Summary:

Why I’m worried about the decline in real wages This is a follow-up to my post yesterday concerning the decline in real average and aggregate wages. Why should the data from just one month cause me to warn that “This is Bad?” To show you, let’s decompose the data into CPI and nominal aggregate wages, shown in the below two graphs, the first of which covers the inflationary era of the 1960s and 1970s, and the second covers the disinflationary era since: In the year prior to at least 5 (arguably 6) of the last 7 recessions, BOTH nominal aggregate wage growth was decelerating (1980 and arguably 1969 being the exceptions) and consumer inflation was increasing (1980 and arguably 2007 being the exceptions). The 1981 recession was caused by the Fed very

Topics:

NewDealdemocrat considers the following as important: Featured Stories, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Why I’m worried about the decline in real wages This is a follow-up to my post yesterday concerning the decline in real average and aggregate wages. Why should the data from just one month cause me to warn that “This is Bad?” To show you, let’s decompose the data into CPI and nominal aggregate wages, shown in the below two graphs, the first of which covers the inflationary era of the 1960s and 1970s, and the second covers the disinflationary era since: In the year prior to at least 5 (arguably 6) of the last 7 recessions, BOTH nominal aggregate wage growth was decelerating (1980 and arguably 1969 being the exceptions) and consumer inflation was increasing (1980 and arguably 2007 being the exceptions). The 1981 recession was caused by the Fed very

Topics:

NewDealdemocrat considers the following as important: Featured Stories, politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Why I’m worried about the decline in real wages

This is a follow-up to my post yesterday concerning the decline in real average and aggregate wages. Why should the data from just one month cause me to warn that “This is Bad?”

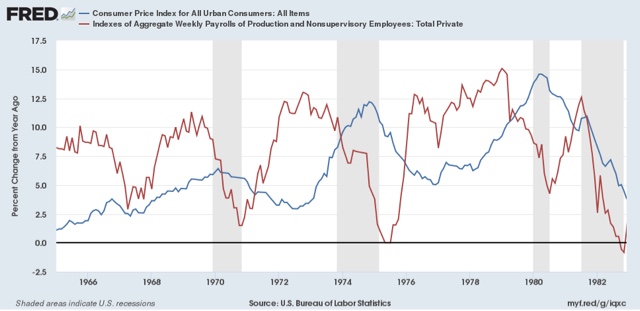

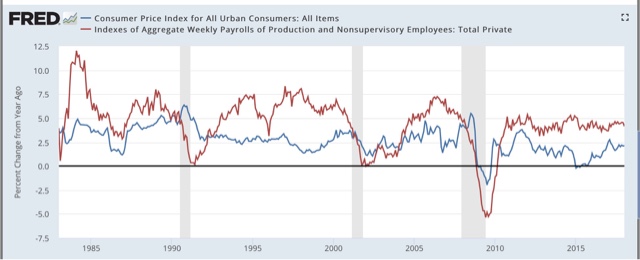

To show you, let’s decompose the data into CPI and nominal aggregate wages, shown in the below two graphs, the first of which covers the inflationary era of the 1960s and 1970s, and the second covers the disinflationary era since:

In the year prior to at least 5 (arguably 6) of the last 7 recessions, BOTH nominal aggregate wage growth was decelerating (1980 and arguably 1969 being the exceptions) and consumer inflation was increasing (1980 and arguably 2007 being the exceptions). The 1981 recession was caused by the Fed very aggressively raising rates, and in the other two instances the pattern held, but with much less of a lead.

Note that a very good coincident marker for the onset of a recession, within about 3 months, has been the point at which the trends intersect. i.e., where YoY consumer inflation increases to the level of decelerating aggregate payrolls.

Note further that in the last 18 months YoY consumer inflation has generally been increasing. Meanwhile there are some slight signs of deceleration in aggregate payrolls, highlighted by this past month.

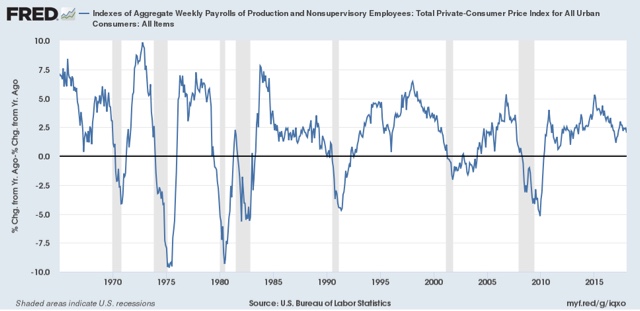

So now let’s subtract YoY inflation from YoY aggregate payroll growth:

When the relative growth in payrolls decreases by 50% from its high (e.g., from 4% to 2%), that is a good marker for the onset of at very least a slowdown (e.g., 1966, 1984, 2016). EVERY SINGLE TIME the line has crossed zero it has indicated the onset of recession.

In the last 6 months, this line has been declining again, from 3% to 2%.

Since the inflation rate is more than anything determined by the price of gas, and I see no reason to expect a decline in that, and further we know that deceleration in YoY payrolls growth is a very regular feature of later expansions, so I see no reason for that to reverse (unless if for some reason the new leadership at the Fed decides to reduce interest rates).

So, there’s nothing imminent, but I am seeing what looks like the beginning of the trend that will ultimately end in a recession, maybe in 18 to 24 months. That’s what has me concerned.