese equities have soared (chart 3).

I am no expert on China, but it is very tempting to conclude that the Chinese gambling spirit has simply migrated from Macau to Shanghai. The combination of a slowing economy and over-extended banks may have started the sell-off, but the rapid growth in investor participation and the widespread use of leverage may be the true explanation why it has gone as miserably as it has. I will leave that conclusion to people with a better understanding of China than me, though.

Greece on the run

The month of August has certainly been a bit quieter than June and July were as far as the Greek spectacle goes, but the bad taste in my mouth has not yet disappeared. And, unlike all of those who have criticised the creditors, and in particular the Germans, for being far too harsh on the Greeks, I take the opposite view. Yes, I do feel terribly sorry for all those poor souls in Greece who got caught up in this tug of war through no fault of their own, but the sad reality is that the country as a whole has lived well beyond its means for many years, and you cannot blame the creditors for putting a stop to that – however painful it is.

Chart 3: The Chinese gambling spirit is migrating from casinos to equities

*Sum of Shanghai and Shenzhen stock exchanges.

Source: BCA Research, ECB

Relative to 1999, when the euro was first introduced as an accounting currency, Greek workers had at one point (around 2009-10) enjoyed almost twice the wage growth compared to the average German worker. Although much of the advantage has since been given up, Greek workers have still outperformed their German colleagues since the introduction of the euro – at least as far as wage growth is concerned (chart 4). I can certainly understand if the man on the street in Germany finds that totally unacceptable.

Chart 4: German v. Greek wage growth since the start of the EMU

Note: Rebased to 100 at the start of the EMU in 1999

Source: BCA Research, Statistisches Bundesamt, Oxford Economics

Sadly, the story gets much worse. James Angelos, a British journalist with Greek roots, has written a fascinating book covering the systematic abuse which has undermined the entire country for years. One island (Zakynthos) has a grotesquely large percentage of (supposedly) blind people – and a fraudulent doctor. Well, probably more than one, because the average doctor in Greece earns only €12,000 per year despite living in the most expensive houses in the best neighbourhoods.

And people in Greece have a weird habit of forgetting to report their parents’ death. Could it be because the benefit cheque will suddenly stop if reported? How can the rest of world possibly criticize the creditors for putting a stop to all of this? I certainly don’t. Read here if you want to read more of this highly entertaining stuff – if it wasn’t so sad.

Ukraine, the Middle East and Puerto Rico in the dumps

Ukraine, the Middle East and Puerto Rico are all in the dumps – but for three very different reasons. Ukraine is caught up in an ugly civil war between pro-Russian rebels and the pro-European majority of the country, and the Middle East is… well, it is the Middle East after all. What more can I say other than prepare for it to get worse before it gets better. As long as young people from all over Europe happily travel to Syria to join ISIS, and we do surprisingly little to stop it, it won’t get any better.

Political events, however painful, rarely move the Dow or the Footsie in a major way, so don’t expect Ukraine or the Middle East to suddenly have a major impact on equity valuations in our part of the world unless the political incident in question turns into an economic one. And in that respect Ukraine holds the bigger potential to upset the cards – at least here in Europe. Total imports of natural gas from Russia account for nearly 30% of total gas consumption in Europe, and 50% of Russian natural gas exports to Europe run via pipelines in Ukraine, putting nearly 15% of European gas supplies at a serious risk, should the crisis escalate.

The recent nuclear deal with Iran should probably be seen in the light of that. Iran – not Russia as most think – controls the largest natural gas reserves in the world, and Europe is obviously quite eager to reduce its dependence on Russia. Expect the recent deal with Iran to be about a lot more than Iran just staying non-nuclear.

What is really happening in Puerto Rico?

“It is not about politics.” When Governor Alejandro García Padilla declared back in late June that Puerto Rico would never be able to repay the about $73 billion it owes, he tried to convince the rest of the world that this was not about politics. Fast forward only a few days, when he said the following: “Puerto Ricans decide the elections in Florida. That’s very important. By deciding the election in Florida, we can decide [who is the next] president of the United States.”

And it is not about politics? He bluntly threatened both mainstream political parties in the U.S. that, if they didn’t support his plans, the cornerstone of which is to allow Puerto Rico to file for bankruptcy which it cannot do under existing legislation, he would ensure that Florida wouldn’t go to their political party in the upcoming presidential elections.

At the end of the day, bankruptcy protection won’t fix Puerto Rico’s problems. It will just push the eventual pain a little bit further down the road. Puerto Rico is essentially an EM economy with DM lifestyle aspirations. An example: U.S. minimum wage laws apply, making Puerto Rico hopelessly uncompetitive vis-à-vis its much cheaper neighbouring countries.

From a political point of view, Puerto Rico is major news, and the next step by one of the front runners (Clinton, Trump or Bush) could quite conceivably have a big say on who the next U.S. president will be. From a financial point of view, this is not massive news. Foreign (non-Puerto Rican) banks are not involved to any meaningful degree in the country, so don’t expect this crisis to turn into Lehman, Mk. II.

Having said that, U.S. mutual funds as well as hedge funds are major holders of Puerto Rican government debt. Oppenheimer Funds and Franklin Advisers are known to control almost $11 billion of face value between them, and various hedge funds own at least $3.5 billion of face value. In other words, do your homework before making any investments.

The fallout from lower commodity prices

Oil prices have fallen 35% since early May with other commodity prices also doing poorly. Adding to the commodity misery, some of the world’s biggest exporters have seen their currency weaken over the summer – e.g. the Chinese renminbi. The net effect of all of that will be further downward pressure on inflation in the months to come. Expect all commodity importing countries to ‘benefit’, although the effect will be vastly different from country to country (chart 5).

Chart 5: Inflation impact from currency and commodity price movements since May

Source: BCA Research

Furthermore, if you consider that (i) yield curves are currently flattening (a sure sign of more difficult times to come), (ii) credit spreads are widening (another sign of more problematic times ahead), and (iii) credit growth as a % of GDP (the so-called credit impulse) has weakened quite substantially recently in the U.S. as well as in the euro zone (chart 6), we could be facing quite a troublesome winter.

As a result, the deflation talk is likely to blossom up again, and several countries on either side of the Atlantic could be flirting with recession later this year or early next. Consequently, yields on long bonds could fall further, and stock markets may be in troubled waters for a while. I don’t expect this to be anywhere nearly as bad as 2008, though. It is a normal cyclical downturn, which may not even be strong enough to be classified as a recession. But a slowdown it is.

This will put the Fed in a delicate position. Their ongoing rhetoric has convinced investors that a hike in interest rates is on the cards – if not in September then definitely in December. My money is on no Fed action in September with the jury still out as far as December is concerned – but I have been proven wrong before. You can argue that a hike now will provide the Fed with that extra bit of ammunition they may so desperately need when the winter chills take control (but I am not convinced).

Chart 6: The credit impulse in Europe and the U.S. is fading

Source: BCA Research

The U.S. dollar is still going strong

The dollar next. As most of my readers will know, I think the U.S. economy will substantially outperform most other OECD economies over the medium as well as the long term – even if there is a modest cyclical slowdown just around the corner.

As you can see from chart 7, the USD has performed very much in line with the interest rate differential between the U.S. and its main trading partners. Combined with the knowledge that the Fed has already begun to signal tightening, it is difficult to be anything but long-term bullish on USD on a trade weighted basis.

Chart 7: USD has tracked the interest rate differential very closely

Source: BCA Research, Bloomberg, Nymex

The latest from BIS

The Bank for International Settlements (BIS) published its 85th annual report in late June, and I could probably spend the next three months digging into its conclusions. Instead, I will jump the fence at its lowest point – with an extensive quote:

“Persistent ultra-low interest rates […] can inflict serious damage on the financial system. Such rates sap banks’ interest margins and returns from maturity transformation, potentially weakening balance sheets and the credit supply, and are a source of major one-way interest rate risk. Ultra-low rates also undermine the profitability and solvency of insurance companies and pension funds. And they can cause pervasive mispricing in financial markets: equity and some corporate debt markets, for instance, seem to be quite stretched.

Such rates also raise risks for the real economy. In the shorter term, the plight of pension funds is just the most visible reminder of the need to save more for retirement, which can weaken aggregate demand. Over a longer horizon, negative rates, whether in inflation-adjusted or in nominal terms, are hardly conducive to rational investment decisions and hence sustained growth.”

BOOM! Couldn’t say it more clearly. Low interest rates may help economic growth in one respect but beware – low rates, if maintained for long periods of time, may do considerable damage. BIS provided the chart below as part of its reasoning (chart 8). I actually find it quite scary. Debt levels just keep rising; it is as if 2008 never happened. I am not sure how this will all end, but some sort of end game is on the horizon. This cannot go on. Will it end in tears?

Chart 8: Interest rates sink as debt soars

Source: BIS 85th Annual Report 2014-15

The grand old men have done it again

Stay with me a little bit longer. I am almost there but cannot resist the temptation to comment briefly on Messrs. Grantham and Gross. Both have done exceptionally well over the years, so it feels slightly awkward to criticize them, but here we go.

Jeremy Grantham first. He went public back in late July with a statement saying that equities are ripe for a major decline in 2016. Now, major declines do not occur every year, so it is actually quite a statement. He really did stick his neck out. Apart from that, he also blatantly admitted that he doesn’t know what will cause the decline in equities. He just expects it to happen.

I don’t believe in being negative for the sake of being negative, but Jeremy has a point – at least as far as U.S. equities are concerned. If there is some sort of turmoil in the offing, U.S. equities are particularly vulnerable because of lofty valuations. The other problem I have with those sorts of statements is that being a notorious bear (as Jeremy Grantham is) is not a great business model.

If you don’t know what I am talking about, or you just happen to disagree, think Tony Dye[2]. Dr Doom, as he was nicknamed, was a brilliant fund manager but turned bearish on the dot.com boom in the 1990s way too early and, by doing so, missed a huge amount of upside (and many clients). I am not suggesting that Jeremy Grantham is Dr Doom all over again, but you probably get my point.

Being too bearish can be as damaging as being too bullish. By being long-term correct but short-term wrong, you not only run the risk of underperforming for an extended period of time; you also risk your job and your career.

Bill Gross next. Only a few days later, he warned that the world is lurching dangerously close to outright deflation. Based on my earlier comments on commodity prices he could be spot on – at least in the short term[3] – but I maintain my long held view that only the euro zone (of the main economies around the world) is in real danger of outright and sustainable deflation.

Bill Gross used the BIS annual report – just like I did earlier – quite extensively to build his case, and finished his note with the following words:

“There is no statistical reason per se for the Fed to raise interest rates, yet absent a major global catastrophe we are likely to get one in September. But the reason will not be the risk of rising inflation, nor the continued downward push of unemployment to 5%. The reason will be that the central bankers that are charged with leading the global financial markets – the Fed and the BOE for now – are wising up; that the Taylor rule and any other standard signal of monetary policy must now be discarded into the trash bin of history. Low interest rates are not the cure – they are part of the problem.”

In my view there is good deflation and there is bad deflation. A drop in CPI prompted by falling commodity prices is good deflation, but I am not convinced that the market is in a state of mind right now to distinguish between good and bad deflation. As inflation drops over the next several months, investors are more likely to pronounce that “deflation is back” and act accordingly. The recent ‘devaluation’ in China will only make that outcome more likely. This could drive equity prices – but also bond yields – further down.

Conclusion

My biggest question mark is on China. I am quite frankly not entirely sure what is going on, but the economy overall is most definitely weakening. The question is by how much? As stated earlier, I don’t see any hard landing around the corner, but a soft landing can also do considerable damage. When you are used to growing by 10%+, a reduction in the growth rate to around 5% certainly feels like a recession. If you add to that the considerable growth in total debt outstanding in China, suddenly ‘only’ 5% GDP growth can be painful.

As far as economic growth is concerned, I am far more concerned about the U.S. and the euro zone than I am about China. There are just too many signs pointing in the direction of slowing economic growth for them to be ignored. If it turns out to be a relatively modest slowdown, most of the damage in equity prices is probably behind us; however, if it turns into a proper recession – and I would assign a probability of at least 30% to that outcome – a further drop in equity prices can be expected – in particular in the U.S. where equities are far more expensive than they are in Europe.

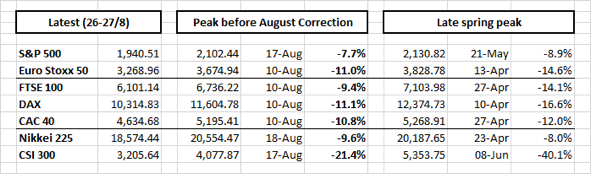

Finally a word or two on the storm currently creating havoc in global equity markets (well – at the very least until a couple of days ago). Most other equity markets didn’t bother too much as the first leg of the Chinese bear market unfolded earlier in the summer. In mid-August it all changed. Suddenly everyone cared, resulting in severe volatility in most equity markets around the world (chart 9).

Chart 9: The performance of global equity markets since May peak

Source: Absolute Return Partners, Bloomberg

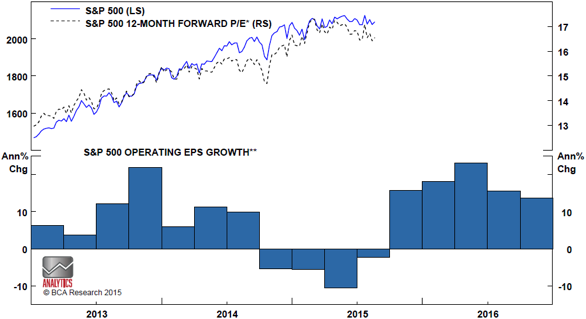

The equity markets that have fallen the least so far are the U.S. and the Japanese markets. If my prediction that we are looking into a more difficult period in the U.S. (and the euro zone), U.S. equities look particularly vulnerable, so maybe Jeremy Grantham will be proven right after all. If you add to that the rather lofty earnings expectations for next year in the U.S. (chart 10), the situation only gets trickier.

Chart 10: U.S. equity valuations appear stretched

*Thomson Reuters / BES

**S&P estimates for 2015 and 2016

Source: BCA Research

Despite not exactly being dirt cheap at current valuation levels, I am therefore going to stick my neck out and suggest that long bonds could actually prove a better investment than equities – at least until we approach the bottom of this economic cycle.

Niels C. Jensen

27 August 2015

©Absolute Return Partners LLP 2015. Registered in England No. OC303480. Authorised and Regulated by the Financial Conduct Authority. Registered Office: 16 Water Lane, Richmond, Surrey, TW9 1TJ, UK.

Important Notice

This material has been prepared by Absolute Return Partners LLP (ARP). ARP is authorised and regulated by the Financial Conduct Authority in the United Kingdom. It is provided for information purposes, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an investment decision. Information and opinions presented in this material have been obtained or derived from sources believed by ARP to be reliable, but ARP makes no representation as to their accuracy or completeness. ARP accepts no liability for any loss arising from the use of this material. The results referred to in this document are not a guide to the future performance of ARP. The value of investments can go down as well as up and the implementation of the approach described does not guarantee positive performance. Any reference to potential asset allocation and potential returns do not represent and should not be interpreted as projections.

Absolute Return Partners

Absolute Return Partners LLP is a London based client-driven, alternative investment boutique. We provide independent asset management and investment advisory services globally to institutional investors.

We are a company with a simple mission – delivering superior risk-adjusted returns to our clients. We believe that we can achieve this through a disciplined risk management approach and an investment process based on our open architecture platform.

Our focus is strictly on absolute returns and our thinking, product development, asset allocation and portfolio construction are all driven by a series of long-term macro themes, some of which we express in the Absolute Return Letter.

We have eliminated all conflicts of interest with our transparent business model and we offer flexible solutions, tailored to match specific needs.

We are authorised and regulated by the Financial Conduct Authority in the UK.

Visit www.arpinvestments.com to learn more about us.

Absolute Return Letter contributors:

Niels C. Jensen

Gerard Ifill-Williams

Nick Rees

Tricia Ward

[1] This is the first of a number of charts borrowed from the brilliant research firm BCA Research which I want to thank for their graciousness.

[2] Tony regrettably died in 2008.

[3] My earlier comments on commodity prices would support such an outcome in the short term.