Two “fundamental” indicators for the American middle/working class and the economy – by New Deal democrat This week is a little light on data, except for housing permits and starts (Tuesday) and existing home sales (Thursday), so let me catch up on a few other indicators. In particular, two of my favorite indicators are based on “fundamentals.” Basically, how much the average American is earning, and how much they are spending. Needless to say, we want both of them to be increasing. That’s because, as I have often said, consumption leads employment. If Americans are cutting back on spending, then cutbacks in employment will soon follow. Because consumption leads, let’s start with spending, i.e., real retail sales YoY. This data series

Topics:

NewDealdemocrat considers the following as important: Employment, Hot Topics, politics, Retail sales, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Two “fundamental” indicators for the American middle/working class and the economy

– by New Deal democrat

This week is a little light on data, except for housing permits and starts (Tuesday) and existing home sales (Thursday), so let me catch up on a few other indicators.

In particular, two of my favorite indicators are based on “fundamentals.” Basically, how much the average American is earning, and how much they are spending. Needless to say, we want both of them to be increasing. That’s because, as I have often said, consumption leads employment. If Americans are cutting back on spending, then cutbacks in employment will soon follow.

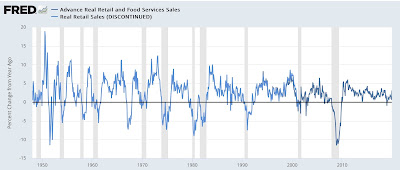

Because consumption leads, let’s start with spending, i.e., real retail sales YoY. This data series goes back 75 years. And it has been very reliable. Here’s the graph:

Leaving aside the pandemic, real retail sales has *always* turned negative YoY within about 6 months before the onset of a recession, except for two times in the 1950s where it turned negative YoY 4 and 5 months into the recession.

There have been some false positives (13 in total), where negative monthly YoY readings were not associated with a recession, but a majority of those were never worse than -1.0% YoY (the exceptions being 1951-52, 1956, 1966-67, 1987, and 2002). Further, a majority of the 13 times only lasted for 1 month, and only 3 have lasted for longer than 2 months in a row (1951-52, 1966-67, and 2002).

In short, even a 1 month negative YoY reading is a yellow flag that a recession might be near, and if it goes on longer than 2 months with at least one negative reading of more than -1.0%, almost certainly a recession has either just started or will within the next few months.

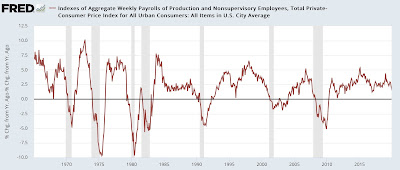

Now let’s turn to employment, in the form of real aggregate payrolls for non-supervisory employees. In other words, in real terms the total pay that the American working/middle class is taking home. This has a 60 year track record, and has also been very reliable:

There have been *no* false positives, ie., where the indicator signaled but there was no recession. There have been 5 times when the indicator did not turn negative until several months into a recession: 1970 (4 months), 1974 (3 months), 1981 (3 months), 2001 (1 month), and 2008 (5 months). But with the exception of 1981, in the other 4 episodes this metric was in a clear and severe downtrend during those months.

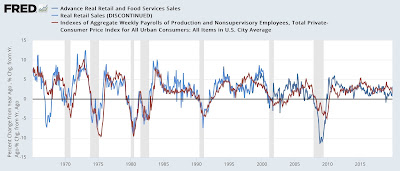

Now let’s see what both look like together in the 50+ years both were in existence prior to the pandemic:

What this shows is that, if both of these two indicators are positive, you could be sure that you are not in a recession. With the sole exception of one month in late 2002, if both are negative you could be sure that you are either just before, during, or coming out of a recession. And frequently real retail sales had turned negative a few months before real aggregate payrolls.

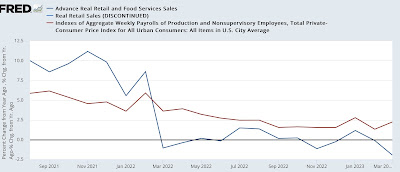

Now let’s look at the past 18 months:

Real retail sales have been negative YoY for 7 of the past 13 months. I have discounted the negatives from last spring, because they were in contrast with the spring stimulus spending spree of 2021. But 4 of the past 5 months have also been negative, and last month (March) by -1.9%. Putting both indicators together, with the exception of 1966-67 and arguably the near double-dip of late 2002, there has never been a time in the past 60 years where a downturn this big for this duration has not meant a recession.

Most importantly, at the moment real aggregate payrolls are still positive, and they are not declining. Because, for reasons I discussed last week, I expect consumer inflation to only be about +3.2% YoY after June, for aggregate real payrolls to turn negative, there will have to be a pronounced slowdown in either hours, or jobs, or wage growth, or a combination of the three.

Signs and portents of an employment slowdown and a near-term recession, Angry Bear, New Deal democrat