Like John Stuart Mill, I´m more interested in credit than in money. Developments in the amount of credit provided are much more instructive to the economist than data on money. Look at the graph below (no. 2 in the ECB press release) , a highly Post-Keynesian graph that originated from the pre-Euro Bundesbank and is now published by the European Central Bank. It shows that money growth in the EU is relatively moderate and, more interesting, caused by a combination of 1) lather large...

Read More »MMT — debunking the deficit myth

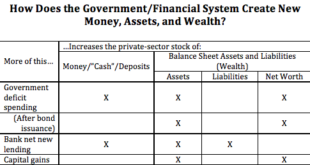

from Lars Syll We have already shown that deficit spending increases our collective savings. But what happens if Uncle Sam borrows when he runs a deficit? Is that wht eats up savings and forces interest rates higher? The answer is no. The financial crowding-out story asks us to imagine that there’s a fixed supply of savings from which anyone can attempt to borrow … MMT rejects the loanable funds story, which is rooted in the idea that borrowing is limited by access to scarce financial...

Read More »Actually, Only Banks Print Money

Asymptosis » Actually, Only Banks Print Money, Steve Roth I’m thinking this headline will raise some eyebrows in the MMT community. But it’s not really so radical. It’s just using the word money very carefully, as defined here. Starting with the big picture: You can compare the magnitude of these asset-creation mechanisms here. (Hint: cap gains rule.) The key concept: “money” here just means a particular type of financial instrument,...

Read More »Money Illusion in the Twenty-First Century

Money Illusion in the Twenty-First Century The starting point for any consideration of inflation is that wages (and interest, profits, and rents) are prices. Every transaction has two sides, and one person’s price is another’s income. In the aggregate, leaving aside international complications, inflation can’t have either a negative or positive effect on aggregate real income. After this, you can explore issues of distribution, inflation’s...

Read More »Money Illusion in the Twenty-First Century

Money Illusion in the Twenty-First Century The starting point for any consideration of inflation is that wages (and interest, profits, and rents) are prices. Every transaction has two sides, and one person’s price is another’s income. In the aggregate, leaving aside international complications, inflation can’t have either a negative or positive effect on aggregate real income. After this, you can explore issues of distribution, inflation’s...

Read More »JP Morgan’s Coffee Machine

It's now widely accepted, though still not universally, that banks create money when they lend. But it seems to be much less widely known that they also create money when they spend. I don't just mean when they buy securities, which is rightly regarded as simply another form of lending. I mean when they buy what is now colloquially known as "stuff". Computers, for example. Or coffee machines. Imagine that a major bank - JP Morgan, for example - wants to buy a new coffee machine for one of...

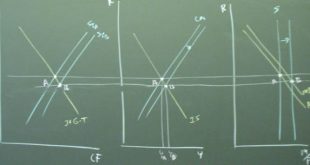

Read More »Reconciling IS-LM and endogenous money

This post was sparked by conversations with people who have opposing views of how money creation works. Some people think that classical models such as IS-LM don't work with endogenous money theory, therefore the models need to be discarded: others think that there's nothing wrong with the model and the problem is endogenous money theory. Personally I think that simple models like IS-LM can be powerful tools to explain aspects of the working of a market economy, and it behooves us therefore...

Read More »Rohan Grey — Administering Money: Coinage, Debt Crises, and the Future of Fiscal Policy

Abstract The power to coin money is a fundamental constitutional power and central element of fiscal policymaking, along with spending, taxing, and borrowing. However, it remains neglected in constitutional and administrative law, despite the fact that money creation has been central to the United States’ fiscal capacities and constraints since at least1973, when it abandoned convertibility of the dollar into gold. This neglect is particularly prevalent in the context of debt...

Read More »Michael Roberts Blog: blogging from a marxist economist — Minsky and socialism

Minsky’s journey from socialism to stability for capitalist profitability comes about because he and the post-Keynesians deny and/or ignore Marx’s law of value, just as the ‘market socialists’, Lange and Lerner, did. The post-Keynesians and MMTers deny/ignore that profit comes from surplus value extracted by exploitation in the capitalist production process and it is this that is the driving force for investment and employment. They ignore the origin and role of profit, except as a residual...

Read More »Comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’ – ECONOMIC THOUGHT

The new issue of the journal ECONOMIC THOUGHT (Vol 8, No 2, 2019) has just been published. In this issue I have contributed a comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’. The issue contains of course the paper by M.Ramirez as well as his reply to my comments. The whole table of contents of the issue is the following: Vol 8, No 2, 2019 Table of contents Hierarchical Inconsistencies: A Critical Assessment of Justification Juozas...

Read More » Heterodox

Heterodox