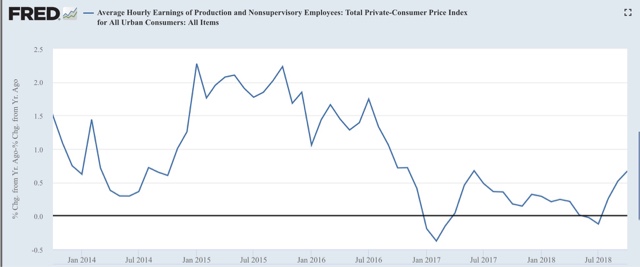

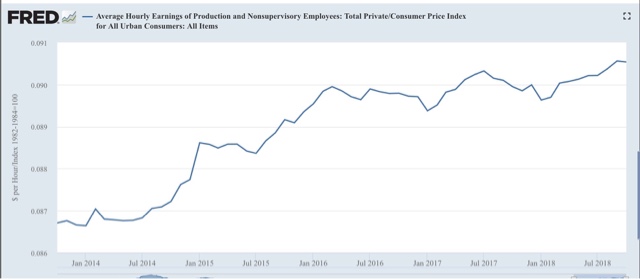

With October consumer price inflation reported, let’s update a few metrics. First of all, while the YoY% growth in real wages increased: real wages were unchanged month over month, as both nominal wages and consumer inflation both increased by +0.3%: Real wages have still not even increased 1% in the last 2 1/2 years. Because, as I noted yesterday, so much of consumer inflation, and therefore real wages, depends on gas prices, and oil prices have been – well – crashing for the past several weeks: we are likely to see a further decrease in inflation, so consumer purchasing power should increase. Another measure worth updating for business cycle purposes is real M1, which rose to a new high in October: as the

Topics:

NewDealdemocrat considers the following as important: Featured Stories, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Real wages have still not even increased 1% in the last 2 1/2 years.

Because, as I noted yesterday, so much of consumer inflation, and therefore real wages, depends on gas prices, and oil prices have been – well – crashing for the past several weeks:

we are likely to see a further decrease in inflation, so consumer purchasing power should increase.

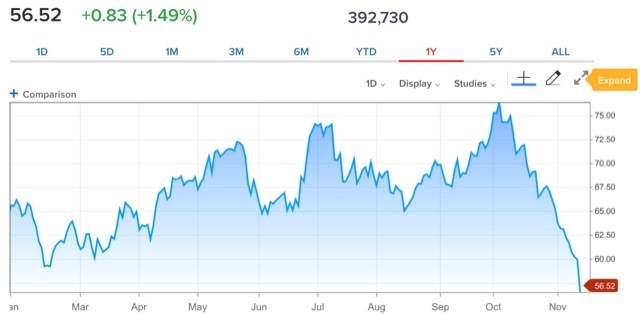

Another measure worth updating for business cycle purposes is real M1, which rose to a new high in October:

as the nominal increase in M1 surpassed inflation handily.

Growth in real M1 had been decelerating, and was on the cusp of turning negative throughout the summer. But in the last two months it has rebounded. This is a good lesson in not simply projecting the trend in leading indicators forward — because we never know when that trend may change.