The long awaited downturn in multi-family construction may finally have happened – by New Deal democrat With the relative fading of manufacturing in importance to the US economy, the leading construction sector has assumed even greater importance. And the most important data about construction are the leading, and long leading, data about residential housing construction. To give a little additional framework, typically the first data to turn are new home sales. But that data series is extremely noisy and heavily revised. The next data to turn are housing permits, and the subset with the least noise and most signal are single family permits. Next are housing starts, which are much noisier than permits, although they represent actual economic

Topics:

NewDealdemocrat considers the following as important: Hot Topics, multi-family construction, Uncategorized, US EConomics

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

The long awaited downturn in multi-family construction may finally have happened

– by New Deal democrat

With the relative fading of manufacturing in importance to the US economy, the leading construction sector has assumed even greater importance. And the most important data about construction are the leading, and long leading, data about residential housing construction.

To give a little additional framework, typically the first data to turn are new home sales. But that data series is extremely noisy and heavily revised. The next data to turn are housing permits, and the subset with the least noise and most signal are single family permits. Next are housing starts, which are much noisier than permits, although they represent actual economic activity. Perhaps surprisingly, next in line are housing completions. Bringing up the rear, but representing the actual sum of economic activity in housing, are housing units under construction.

And as I have pointed out almost every month for the past year, because of pandemic bottlenecks in production of relevant materials, units under construction have lagged by a particularly long time.

That may finally have changed this month.

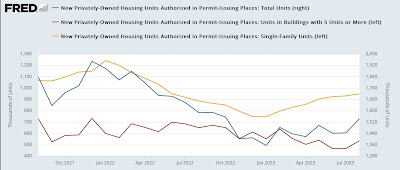

Let’s start with permits (Note: In each of the graphs below, blue represents the total (on the right scale), gold single family units, and red multi family units). Permits have rebounded since their bottom in January, and made a 10 month high:

Single family permits, which convey the most signal, participated in that increase, rising to their highest level since May 2022. This is good news (but we’ll come back to that below). Meanwhile, while they did rise, multi-unit permits continued to languish near their 3 year low set in June.

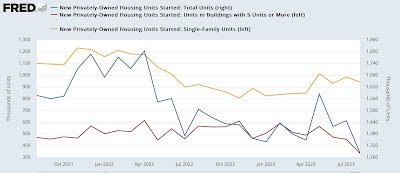

Starts, on the other hand, declined sharply in August. Perhaps most significantly, multi-family starts declined to their worst level since August 2020 (not shown):

Because starts are so noisy, take this with a big grain of salt.

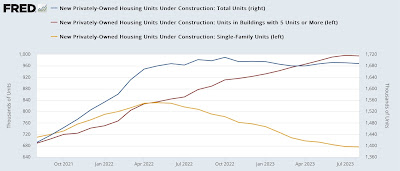

But the biggest news was what happened with units under construction. The total declined slightly, as did single family units. But most significantly, for the first time since February 2021, multi-family units under construction also declined, albeit only by 2,000 units annualized:

Why is this so important? Because, as this long term historical graph shows, total housing units under construction, although the most lagging of housing construction statistics, have also had to turn down before recessions begin:

Even moreso, as shown above multi-family units under construction, which typically turn after single family units, have also usually (except for 2008 and the pandemic) turned down before recessions have begun.

So the fact that multi-unit dwellings under construction may finally have made their turn is significant in terms of meeting the conditions for a recession to begin. If this continues, the final thing to look for is if total units under construction decline 10%, which is the average decline before the onset of recession.

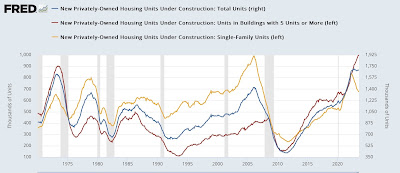

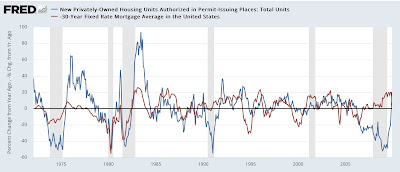

In that regard, finally let’s return to permits. As I have written dozens of times in the past decade, mortgage rates lead permits. Here’s the 40 years between the beginning of the modern data and the end of the Great Recession:

With the exception of the housing bubble (where everyone “knew” that “housing only goes UP!” so continued to buy housing even after mortgage rates increased) and the mirror-image bust, permits for housing reliably followed mortgage rates.

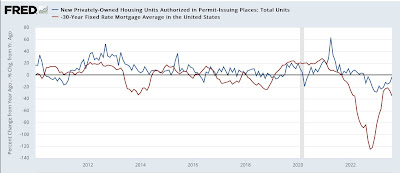

Here’s the subsequent 10+ years through the present:

The typical leading / lagging relationship re-asserted itself. And as you can see, with mortgage rates reverting to over 7%, on a YoY% basis they are forecasting permits to turn back down perhaps by 20% or more from already depressed levels YoY as well.

It will take another couple of months’ worth of data to be more confident, but it certainly appears that the turn I have been waiting for in the housing market has finally happened. This is an important reason why, while I have removed the “recession warning” from the end of last year, the “recession watch” remains, pending a return down of several short leading indicators like vehicle sales and the stock market.

A Fed nightmare? Housing permits and starts confirm improvement from bottom, multi-unit construction sets new record high, Angry Bear, New Deal democrat