Jargon is a heck of a drug: If names be not correct, language is not in accordance with the truth of things. If language be not in accordance with the truth of things, affairs cannot be carried on to success. The discourse of global warming/climate change is lousy with jargon. This rampant obfuscation gives science deniers rhetorical leverage and induces hallucinations about “Green New Deals” and “Environmental Kuznets Curves.” “Decoupling,” “rebound effects” and “externalities” are three terms that invite systematic incomprehension. The first two are dead metaphors and the third is an outright fraud — there is nothing “external” about an externality. A little reflection on what these terms actually refer to can help clarify what can and cannot be done

Topics:

Sandwichman considers the following as important: climate change, Featured Stories, Hot Topics, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Jargon is a heck of a drug:

If names be not correct, language is not in accordance with the truth of things. If language be not in accordance with the truth of things, affairs cannot be carried on to success.

The discourse of global warming/climate change is lousy with jargon. This rampant obfuscation gives science deniers rhetorical leverage and induces hallucinations about “Green New Deals” and “Environmental Kuznets Curves.” “Decoupling,” “rebound effects” and “externalities” are three terms that invite systematic incomprehension. The first two are dead metaphors and the third is an outright fraud — there is nothing “external” about an externality.

A little reflection on what these terms actually refer to can help clarify what can and cannot be done about carbon dioxide emissions. From the perspective of shameless self-promotion, it can also help show why my policy proposal makes sense and others don’t.

Decoupling

“Decoupling” appears to have crossed over to environmental economics from the idea of decoupling economic growth from energy consumption. See, for example, Loren Schmid (1975):

Past evidence has indicated that there is a direct relationship between per capita GNP or standard of living and energy consumption. What is needed is a decoupling of this relationship so we can reduce our energy use without loss of productivity. There is some evidence that as a country advances into secondary and tertiary economies, energy can be more efficiently used in raising productivity. Thus, there is an indication we can decouple the relationship but much more needs to be known before we experiment.

It stands to reason that the metaphor would come from engineering or physics — Dr. Schmid was a physicist — because decoupling is a technical term in electrical engineering. A decoupling capacitor, for example, isolates one part of an electrical network from unwanted noise generated in another part of the system. There is a problem, though, in transporting the term from circuits to the economy/energy nexus. David Hertz outlined the problem five years earlier, decoupling — in the sense of buffering — decreases as the scale of industrial activity increases:

Scientists and engineers have, in general, dealt with systems in physics, chemistry, and biology that were actually — or were assumed to be — independent of one another. For the most part, such assumptions have been valid. For example, a few molecules of gas in a container may be treated, for most technical purposes, as though they were independent of one another. In other words, they are “decoupled” — no heed need be paid to any effect which one has on another. As more molecules are added to the container, interactions among the molecules become greater, and at some point the density will be such that technological conclusions drawn about the behavior of the gas under the assumption of decouplings will be incorrect.

But we have gotten ahead of the story. Before the decoupling metaphor was adopted as standard jargon in economics, there was “de-linking.” Jänicke et al. (1989) wrote:

Structural change as an ongoing shift of labour, capital, and skills to more intelligent uses can also be conceived as a process of continuous de-linking. The contribution of traditional factors to the national product decreases, i.e. they tend to change or lose their function in the process of development.

More conventionally, this “de-linking” could be thought of as some combination of factor substitution, technological refinement and/or productivity improvement. But the point of designating it “de-linking” is apparently to disavow the inevitability of a connection between economic growth and pollution, as the article’s abstract suggests:

The authors come to the conclusion that the strong correlation between economic performance and environmental pollution, unequivocal in 1970, had become much weaker in the 1980s. The de-linking of economic growth from material intensive industrial production processes is particularly evident.

Three years later, one of Jänicke’s co-authors, Udo Simonis, referred to their study as asking “whether there was a (relative) decoupling of these factors from the GNP or even a (absolute) decrease of production and pollution in these industries since the early 1970s.” This is the first instance I could find of a distinction between relative and absolute decoupling of economic growth from environmental impacts.

In a paper published in 1997, Andrew Gouldson and Joseph Murphy cited the Jänicke study as evidence “that there has been a ‘decoupling’ of economic growth from environmental damage.” Gouldson and Murphy acknowledged a number of important caveats to that conclusion. Nevertheless, their characterization of the findings contrasted with Simonis’s assessment, from five years earlier, that “evidence of this decoupling of GNP growth from the growth of environmentally harmful effects is, however, not well established and not widely spread.”

From Absolute and Relative Surplus Value to Relative and Absolute Decoupling: The Odd Coupling

In chapters 15 and 16 of Capital volume one, Marx distinguished between absolute and relative surplus value. Could it be in the case of relative and absolute decoupling, we might learn more from the adjectives that from the noun? I could find only two sources that referred to both relative and absolute decoupling and absolute and relative surplus value. Neither one explicitly explored the coincidence of the adjectives.

Elsewhere, I have pointed out that what is “decoupled” in the decoupling story are rates of change, even in the case of so-called absolute decoupling. Relative decoupling means the consumption of fossil fuels or the emissions of carbon dioxide are increasing, just not as fast as economic growth. Absolute decoupling happens when consumption or emissions decrease while the GDP increases.

I have also remarked that what current jargon refers to as decoupling is substantially the same as what Robert Solow in 1972 called productivity of natural resources, on the explicit analogy to labor productivity. Now I will go one step further with that analogy between labor and resources: relative decoupling is coupled to relative surplus value and absolute decoupling is coupled to absolute surplus value in ways that make an “ecological modernization” transition from relative decoupling to absolute decoupling technically preposterous and politically unpalatable.

Let’s back up a step now and examine Marx’s distinction between absolute and relative surplus value. Marx defined absolute surplus value as depending upon the lengthening of the working day with a given wage and intensity of labor. If the expense of the worker’s wage was recouped in the value added by the output of the first six hours of work during a ten-hour day then extending the day from ten hours to eleven would increase the capitalist’s share, the “surplus,” by 25%, (all else remaining equal). Relative surplus value refers to the intensification of the production process given a working day of a fixed length. By increasing the productivity of each hour of work, the amount of time it takes for the value of output to recoup the wage is reduced, thus leaving more time in the given day for the production of a surplus.

In actuality, the intensity of work, the wage and the length of the working day are not fixed, so the rate of surplus value production would always result from some combination of absolute and relative. In fact, Marx argued, the introduction of machinery that intensified labor compelled the capitalist to also extend the working day — at first because of the more rapid “moral depreciation” of new inventions and ultimately, when mechanization became general, because of the contradiction machinery imposed between the increased rate of surplus value and the decreased number of workers employed relative to the value of capital employed.

But there is a limit to the extension of the working day. “The immoderate lengthening of the working-day,” Marx observed, “leads to a reaction on the part of society… and, thence to a normal working-day whose length is fixed by law.” This regulation is what Marx described in his Inaugural Address to the International Working Men’s Association as “the victory of a principle; it was the first time that in broad daylight the political economy of the middle class succumbed to the political economy of the working class.” After the passage of the Ten-Hours Bill, capital was compelled to rely more heavily — although not exclusively — on the intensification of work rather than the lengthening of the working day.

In chapter eight of Fossil Capital, Andreas Malm chronicles the transition from water to steam, with particular attention to the role of the struggle for a legally-enforced ten-hour day in accelerating and solidifying that transition. It was precisely those characteristics that distinguished coal from water power — it’s energy density, portability and invariable dependability — that assured its adoption in spite of water power’s cost advantage at the time. Solar and wind power share precisely those site specific and seasonally variable characteristics of water power that made fossil fuel the energy source of choice for the production of relative surplus value.

During the decades that consolidated the transition from water power to steam, the “relative decoupling” of economic growth from coal consumption was in the opposite direction — coal consumption grew faster than industrial output even though the efficiency with which energy was produced from coal improved spectacularly. That increase in consumption in spite of an increase in fuel economy brings us to the rebound effect.

Rebound Effects

One of the more auspicious implementations of the rebound principle was made by William Stanley Jevons in 1865, addressing the issue of fuel consumption. “It is wholly a confusion of ideas,” wrote Jevons in The Coal Question, “to suppose that the economical use of fuel is equivalent to a diminished consumption. The very contrary is the truth.” He went on to explain:

As a rule, new modes of economy will lead to an increase of consumption according to a principle recognised in many parallel instances. The economy of labour effected by the introduction of new machinery throws labourers out of employment for the moment. But such is the increased demand for the cheapened products, that eventually the sphere of employment is greatly widened. Often the very labourers whose labour is saved find their more efficient labour more demanded than before.

This “principle recognized in many parallel instances” was, of course, the principle that production opens up a market for products, that supply creates its own demand, that one man’s labor creates employment for another. In short, it was the doctrine of the impossibility of overproduction, also known as Say’s Law of Markets. But in this case, Jevons applied it not to expanded employment, which is typically considered a good thing, but to the increased consumption of fuel:

Now the same principles apply, with even greater force and distinctness, to the use of such a general agent as coal. It is the very economy of its use which leads to its extensive consumption….

And if such is not always the result within a single branch, it must be remembered that the progress of any branch of manufacture excites a new activity in most other branches, and leads indirectly, if not directly, to increased inroads upon our seams of coal.

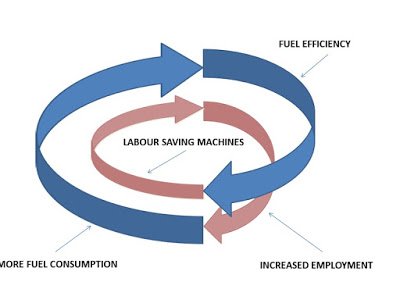

The catch here is that employment and the consumption of fuel are not merely “parallel instances” but are intimately linked in a feedback loop with the expansion of employment dependent on increased consumption of fuel through the (literal) mechanism of labor-saving machinery.

|

| Paradox Paired: the job bone’s connected to the fuel bone |

What this means is that if you accept (reject) a fundamentalist interpretation of Say’s Law, you must also accept (reject) a fundamentalist interpretation of the Jevons Paradox. You don’t get to pick and choose among them because the Jevons Paradox is simply another application of Say’s Law. If you accept a strong (but not absolute) version of Say and a weak version of Jevons (decoupling), you will need to provide a much better explanation for exactly how that could come about. Glib references to the built-in, self-adjustment mechanism of prices or the magic wand of technology won’t do.

There is an upside to this — if one can call it an “upside.” Technology will never eliminate the need for human labor. Robots will eliminate some old jobs but they will create other new jobs. To create enough new jobs to reabsorb the displaced workers, they will need to consume more and more fuel and consequently emit more carbon dioxide. Thus limits to the availability of cheap fuel and limits to the capacity of the atmosphere to absorb carbon dioxide impose limits on both the displacement of workers by machines and on the re-absorption of displaced workers through expanded production and consumption.

On the Rebound Back to Decoupling…

What this implies is that the superficial relative decoupling of GDP growth relies on a more profound and intractable coupling with fuel consumption of one of the key components of GDP, hours of work, thus ensuring continued increase of CO2 emissions. Not only is relative decoupling of GDP “unlikely” to turn into absolute decoupling, relative decoupling relies on and is driven by the indissoluble connection between labor productivity, fuel economy, job growth and expanding fuel consumption. This is where the link between Say’s Law and the Jevons Paradox hits the fan.

At a glance, the relative decoupling of GDP growth from CO2 emissions looks impressive. From 1960 to 2011, the dollar value of output in the U.S. that could be produced for each ton of CO2 emitted increased more than 250%. The amount of employment created, however, only increased by around 20%. In other words, GDP also decoupled from job creation almost as much as it decoupled from carbon dioxide emissions.

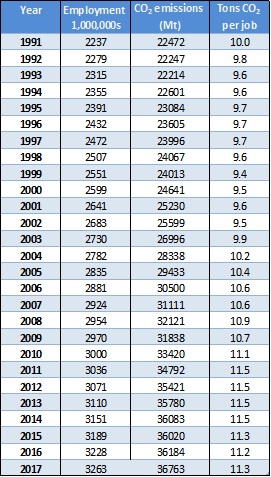

Since 1990, the gap has widened. CO2 emitted per person employed in the U.S. was about the same in 2011 as it had been in 1990 although the dollar value of economic output had increased by 58%. Even that sluggish job performance shines compared to the global figures, where the number of jobs created per million metric tons of CO2 declined by 12% between 1990 and 2017. That is not the kind of decoupling technological optimists had in mind.

|

| Global Employment and CO2 emissions |

Inside Externalities

Two competing policy frameworks for regulating carbon dioxide emissions are carbon taxes and cap and trade. Both are grounded in a property rights discourse that ignores the peculiar characteristics of wage labor. This is important because labor-power shares those characteristics with “nature” or more precisely with what Elinor Ostrom designated “common-pool resources” — such as air, water, forests, fisheries, pastures, etc. Labor-power is also a common-pool resource.

A coherent policy framework needs to explicitly account for social and environmental overhead costs rather than tacking them on as a presumably incidental afterthought — in the economic jargon, an “externality.” Uncompensated overhead costs are not external to the profit-pursuing decision processes of firms, as Robert Prasch pointed out:

For a profit-maximizing firm pursuing a reduction in its costs, it is equally “efficient” to (1) develop a process that will economize on the quality or quantity of inputs necessary to produce a given level of output; (2) purchase the same quality and quantity of inputs at a reduced price; or (3) adopt a new process that shifts a portion of the firm’s production costs to some other person or entity or the environment.

When economists speak of “technical change,” the first of these approaches is almost always implied. The second is, to a degree, covered when the analysis of “factor markets” is covered. The third option, cost shifting, is almost always downplayed or neglected. Despite its neglect by professional economists, cost-conscious firms have been most attentive to the possibilities of cost shifting. It follows that economists’ tendency to neglect this variety of cost savings is unwarranted.

Ignoring or neglecting the often deliberate aspect of cost-shifting invites policy responses that condone or perversely subsidize and thus foster environmental and social harm — a moral hazard. Under such a policy regime, predatory and parasitical cost-shifting advances by out-competing investment in socially beneficial and environmentally sustainable innovation. Moreover, some of the cost-shifting may actually be sub-optimal for the firm doing it but is nevertheless compelled by competitive pressure — a type of prisoner’s dilemma.

Coase argued that the suggested courses of action in the Pigovian tradition – liability, taxation or regulation – were inappropriate and often undesirable. He claimed that the traditional approach to the problem of social cost “tended to obscure the nature of the choice that has to be made” and characterized the question posed by the approach as “one in which A inflicts harm on B and what has to be decided is: how should we restrain A?” He objected that the problem was really a reciprocal one and the real question should be “should A be allowed to harm B or should B be allowed to harm A? The problem is to avoid the more serious harm.”

However, Coase didn’t consider the full range of Pigou’s examples and analysis. Coase’s restatement of the problem addressed only the specific externality problems discussed by Pigou in part II, it entirely overlooked the radically different labor-market problem encountered in part III, in which competitive pressure compels an employing firm to inflict harm on both itself and its employees and thus regulatory restraint of the firm (and competing employers) may benefit both and thus benefit society as a whole.

As is all too common in the discussion of externalities, Coase evaded the thorny questions of working conditions and unemployment. Whatever gains in tractability may be accomplished by such a maneuver are more than offset by a forfeit of realism and of insight into the complex interdependence of economic factors in the long period. The determination of the hours of work provides a particularly compelling example of a circumstance in which mutual benefit could result from an imposed non-market restraint and mutual harm result from market “freedom.”

In part III of The Economics of Welfare, Pigou argued that “after a point, an addition to the hours of labor normally worked in any industry would, by wearing out the work people, ultimately lessen rather than increase the national dividend.” That observation was derived from the theoretical contribution of another of Alfred Marshall’s star pupils, Sydney J. Chapman. As Chapman demonstrated, under competitive conditions, employers would tend to prefer hours of work that exceed the length that would be optimal for output. If an individual employer and workers were able to negotiate more optimal hours of work, it would involve a present investment by the employer in the workers’ future productivity. Well-defined property rights to that future capacity could not be transferred to the employer and thus the arrangement could be upset by a future offer of higher wages from a competing employer. The reliance on a property rights framework thus imposes a sub-optimal policy solution.

In accord with Chapman, Pigou viewed market failure with respect to the hours of work as commonplace, observing that, “the evidence is fairly conclusive that hours of labor in excess of what the best interests of the national dividend require have often in fact been worked.” For Pigou, this standard of “the best interest of the national dividend” demarcated a situation where there is “a prima facie case for public intervention.” Recall also that Alfred Marshall had argued that “the demand for work comes from the National Dividend,” thus according to Marshall’s own strictures, overly long hours would result in decreased employment as well as diminished output.

Less Growth; More Dividend?

Treating cost-shifting as “external” to economic decision-making of firms has another pernicious effect on the national dividend. It causes sums of money to be counted as revenue that are in fact unsecured “debts” that will never be paid back and thus will some day have to be written off by the community as a loss. In the case of CO2 emissions and climate change, that day of reckoning is deferred far into the future. Economic “growth” in the interim that is bolstered by such environmental embezzlement is an illusion. In The Great Crash, John Kenneth Galbraith addressed the significance of the time element in embezzlement, that “most interesting of crimes”:

Alone among the various forms of larceny, it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery… At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars.

In the case of climate theft, it is untold trillions of dollars that are at stake and the time elapsed measured in decades. The fossil growth bezzle is both an illusion and it is a diversion. Labor and natural resources that might otherwise be invested in the improvement of social infrastructure are instead confiscated for the entertainment and aggrandizing of assorted “moguls” and their entourages.

When exploitation exceeds the carrying capacity of a pasture, a forest or a fishery it impedes the ability of that resource to replenish itself. Condoning and actively promoting cost-shifting, in the name of growth leaves the earth and its inhabitants with progressively less sustenance and comfort.

Eventually, the Commerce Department will be forced to abandon tabulating these resource-gulping, waste-belching machinations as goods or services. Whether by accident or design, when decoupled from the pump and dump of surplus-value cost-shifting, GDP will decline precipitously.

The Poverty of Decoupling

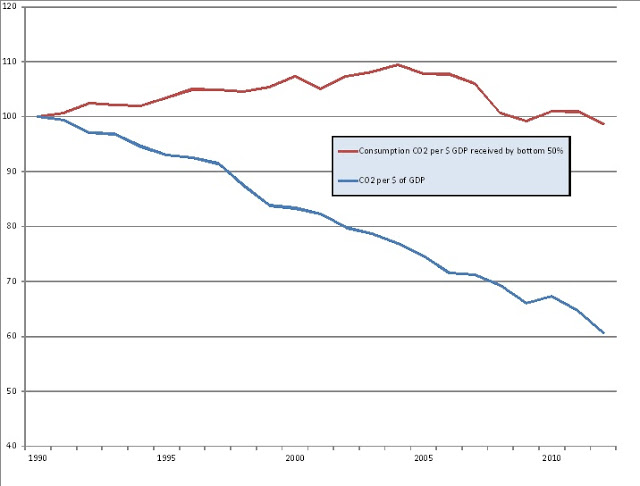

When all other arguments fail to persuade, the gurus of green growth plead poverty. “Without growth you are condemning the poor to never rise out of poverty!” So, how much of the benefit of economic growth with relative decoupling accrues to the poor? None. For each dollar of after-tax income, including transfers, received by an individual in the bottom 50% of income in the U.S. in 2012 virtually the same quantity of CO2 was emitted into the atmosphere as in 1990. There was no decoupling of income from carbon dioxide emissions.

|

| Relative Decoupling for Whom? |

How can this be? For starters, as Kostas Bithas and Panos Kalimeris point out dividing CO2 emissions by GDP gives a misleading result if you are concerned about the extent to which economic growth is contributing to individual income because that denominator is dominated by population growth. Instead, dividing emissions by per capita GDP gives a more accurate picture. Why not per capita emissions by per capita GDP? Because what matters for climate change is the aggregate of emissions. Being able to support a growing population on slightly less CO2 will not solve the problem. Running faster on a faster running treadmill does not get us any closer to our destination. Incidentally, way back in 1975 when the concept of decoupling energy consumption from GNP was being mooted by Loren Schmid, the focus was indeed per capita GNP. Funny how apologists for growth could systematically omit a key element that undermines their case!

The second correction is that the share of income going to the lower-income 50% of the population has been declining since the 1980s. From 1990 to 2012, that share fell from around 22% of GDP to just under 19% of GDP, according to Piketty et al. Finally, a consumption-based estimate of carbon dioxide emissions instead of a territorial estimate takes into account the emissions embodied in trade. Sending manufacturing overseas doesn’t reduce CO2 emissions. With the added shipping and higher emissions intensity of manufacturing in the exporting countries, it increases global emissions.

The Tail Does Not Wag the Dog

Some readers may object to the political and political economy implications of “surplus value” as referring to an analysis founded on an archaic “labor theory of value.” Personally, I don’t think a labor theory of value is one iota less subjective than a subjective utility theory. Most people work for a living and that colors how they form their perceptions the “value” of the things they buy.

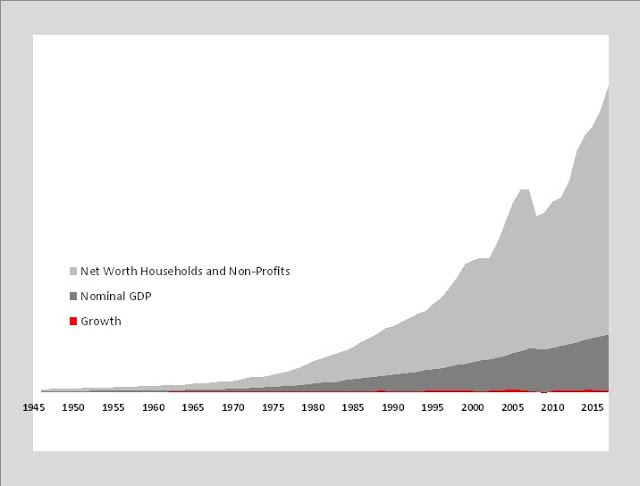

But I won’t quibble. Instead, I will point to a “stylized fact” — a regularity that endured for half a century in the U.S. — from 1946 to 1996, the ratio of household net worth to GDP hovered between 3.4:1 and 4:1, averaging 3.7:1. Net worth is a valuation but for it to maintain a fairly constant ratio to GDP indicates that a more or less stable proportion of current output each year is devoted to durable assets rather than current consumption. In turn, increasing GDP depends on some portion of those durable assets being “means of production.” Economic growth is thus empirically tied to some process of accumulation of productive assets.

After 1996, the ratio of household net worth to GDP has staggered through three successive bubbles, never falling below the 4:1 ratio that had been the maximum during the previous 50 years. At the end of 2017, the ratio was 5.2:1. The evidence of the last 20 years suggests that as valuations become increasingly decoupled from current output, they also become more volatile. This is not the “Goldilocks” economy the pundits of the 1990s imagined.

What this portends for the transition from fossil fuels is that “growth” is a rather slippery slope when moving away from established regimes of accumulation. When green growth advocates talk of investing 1.5% to 2% of current GDP in renewable energy, they are probably off by, say, an order of magnitude. Growth is not just the tip of the GDP iceberg. It is only the tip of the tip of the Net Worth GLACIER.

|

| The little red smudge at the bottom is “growth” |