The consumer vs. producer divergence widens at year end My economic theme for about the past half year has been the contrast between the floundering producer sector vs. the decent consumer sector. With two of the last important reports of the year out this morning, that divergence has been highlighted. First, the good news: real personal income rose +0.4% in November, and real personal spending rose +0.3%. Here’s a look at the past five years: Figure 1 No perceptible slowdown here! But now, let’s look at the producer side, where the Kansas City Manufacturing Survey was the last of three regional surveys to be reported this week. Here is the moving monthly average of all five regions that I update in my weekly post: Regional Fed New Orders

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

The consumer vs. producer divergence widens at year end

My economic theme for about the past half year has been the contrast between the floundering producer sector vs. the decent consumer sector. With two of the last important reports of the year out this morning, that divergence has been highlighted.

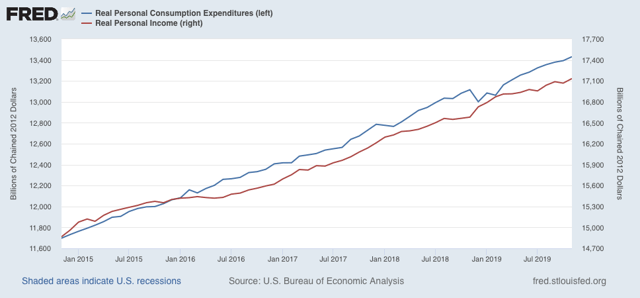

First, the good news: real personal income rose +0.4% in November, and real personal spending rose +0.3%. Here’s a look at the past five years:

Figure 1

No perceptible slowdown here!

But now, let’s look at the producer side, where the Kansas City Manufacturing Survey was the last of three regional surveys to be reported this week. Here is the moving monthly average of all five regions that I update in my weekly post:

- *Empire State down -2.9 to +2.6

- *Philly up +1 to +9.4

- Richmond down -10 to -3

- *Kansas City down -13 to -16

- Dallas up +1.2 to -3.0

- Month-over-month rolling average: down -3 to -2

Today marks the very first time all year that the average of all five actually crossed into negative territory. This does not bode well for the December ISM manufacturing survey in particular, and for the manufacturing sector going forward into 2020 in general.

To conclude 2019: the consumer is alright. The producer, not so much.