In Europe (the Euro area, to be precise), both unemployment and inflation are down, according to Eurostat,. Which, again, shows that the Phillips curve, a crucial concept behind neoclassical macroeconomic thinking that assumes a more or less stable negative relation between unemployment and inflation (high unemployment will bring inflation down), is not the place to go when predicting or analysing inflation. Sometimes, this relation is specified as a relation between wage increases and inflation. But that relationship does not hold either: keeping wage increases below the level of inflation does not curtail international inflation (while it will wreck households and the national economies). And assuming that a country like Spain needed 20% inflation to keep inflation in check (no,

Topics:

Merijn T. Knibbe considers the following as important: Economics, economy, Finance, inflation, Interest rates, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

In Europe (the Euro area, to be precise), both unemployment and inflation are down, according to Eurostat,. Which, again, shows that the Phillips curve, a crucial concept behind neoclassical macroeconomic thinking that assumes a more or less stable negative relation between unemployment and inflation (high unemployment will bring inflation down), is not the place to go when predicting or analysing inflation. Sometimes, this relation is specified as a relation between wage increases and inflation. But that relationship does not hold either: keeping wage increases below the level of inflation does not curtail international inflation (while it will wreck households and the national economies). And assuming that a country like Spain needed 20% inflation to keep inflation in check (no, this is not a joke, this did happen) was, and is, not just silly and ignorant but outright destructive.

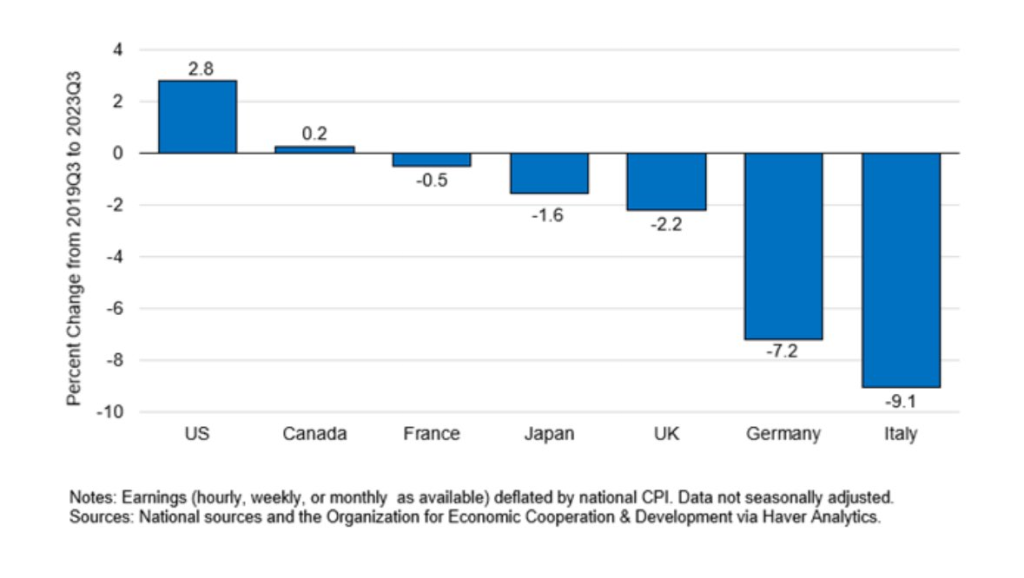

Graph 1. Real wage growth since the pandemic

Having stated this, I did not see the inflation surge coming, even when a combination of simple arithmetic with basic economic reasoning would have suggested that 10% plus inflation was totally possible. A not-even-perfect storm of surging food plus surging energy prices shows that, arithmetically, inflation can easily and rapidly increase above 5 or even 10%. While basic historical analysis yields that a combination of an increase of energy and energy prices is perfectly possible. Since 1973, energy prices have surged on a somewhat regular basis, while, since 2000, we´ve also seen regular bouts of food price inflation. It was a question of time before these two events coincided, causing a rapid erosion of the purchasing power of money incomes. Isabella Weber does better.

A next price storm might, when on top of price surges in the global market the currency of your country or currency area weakens, be more perfect. This raises the question of how to deal with inflation, considering unpredictable international price surges and the fact that people with low incomes, be it inside or outside the Euro area, spend a relatively large part of their income on food and energy. Isabella Weber suggests (based on input-output analysis of inflation) that we have to look at how price waves travel through the economy and have to develop policies aimed at controlling ´systemically significant´ prices, for instance by price controls in combination with stocks of food and oil. And we have to enable wage increases, to make up for lost purchasing power. Also, economists are often condescending about subsidies for farmers. However, subsidies are one method to square the circle: acceptable incomes for farmers in combination with low food prices. This is especially important for low-income countries, where a relatively large part of the population works in agriculture. Be that as it may, the simplistic ideas about inflation of neoclassical macroeconomics have been proved wrong, again. Better analyses and policies are needed.