You would think, wouldn't you, that an "Alternative Brexit Economic Analysis" by four highly experienced and qualified economists would be a rigorous exercise in economic forecasting, supported by excellent econometrics and with care taken to avoid confirmation and selection bias? A new paper from the Brexit-supporting thinktank Economists for Free Trade critiques the Government's recent forecast that Brexit would cause a GDP loss of between 2 and 8 percent over 15 years, with the "hardest" Brexit causing the greatest loss. Or at least, that's what the paper says it is doing. But the way it goes about it is decidedly odd for something claiming to be an "Alternative Brexit Economic Analysis". The first section of the report is an extensive discussion of the reasons why no-one should

Topics:

Frances Coppola considers the following as important: Brexit, Economics, trade

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

You would think, wouldn't you, that an "Alternative Brexit Economic Analysis" by four highly experienced and qualified economists would be a rigorous exercise in economic forecasting, supported by excellent econometrics and with care taken to avoid confirmation and selection bias?

A new paper from the Brexit-supporting thinktank Economists for Free Trade critiques the Government's recent forecast that Brexit would cause a GDP loss of between 2 and 8 percent over 15 years, with the "hardest" Brexit causing the greatest loss. Or at least, that's what the paper says it is doing. But the way it goes about it is decidedly odd for something claiming to be an "Alternative Brexit Economic Analysis".

The first section of the report is an extensive discussion of the reasons why no-one should ever believe forecasts produced by the UK Civil Service. The authors argued that because HMT's forecasts are frequently wrong, they could not be trusted to make forecasts.

But this is ridiculous. I would be much more worried if HMT was frequently right. The whole point of making official economic forecasts is to inform policymakers and trigger policy decisions in response. Successful policymaking inevitably renders forecasts wrong. So giving chapter and verse on all the wrong forecasts made by HMT and others since the Gold Standard proved absolutely nothing.

More importantly, it had no place in a serious economic analysis. Making ad hominem attacks on the authors of the report you are critiquing is bad form. And in this case, it was downright stupid. I lost interest very quickly and moved on to the second section, which at least actually critiqued DexEU/HMT's report.

It was immediately evident that none of the authors had actually seen the report they were aiming to critique. They had only seen the carefully curated Buzzfeed leak. Nor did they have direct access to the model that DexEU/HMT used. It is a bit difficult to critique a report you haven't read and a model you haven't seen. You have to make hefty assumptions about the report, the model, and the data and assumptions used to generate the results.

Making assumptions is not in itself a problem. It is an inevitable part of economic forecasting, since no-one ever knows everything about an economy (or indeed about the future). However, assumptions need to be reasonable, supported by empirical evidence if possible, and fully documented. The group did document their assumptions. But reason and evidence were sadly lacking.

Here is the assumption they made about the nature of the model:

We now understand that Whitehall’s new approach employs a standard Computable General Equilibrium (CGE) Model, just the same as the World Trade Model created and used by the Cardiff University macroeconomics research group.Er, if you haven't seen the model, how do you know it is "just the same" as the World Trade Model used by the Cardiff University group?

Because the Government Economic Service does not have the in-house capability to develop such complex models, they sensibly have elected to use the Global Trade Analysis Project (GTAP) model, a workhorse created at Purdue University in Indiana that has been developed since 1992 by multiple universities, government and international agencies.A trade model created at Purdue University in Indiana can't possibly be "just the same" as a trade model created and used by Cardiff University. But Cardiff's model is created by a research group run by Patrick Minford, one of the authors of the paper. Understandably, he wants to use it. So the paper assumes equivalence between the two models to justify using the Cardiff model to debunk an analysis produced using the GTAP model.

To be fair, the two models do appear to produce similar results. The respected Canadian consulting group Ciuriak Consulting used a version of GTAP to estimate the economic effects of adopting "unilateral free trade" (UFT), which Economists for Free Trade take as an approximation to "general free trade" (more on this shortly). Ciuriak's model shows only a very small GDP boost for the UK from UFT, about 0.8%. It bases this on an estimate that removing trade barriers would reduce average import costs by 4%. But Patrick Minford thinks import costs would reduce by 20%, not 4%. To adjust Ciuriak's results for his higher estimate, Economists for Free Trade multiplies the GDP boost from UFT by 5, arriving at a figure of 4% of GDP. Apparently this is the same as Minford's Cardiff model produces.

But this causes Economists for Free Trade a problem. They rejected HMT's previous forecasts because they had been produced using a "gravity" model of trade, whereas Economists for Free Trade prefer a Computable General Equilibrium (CGE) model. But the new DexEU/HMT model is a CGE model. Furthermore, Ciuriak's GTAP model produced similar results to Cardiff's when adjusted for different assumptions. But Whitehall's GTAP model forecasts are nothing like them. They are actually within spitting distance of those produced by the "discredited" gravity model.

So how do Economists for Free Trade deal with this? They cast aspersions on GTAP:

An additional important problem in the Whitehall calculations is with the GTAP model itself. It is a good CGE model - in principle, much like the World Trade Model used by the Cardiff research team. However, it is a vast and detailed model and is unlikely to model the UK economy and trade very well. No one has attempted to test it on the UK and, because it is so large, no one is likely to do so.This is an entirely spurious explanation. Ciuriak used essentially the same GTAP model as DexEU/HMT, but their results were much closer to Cardiff's.

The real reason for the differences is the data and assumptions fed into the models. Indeed, Economists for Free Trade themselves say this:

If the correct Brexit policies are fed in, it seems that all of the models – GTAP, Cardiff, and gravity models – produce directionally the same results – all clustered around a positive 2 per cent to 4 per cent of GDP range."Correct Brexit policies" is another ad hominem attack. DexEU is the department tasked with implementing the Government's Brexit policies. Economists for Free Trade are alleging that it is not using the Government's Brexit policies when producing forecasts. The implication is that the civil servants tasked with delivering Brexit are trying to undermine it. Subtle allegations of this kind do not belong in a serious economic analysis.

However, DexEU/HMT do appear to have used an entirely different set of assumptions from those of Economists of Free Trade. How do the authors explain this inconsistency?

Simple. They say the DexEU/HMT assumptions are wrong:

The latest Whitehall analysis makes many assumptions that are simply not credible. Strangely, it does not even model the new agreement with the EU that the government is seeking. But it does appear to assume that even with an EU agreement there would be absurdly large border costs on UK-EU trade; also that eliminating current EU-set trade barriers against non-EU countries would have negligible effects on the UK's non-EU trade and the UK economy, an assumption that is demonstrably false on the very GTAP model it is using.It is a trifle unfair to criticise DexEU/HMT for not modelling the effects of a trade agreement which not only has yet to be agreed but on which the Government itself is divided. But the real issue is the claim that DexEU/HMT has made unrealistic assumptions about border costs and the effects of ending EU-set tariffs. This is the cause of the differences between the Whitehall and Cardiff models. Both rest on Government policy as laid out in the Lancaster House speech, but the interpretation of that policy is entirely different.

Economists for Free Trade define the Government's preferred outcome for Brexit as "general free trade with the non-EU world" plus a "close relationship with the EU". And they equate "general free trade" with UFT.

But UFT is not Government policy. How can Economists for Free Trade call this the "correct Brexit policy", and criticise DexEU/HMT for not using it in the GTAP model?

The key is in their view of how UFT would work in practice. Economists for Free Trade describe UFT thus:

UFT approximates the combined effect of many FTAs with the rest of the non-EU world in eliminating protection of food and manufactures: in an FTA you seek opening of other markets in return for opening yours. Other countries therefore demand you eliminate your protection in exchange for eliminating theirs: so your own trade barriers decrease as they would in UFT.In a free trade agreement (FTA), both sides agree to lower trade barriers. So Economists for Free Trade assume that if the UK were to lower all its trade barriers, the rest of the world would reciprocate. This would in effect create a worldwide FTA, amounting to "general free trade".

But there is not one shred of empirical evidence that the UK unilaterally lowering trade barriers would necessarily result in other countries lowering theirs. There is even some historical evidence to the contrary.

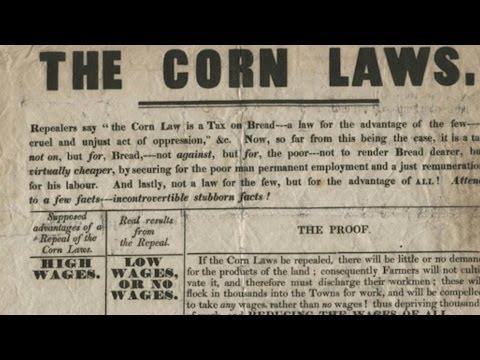

In 1846 Britain repealed the last of its major tariffs (the famous Corn Laws) in the hope that European countries and the USA would repeal theirs. Minor tariffs were also dismantled over the ensuing decade or so. But other countries happily took advantage of the trade advantage that Britain's zero tariffs afforded them. Ten years later, Richard Cobden, architect of the free-trade movement, despairingly concluded that Britain would need to construct free trade agreements. The first such FTA was agreed with France in 1860. Others followed. By 1870, trade between the UK and European countries was governed by a web of FTAs. I suppose, if you have enough FTAs, you can claim you have "general free trade", sort of. But boy is it complex to administer. And it is incredibly fragile. All it needs is one large country not to play the "spaghetti FTAs" game, and the whole house of cards collapses.

It was the USA that wouldn't play. During the Civil War it raised import tariffs, and they remained high thereafter. European countries responded in kind. But not Britain. Dear me, no. The free market ideologues still ran the roost, so Britain maintained zero tariffs in an increasingly protectionist world. It was, of course, running the largest empire in history at that time, so was protected from the worst effects of this crazy policy through coercive trade relationships with its colonies. But it nevertheless paid a price - the decline of its agricultural industry as cheaper imports flooded the market. By 1911, Britain's agricultural industry was in such bad shape that the sons of farmers were emigrating to Australia to farm sheep because there was "no money in farming" in the UK. There's some evidence, too, that America's burgeoning manufacturing sector, protected by high tariffs, crowded out Britain's manufacturing to some extent in the late 19th century.

Economists for Free Trade's assumption that UFT would be equivalent to "many FTAs" is thus another spurious equivalence. UFT is not remotely similar to "general free trade". Even with sterling depreciation (not possible in the late 19th century due to the gold standard), it could be very damaging to the UK's domestic industries, in particular agriculture and manufacturing. This is indeed what other economic analysis shows.

But even if UFT were a credible proxy for general free trade, there is still a large difference between Economists for Free Trade's estimates of the GDP gain from UFT and Ciuriak's estimates, and not in the right direction. Unsurprisingly, therefore, Economists for Free Trade also criticise Ciuriak's assumptions:

However, it has been shown - rather uncontroversially - that trade barriers erected by the EU for food and manufactures are each 20% (see Minford, et al) when nontariff barriers are included; 4 per cent is simply the tariff barriers alone. In other words, Ciuriak and Xiao assume post-Brexit that we do not eliminate non-tariff barriers set up by the EU against the world. But if we wish to achieve free trade that would be nonsensical.No, it is this statement that is nonsensical. If the EU puts up non-tariff barriers against the world, then after Brexit, the UK will face those barriers even if it adopts UFT, unless it enters into an agreement with the EU to lower the barriers. It may get a trade boost from the rest of the world if it lowers its own non-tariff and tariff barriers, though this is unlikely to be reciprocated, as I explained above. But Minford's estimate is based upon EU trade barriers disappearing, which they clearly won't. If we wish to keep trading with the EU, we will have to replicate what Economists for Free Trade call "non-tariff barriers" and the rest of us know as "product safety standards", not only on exports but on imports as well, because imports feed into exports and the EU is going to want to know that their imports comply with their standards. And since it is unlikely that trade with the rest of the world could suddenly ramp up sufficiently to substitute for trade with the EU, a large reduction in trade with the EU would be extremely damaging. A 20% benefit from tariff and non-tariff barrier reduction thus looks anything but uncontroversial.

So having criticised both Whitehall and Ciuriak for using far more prudent estimates than their own, Economists for Free Trade then make matters worse by blithely magicking away all border costs under the guise of a "close relationship with the EU". "We have assumed for the purposes of modelling that border costs are effectively zero," they say.

There isn't a border crossing in the world where border costs are zero, except within the EU's single market - and the UK is leaving it. There is no reason whatsoever to assume that border costs for the UK after Brexit would be zero when those of other third party countries with which the EU has free trade agreements are not.

Combining a spurious equivalence between UFT and general free trade with an extraordinary assumption that border costs would be zero has a remarkable effect on GDP forecasts:

Thus, having redone the GTAP trade calculations reported for Open Europe with the assumptions appropriate for the Government’s expressed Brexit policy of ‘EU Canada+ plus’ ROW Free Trade’, GTAP produces a GDP gain of 2 per cent. This compares to the 5 per cent loss reported by Whitehall officials in the Buzzfeed leaked report - a directional difference of 7 percentage points.Economists for Free Trade turned a substantial loss into a reasonable profit by making unsupported and unrealistic assumptions. If only Carillion had employed them.

The third section of the piece, by far the longest, is an exposition of Economists for Free Trade's own views on Brexit. Others have commented on the obvious errors in this section, which are due to the authors' evident lack of understanding of WTO rules. My greater concern is that a long discourse on your own position is not appropriate in a paper purporting to critique someone else's. As a reminder, the stated purpose of the report was to critique the economic forecasts for Brexit recently produced by DexEU & HMT, and leaked to Buzzfeed.

And this brings me to the report's "key points". There are three:

- Based on the track record of Whitehall and associated institutions, it must be questioned if the conclusions of this secret report can be trusted

- If the Government's policy - as declared at Lancaster House - is fed into the new Whitehall model, it produces positive outcomes for Brexit that are essentially the same as those of the models of other independent economists

- The UK can have a bright future outside of the EU irrespective of whether or not the UK is successful in securing an attractive trade deal with the EU, assuming Government implements the correct policies with regard to the exit and subsequently after we have left

This is not an economic analysis, it is a polemic.

Related reading:

Magnanimous Albion - Deirdre McCloskey

Tariffs and Growth in Late 19th Century America - Irwin

The latest pro-Brexit analysis has got its sums badly wrong - Financial Times

Image from Wikipedia.