September JOLTS report: a jobs market moving from thriving to hot Tuesday’s JOLTS report once again confirmed the very good employment report from one month ago, with two series making all-time highs and one an expansion high: Quits ust below their all-time high set one month ago Hires made a new all-time high Total separations made another new expansion high Layoffs and discharges spiked back to average levels for this expansion Job openings made yet another all-time high Let’s update where the report might tell us we are in the cycle, remaining mindful of the fact that we only have 18 years of data. Below is a graph, averaged quarterly, of the *rates* of hiring, quits, layoffs, and openings as a percentage of the labor force since the inception of the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

September JOLTS report: a jobs market moving from thriving to hot

Tuesday’s JOLTS report once again confirmed the very good employment report from one month ago, with two series making all-time highs and one an expansion high:

- Quits ust below their all-time high set one month ago

- Hires made a new all-time high

- Total separations made another new expansion high

- Layoffs and discharges spiked back to average levels for this expansion

- Job openings made yet another all-time high

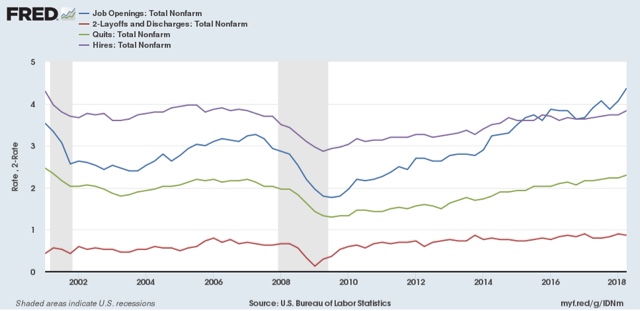

Let’s update where the report might tell us we are in the cycle, remaining mindful of the fact that we only have 18 years of data. Below is a graph, averaged quarterly, of the *rates* of hiring, quits, layoffs, and openings as a percentage of the labor force since the inception of the series (layoffs and discharges are inverted at the 2% level, so that higher readings show fewer layoffs than normal, and lower readings show more:

To put this in context, during the last expansion:

- Hires peaked first, from December 2004 through September 2005

- Quits peaked next, in September 2005

- Layoffs and Discharges peaked next, from October 2005 through September 2006

- Openings peaked last, in Spril 2007

By contrast during and after the last recession:

- Layoffs and Discharges troughed first, from January through April 2009

- Hiring troughed next, in March and June 2009

- Openings troughed next, in August 2009

- Quits troughed last, in August 2009 and again in February 2010

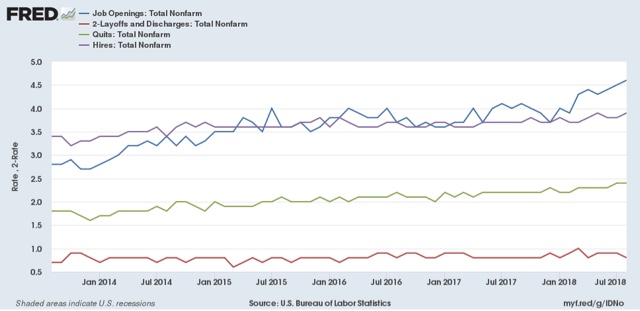

Here’s what the four metrics look like on a monthly basis for the last five years:

Job openings, quits, and hires have all surged higher this year, with openings virtually “on fire.” .

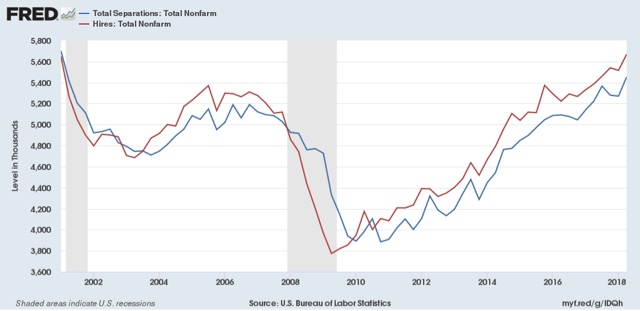

Next, here’s an update to the simple metric of “hiring leads firing,” (actually, “total separations”). Here’s the long term relationship since 2000 through Q3 of this year:

Here is the monthly update for the past two years measured YoY:

In the 2000s business cycle, hiring and then firing both turned down well in advance of the recession. Both are still advancing. The YoY% rate of growth had been decelerating, but has accelerated again.

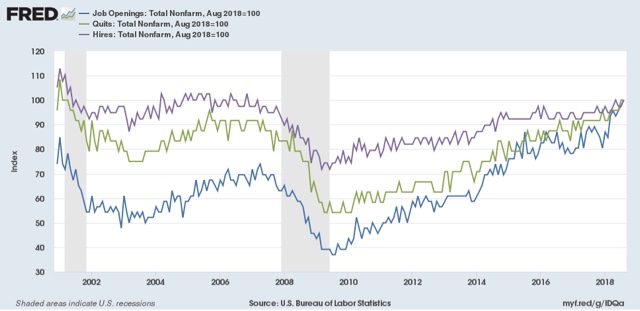

As I noted when I first presented this graph, while the rate of job openings is at an all time high, the rate of actual hires has only just reached its normal rate during the several best years of the last, relatively anemic, expansion, and is below its rate at the end of the 1990s expansion. Meanwhile quits are just below their best level of 2001 (at the end of the tech boom).

that the *rate* of actual hiring is below that of the anemic Bush expansion is very telling. My take is that employees have reacted to the employer taboo against raising wages by quitting at high rates to seek better jobs elsewhere.

In summary, the August JOLTS report shows an employment market that is moving past thriving to downright hot, but a market that continues to reflect a failure of wage equilibrium, My expectation is that this will last a few more months, and then start to cool down early next year as a slowdown begins to take hold.