Everything pretty much as expected, more comments via the charts: Highlights Inflation data are inching higher while softness in spending is offset by strength in wages. The core PCE price index managed only an as-expected 0.2 percent gain in February though the year-on-year rate moved a notch higher to 1.6 percent, which is still subdued but just better than Econoday’s consensus. Overall prices also rose 0.2 percent with this yearly rate also up 1 tenth, at 1.8 percent. Movement is slow but is consistent with the Fed’s expectations for a gradual rise this year to their 2 percent inflation target. The strongest news in the report comes from the wages & salaries component of personal income which posted a fourth straight sharp gain, at 0.5 percent. This helped total income

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

Everything pretty much as expected, more comments via the charts:

Highlights

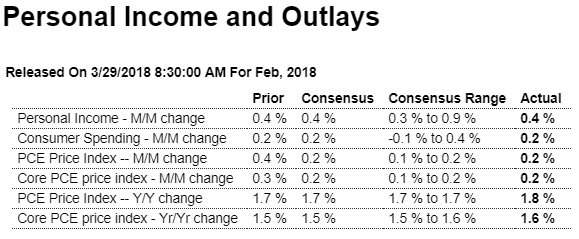

Inflation data are inching higher while softness in spending is offset by strength in wages. The core PCE price index managed only an as-expected 0.2 percent gain in February though the year-on-year rate moved a notch higher to 1.6 percent, which is still subdued but just better than Econoday’s consensus. Overall prices also rose 0.2 percent with this yearly rate also up 1 tenth, at 1.8 percent. Movement is slow but is consistent with the Fed’s expectations for a gradual rise this year to their 2 percent inflation target.

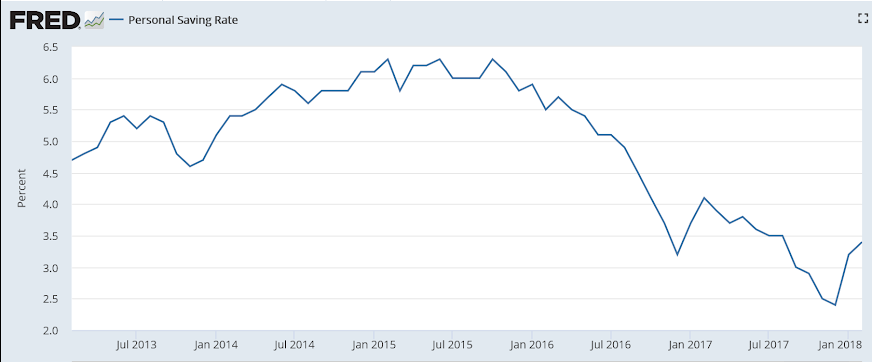

The strongest news in the report comes from the wages & salaries component of personal income which posted a fourth straight sharp gain, at 0.5 percent. This helped total income which rose 0.4 percent for a third straight month and also helped the savings rate which rose 2 tenths to a still modest 3.4 percent.

Also helping savings, unfortunately for retailers at least, was softness in spending which gained only 0.2 percent for the second straight month. Spending on services, at 0.3 percent, continues to hold up this component.

Consumer spending doesn’t look like it will be the backbone of the first-quarter GDP report like it was in the fourth quarter, barring that is a standout month for March. Otherwise, wages and inflation are moving in the right direction, that is consistent with moderate economic growth and gradual removal of stimulus by the Fed.

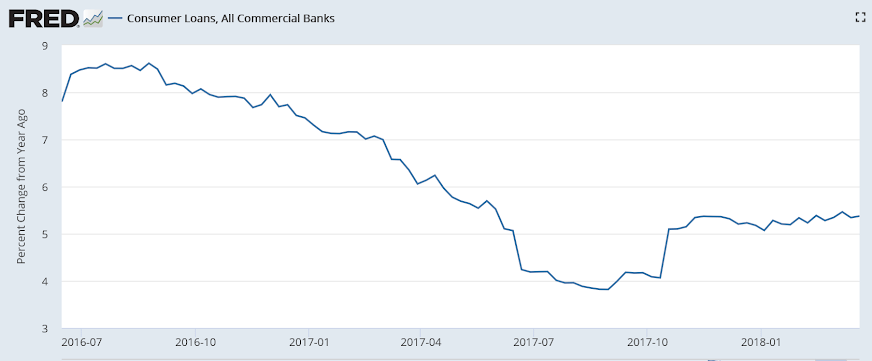

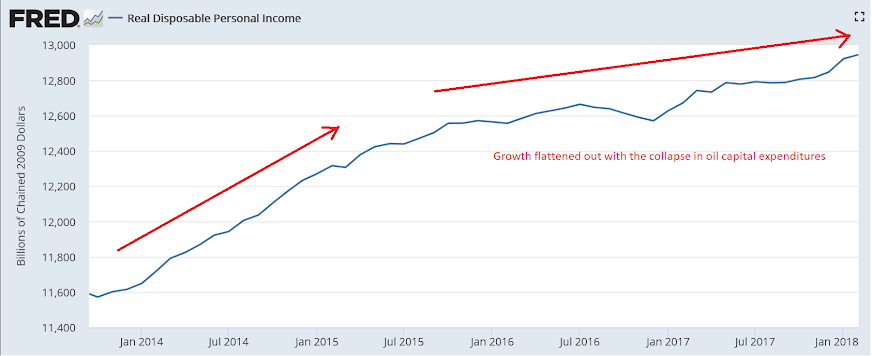

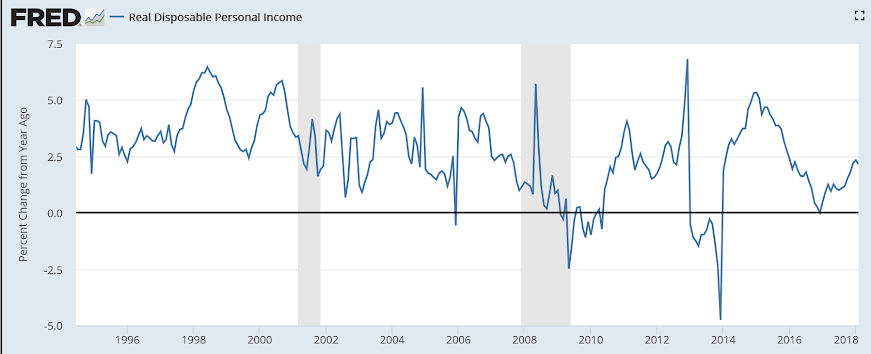

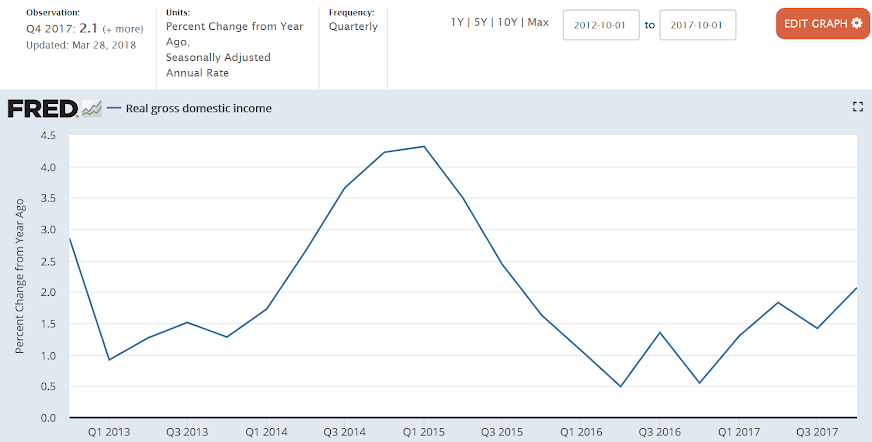

Growth is plenty low enough for a recession, depending on desired savings rates:

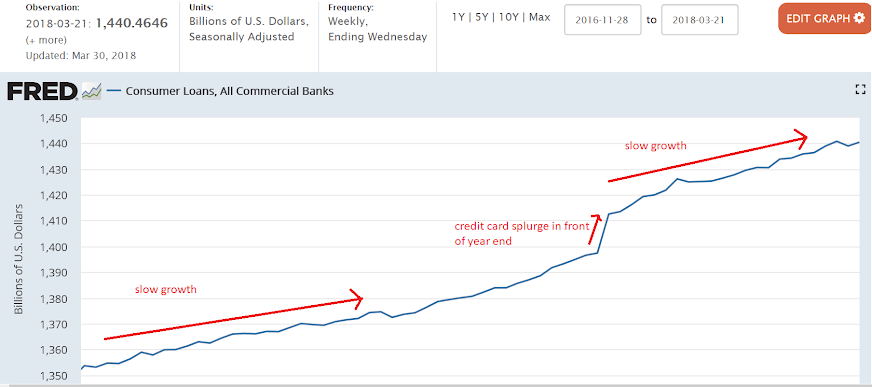

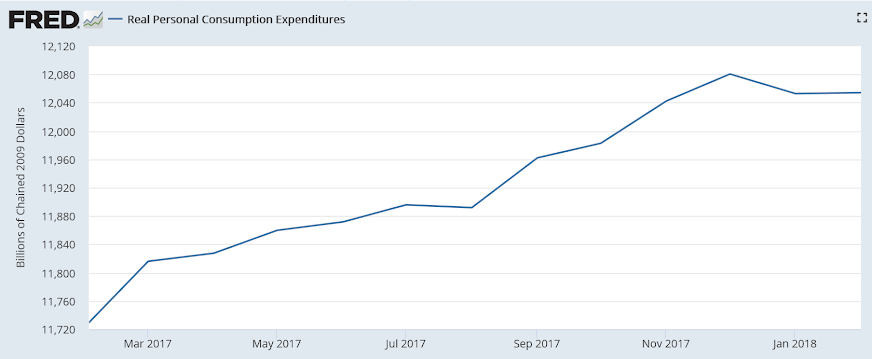

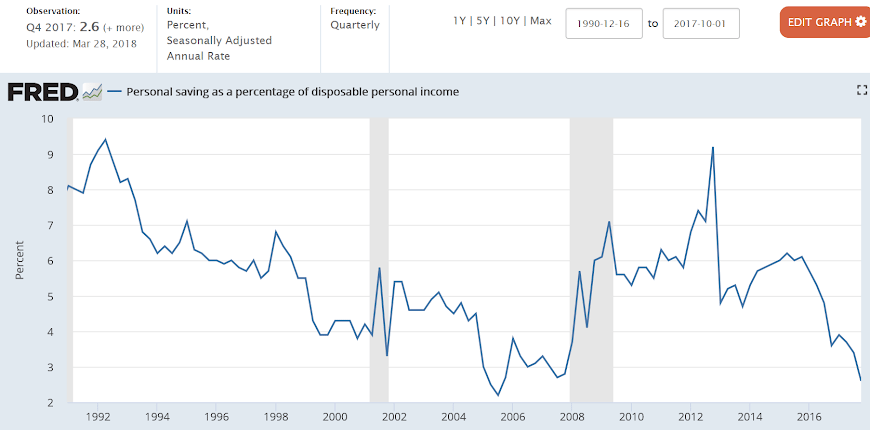

Starting to slow after a year end credit driven mini spending spree further depleted savings:

The personal savings rate began dropping after oil capex collapsed as income growth slowed more rapidly than consumption growth slowed, as it remains at what looks to me are unsustainably low levels.

GDI and GDP are equal by identity, as one man’s sales are another’s income. However they are compiled independently using estimates and are often very different when first released, generally coming together over time with revisions as more data becomes available. Most recently GDI has been substantially below GDP and it remains to be seen which will turn out to have been more nearly correct:

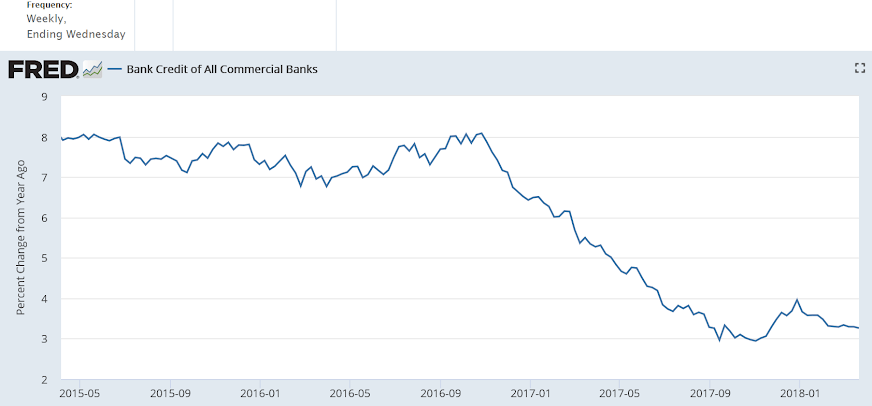

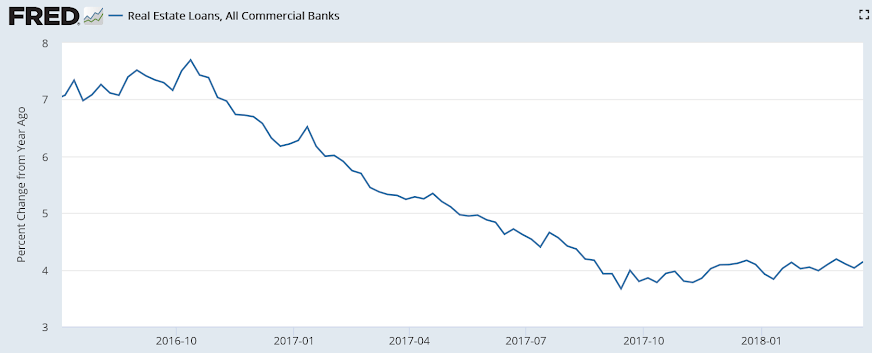

Bank loan growth remains depressed, and as bank loans create bank deposits, the growth of that component of ‘money supply’ also remains depressed: