One of several articles I picked up on over the last few days. and decided to post at Angry Bear. Younger people are having to overextend themselves financially to buy housing. Not so different than a few decades ago. Except they are more in debt and more apt to go bankrupt due to a lost job, etc. Income does not appear to be keeping up with the price of housing and loan interest rates. Or perhaps, mortgage increases have outstripped income? A brief introduction to a serious issue. Due to my status as a veteran, I was able to get a VA mortgage at an ~2.6% with less than 5% down. What does this mean in terms of interest and costs to me. After three years of payments, half of my mortgage payment goes to equity and the other half to interest.

Topics:

Angry Bear considers the following as important: Hot Topics, housing affordability, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

One of several articles I picked up on over the last few days. and decided to post at Angry Bear. Younger people are having to overextend themselves financially to buy housing. Not so different than a few decades ago. Except they are more in debt and more apt to go bankrupt due to a lost job, etc.

Income does not appear to be keeping up with the price of housing and loan interest rates. Or perhaps, mortgage increases have outstripped income? A brief introduction to a serious issue.

Due to my status as a veteran, I was able to get a VA mortgage at an ~2.6% with less than 5% down. What does this mean in terms of interest and costs to me. After three years of payments, half of my mortgage payment goes to equity and the other half to interest.

Closing costs took a bit of funding. However, we just sold a home so we could afford it. New buyers do not have this advantage.

More on this later. I find it interesting.

Hitting Home: Housing Affordability in the U.S. March 2024

By Karan Bhasin, Prakash Loungani and Aziz Sunderji

Econofact

The Issue:

News reports abound of housing becoming unaffordable to a widening swathe of the American population, both home buyers and renters and across the country, not just in traditionally high price areas like San Francisco and New York. This deteriorating affordability directly impacts American lives, including where people choose to live and work. It has also been cited as a major contributor to key social problems like rising homelessness and worsening child wellbeing. How does affordability vary across locations and income classes? What factors are making housing unaffordable and can policies counter them?

The Facts:

- Housing affordability has worsened over the past two decades. Median house prices are now 6 times the median income, up from a range of between 4 and 5 two decades ago. In cities along the coasts, the numbers are higher, exceeding 10 in San Francisco for instance. The ratio of median rents to median income has also crept up over this period from 25 percent to 30 percent. Rising house prices are a particular problem for those intending to buy their first homes, while existing homeowners are cushioned somewhat by their increased equity in the house as the price of their home rises.

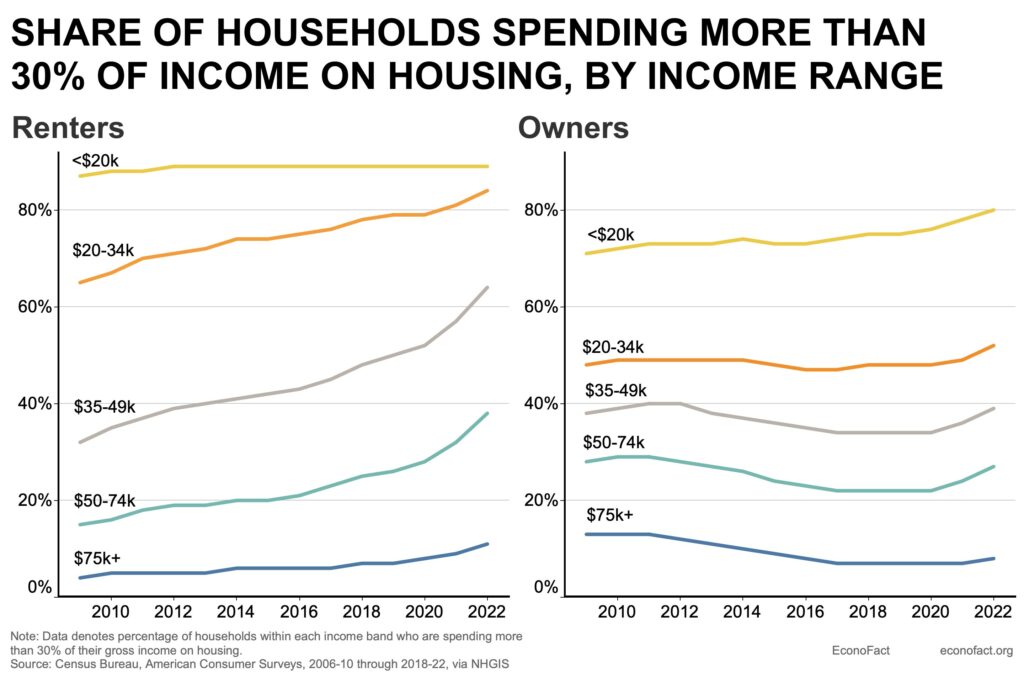

- Households — renters in particular — are increasingly cost-burdened. Households are considered cost-burdened if they spend more than 30% of their income on rent, mortgage and other housing needs. Among homeowners, about 40 percent of those in the $35,000-49,000 income range are cost-burdened, though this share has not changed much over the past decade (see chart). In contrast, the share of cost-burdened renters in that income range has risen sharply from under 40 percent of households in 2010 to over 60 percent today. Even as most households are spending a smaller share of their budget on other basics like food and clothing, the share of household’s budgets spent on housing has increased. On average the cost of housing has increased by $5,000 (2021 dollars) per year since 1984.

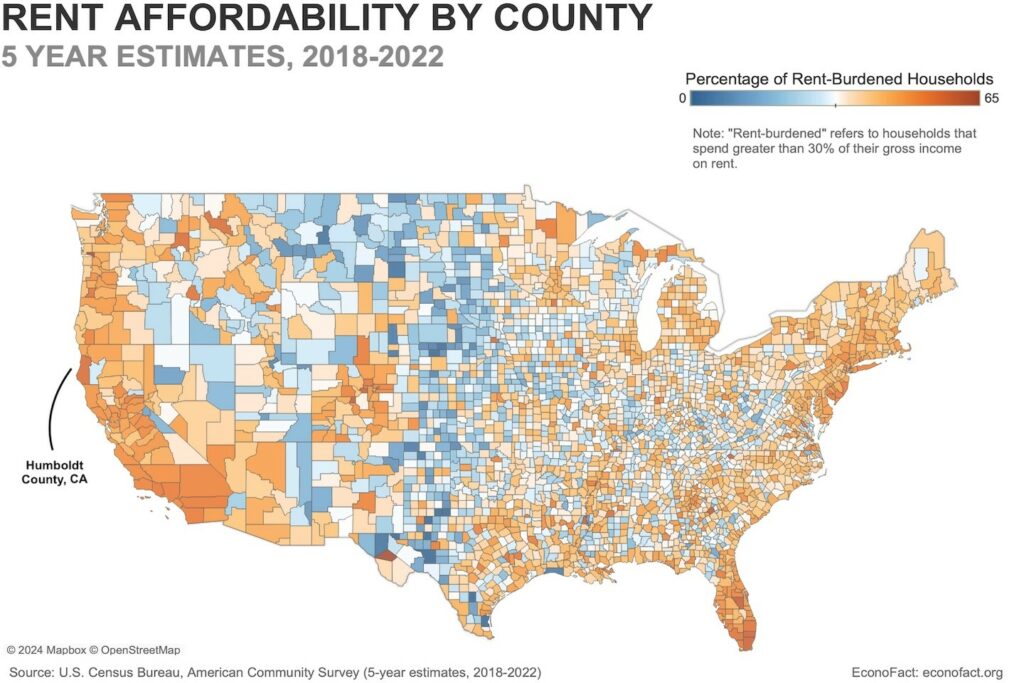

- Affordability is becoming an issue across the country. Historically, rural and interior areas of the country have been more affordable. But, even prior to the pandemic, migration toward these locations has helped drive faster house price appreciation than in more expensive regions. The pandemic and increased use of remote work practices further leveled the playing field: urban flight to less densely populated — and typically cheaper — regions has further shrunk the affordability gap between regions. Nevertheless, the coastal parts of the country remain more cost-burdened than the rest of the country, particularly for renters (see map below). For instance, 56% of Humboldt County households in California’s redwood coast are rent-burdened.

- The lack of affordable housing has contributed to rising homelessness in many cities. About 250,000 Americans were without homes in 2023, according to estimates by the Department of Housing and Urban Development, with a quarter of them concentrated in New York and Los Angeles. And while the causes of homelessness are complex, lack of housing supply is considered to play a significant role.

- The decline in housing affordability reflects a mix of longer-term and cyclical factors. Demographic developments have contributed to the demand-supply imbalance. Supply is crimped by more older Americans opting to age in place — choosing to remain single-family homeowners rather than move in with other family members, into a retirement community, or a smaller home — than was the case a decade ago. While home tenure has always been higher for older households than younger ones, the number of over- 65s has quadrupled from 15 million to 60 million since 1960. The aging population is the biggest driver of lengthening home tenure. On the demand side, the biggest driver is new household formation. Americans formed about a million new households a year between 2015-2017, but the pace has almost doubled according to the most recent data, largely reflecting a pickup in household formation rates among millennials.

- A long-standing lack of homebuilding has also contributed to rising home prices. While lack of homebuilding is an issue in many countries the shortfall has been particularly acute in the United States. Amongst comparable major countries, the United States is the only one in which the housing stock grew more slowly than the population between 1995 and 2020. The deficit was particularly pronounced following the 2008 Great Financial Crisis: fewer new homes were built in the 10 years ending 2018 than in any decade since the 1960s.

- Lack of homebuilding reflects in part tight regulatory restrictions in many parts of the country. Most importantly, zoning laws, which are largely in the hands of local jurisdictions, restrict housing density in various ways but in particular via limits on minimum lot sizes, and zoning for single-family housing only. These caps have often been implemented at the request of local residents (see here). Often dubbed “NIMBYs” (for “not in my backyard”), such residents are concerned that greater housing density and a growing presence of lower-income households in their neighborhoods will lower their home values by leading to aesthetic blight, excessive demand for local amenities and infrastructure, and higher crime.

- More recently, higher interest rates since 2022 have exacerbated these secular trends to make housing even more unaffordable. The mortgage rate on a 30-year home loan soared from 3 ½ percent in early 2022 to nearly 8% in October 2023 as the Federal Reserve raised policy interest rates; the mortgage rate had only eased to about 7% by March 2024 as the tightening cycle had peaked. The problem is compounded by mortgage lock-in: higher interest rates have left many homeowners — many of whom bought homes or refinanced at the lows of 2020-21 — with cheaper-than-market mortgages, reluctant to sell their house and reset their mortgage at current, higher rates. Would-be homebuyers today therefore face both high prices and onerous financing costs. This is especially a problem for first time buyers — like 70% of Millennial buyers —who have no home equity to roll into their next purchase.

- The post-pandemic trend towards increased work from home also affects housing affordability. Some recent research argues that working from home increases housing demand — for instance by increasing the need for home offices — and puts upward pressure on house prices and rents (with a commensurate decline in commercial property prices and rents). At the same time, the increased flexibility in working from home makes possible the growth of ‘zoom towns’ that are further away from unaffordable cities and suburbs, reinforcing the trend towards convergence of housing costs across the country.

What this Means:

Lack of housing affordability is an issue in many countries, so it isn’t a uniquely American problem. And the complexity of the factors affecting housing affordability suggests that there isn’t an easy way to remedy the problem. Nevertheless, there may be some prospect for relief over time for Americans. In the near term, the expected reversal of the Fed’s tightening cycle starting later this year is expected to lower mortgage rates helping cost-burdened households while also boosting supply by dampening the mortgage lock-in effect. Over the medium-term, the swell of millennials and boomers driving high household formation is set to subside and decline. A longer-run solution to reversing the steady decline in housing affordability — or least keeping it in check — rests on increased supply (though some research suggests that supply restrictions have played a bigger role in boosting house prices than rents). There are some encouraging signs of willingness to change zoning laws and allow greater construction of affordable housing in urban centers. Indeed, there has already been some increase in multifamily housing starts in recent years. A large pipeline of apartments under construction is set to hit the market over the coming months; this could help ease some of the pressure on rents. Policy actions that combine tax incentives to encourage greater supply of affordable housing can nudge this process along. Homebuilders too can innovate in an effort to create more affordable housing. While these recent steps are encouraging, the secular forces that have driven down housing affordability seem unlikely to quickly reverse, keeping the issue high on the policy agenda.