The wealth of people and the wealth of nations Originally Published at Wealth Economics If you read this blog much, you’ll find many careful definitions of terms — something that the economics profession is terrible at. A blog called Wealth Economics really has to start at the top, with wealth. So here it is. “The only real, true wealth is…” You hear that sentence a lot — from economists, pundits, and all sorts of everyday people. It has lots of different endings. All of them are in some sense true and valid. The only “true” wealth is…friends, family, and loved ones. The only true wealth is “real,” productive goods. The only true wealth is land, or the whole environment. Or the discounted (“capitalized”) net present value of all future

Topics:

Steve Roth considers the following as important: Hot Topics, US/Global Economics, wealth

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

The wealth of people and the wealth of nations

Originally Published at Wealth Economics

If you read this blog much, you’ll find many careful definitions of terms — something that the economics profession is terrible at. A blog called Wealth Economics really has to start at the top, with wealth. So here it is.

“The only real, true wealth is…”

You hear that sentence a lot — from economists, pundits, and all sorts of everyday people. It has lots of different endings. All of them are in some sense true and valid. The only “true” wealth is…friends, family, and loved ones. The only true wealth is “real,” productive goods. The only true wealth is land, or the whole environment. Or the discounted (“capitalized”) net present value of all future cash flows. Or thriving businesses. Or a healthy, well-educated, productive populace.

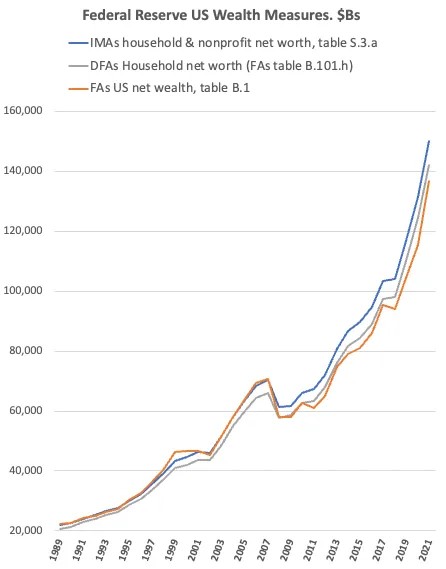

Again, there’s truth in all of those; they all provide particular ways of understanding the world. But here we’re going to focus on a much more mundane and technical meaning for the word “wealth”: balance-sheet/account assets, or net worth. (Net worth is just assets minus liabilities. It’s a remainder. You can think of it as unencumbered assets.) This is the same meaning the Fed uses in its various wealth measures (below), and it’s arguably the most widely agreed-upon meaning of the word. When people talk about “taxing wealth,” for instance, everyone agrees that we’re talking about taxation based on people’s assets and net worth.[1]

As used here, individual wealth is not just held by the wealthy, though they certainly hold most of it. If you have $200 in your checking account or your wallet (even briefly), that counts as wealth, assets that you own — just not very much of it, and perhaps not for very long. (Few households write down a formal balance sheet except, say, when applying for financial aid. But far more have a rough balance sheet in their heads: sum up your checking and brokerage account balances plus your estimated home value, and subtract your mortgage and credit-card balances due.)

While this measure might seem narrow, bloodless and technocratic (it is), it has real human import in our thoroughly monetized and financialized world. You can only spend on rent, groceries, or anything else, if you have assets to spend. (Spending is transferring assets from one economic unit to another; all spending comes out of assets.) And when you’re approaching retirement, your assets, net worth, or wealth largely determines whether you and your loved ones will enjoy a comfortable and secure (or even opulent) life in the decades after you stop working and earning income — and when or if you get to retire.

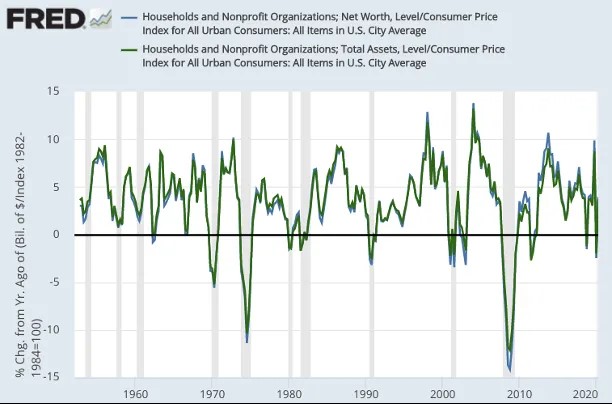

Accounting-based monetary wealth also dominates at the macroeconomic level. With one exception, every “real-economy” recession over the last half century was preceded by a downturn in asset-market prices, so in real household assets and net worth.[2]

This definition of wealth has a very particular advantage for economists: it can be, and is, measured as part of a comprehensive web of accounting identities. Those let us ask and answer a very pertinent question: where does wealth come from? How is it accumulated? (That’s the subject of the next post.) In this analytic sense, somewhat paradoxically, accounted wealth is the only “real” wealth, which can be tallied up numerically. It’s only a seeming paradox, though: nobody would claim that zillionaires’ or retirees’ accounted wealth has no “real” import. It very much does.

But…what are assets?

If we’re going to use assets (and net worth) as our measure of wealth, we’d better be perfectly clear what we mean by “assets.” The best place to start is with the idea of ownership, because the asset side of your balance sheet is a list of the things you own (with various legal rights and restrictions), and the current market value of those ownership rights.[3]

To be (excessively?) precise: as used here, assets are labeled balance-sheet entries tallying the market value of ownership rights imparted in financial instruments. (Yes: a real-estate title here is considered a financial instrument, that confers a set of ownership rights which have market value, and can be sold.) Assets are accounting objects that have powerful meaning and effect in the “real world.”

By this definition, a house is not an asset (it’s a long-lived real good). A title to the house is not an asset (it’s a financial instrument specifying ownership rights to the house). In our usage, only the labeled balance-sheet entry designating the monetary value of those rights is an asset. In this precise usage, assets only exist on balance sheets, brokerage and bank-account statements, and similar. Don’t confuse the thing itself with 1. rights to the thing, with 2. the agreement/instrument designating those rights, with 3. the accounting entry tallying the right’s numeric, unit-of-account, market value.

There’s no need to be such sticklers in all our discussions. People constantly refer to houses or intellectual property rights as assets, and this blog won’t be so fussy as to preclude that. But it’s good to be perfectly clear what we mean when we use that convenient shorthand.

[1] Note that this stock measure of wealth is very different from Adam Smith’s flow definition, here from the concluding words of his introduction to The Wealth of Nations: “real wealth, the annual produce of the land and labour of the society.” Economists have another name for this measure; it’s called “production.”

[2] The one exception to this pattern is the 2020 recession, which was very much caused by a “real economy” “shock,” as bruited in so many economic models. (Asset markets reacted with a big one-month decline, but then just continued their random upward walk, recovering within five months.) Interestingly, household assets and net worth are equally good recession predictors. Household liabilities add no predictive power because they’re small, about 15% of assets, and their changes via new borrowing and loan payoffs are also slow hence small.

[3] The NIPAs’ definition of assets (p. 2-2), adopted from the SNAs, is explicitly ownership-based: “According to the SNA, assets ‘are entities that must be owned by some unit, or units, and from which economic benefits are derived by their owner(s) by holding or using them over a period of time.’”