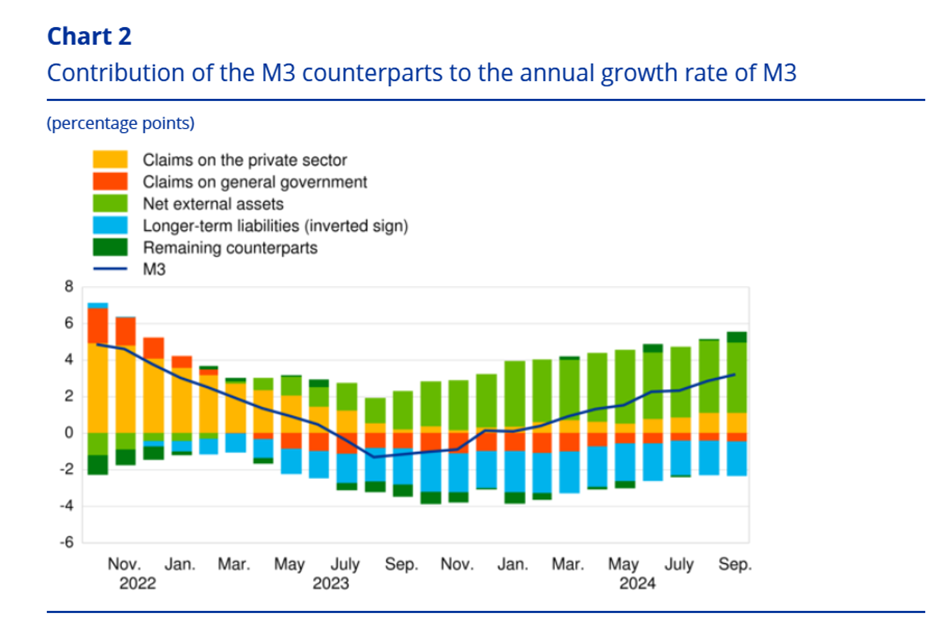

Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of 1) lather large inflows of money from outside of the Euro area (I do not know from which country) in combination with 2) a sizeable negative effect from ´longer term liabilities´. People move money from overnight accounts, which are included in the ´M3´ definition of money, to longer term accounts which are not

Topics:

Merijn T. Knibbe considers the following as important: ECB, Finance, Interest rates, investing, monetary-developments, money, personal-finance, Post Keynesian, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of

1) lather large inflows of money from outside of the Euro area (I do not know from which country) in combination with

2) a sizeable negative effect from ´longer term liabilities´. People move money from overnight accounts, which are included in the ´M3´ definition of money, to longer term accounts which are not included in this definition. The long-term accounts, with a maturity of over 2 years, have higher interest rates than overnight accounts but you can´t touch your money for at least two years) which pay higher interest rates.

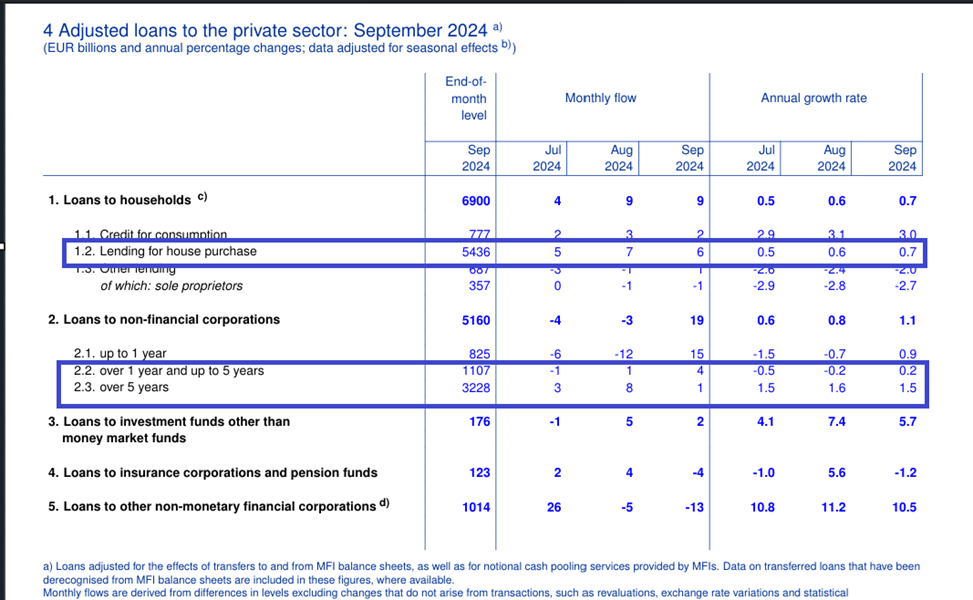

In both these cases, Euro´s are shifted around, no new Euro´s comes into existence. Net credit, however, does lead to new Euro´s and the ECB also provides data on this (table 1)

Table 1 shows, surely when considering the rate of inflation of at present around 2%, very moderate levels of net lending by households as well as corporations. As is well known, this kind of lending leads to new money. New money does not come ´out of thin air´ but it´s based upon trust of the banks in households and corporations. Important: looking at the total amount of loans ´lending for house purchase´ is the most important kind of lending. Summary: monetary developments in the Euro Area are very moderate. There is no sign of an overheated credit market and neither of sectors who are overstretching their balance sheets (at least not on the aggregate level).